Blog

Fannie Mae’s Portfolio Unchanged in August. Delinquencies Rising at Faster Rate

In their monthly summary, Fannie Mae today said their retained portfolio was unchanged at $779.4 billion in August 2009. This follows an 18.2% contraction in July and brings Fannie Mae's year to date portfolio growth to a rate of -1.5%. Last week Freddie Mac reported their retained portfolio contracted by almost 30% to $779.4 billion in August. Year over year Freddie Mac's portfolio has shrunk by 4.7%

As a reminder, Congress has mandated that the GSE's must start reducing their retained portfolios by 10% a year beginning in 2010 until their portfolios reach a size of $250 billion each.

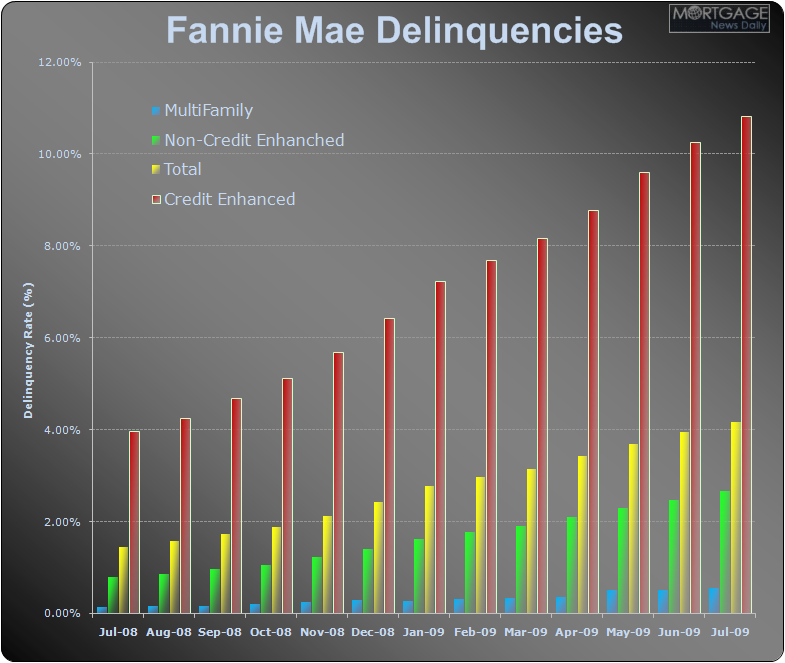

In regards to the performance of Fannie's portfolio, the overall delinquency rate rose 23 basis points to 4.17% in July. All categories that comprise the overall deliquency rate worsened.

Of these categories, the worst performer continues to be loans with mortgage insurance, which are also known as “credit enhanced.” Delinquency rates among these loans rose to 10.83% from last month's read of 10.25%.

Non-credit-enhanced loans also worsened, rising from 2.47% in June to 2.66% in July. Multi-family loans–the only loan category that has shown any ability for isolated month over month improvement–worsened from 0.51% to 0.56%, marking the only two months on record over half a percent.

It's expected that loans requiring credit enhancement in order to meet Fannie Mae guidlines would be the worst performers in terms of overall delinquency rate within a category. However more subtle trends are alarming.

Historically more stable categories are now declining at a faster annual rate than credit enhanced loans. Whereas credit-enhanced loans are not even 3 times worse than the 3.97% reading from a year ago, multi-family loans are over 4 times worse than last year's 0.13%. Even non-credit-enhanced loans rose at a faster rate than loans requiring MI, more than 3 times worse than their 0.8% reading from a year ago.

The below chart illustrates Rising Delinquency Rates.

In regards to the contraction of both Fannie and Freddie's retained portfolio, besides the obvious Congressional mandate of smaller portfolio sizes beginning in 2010, MND speculates that recent contraction is a result of the GSE's making room for more delinquent and modified loans.

To whatever extent these delinquency rates and their interdependentrneconomic factors had a stake in the onset of the recession, so too willrnthey serve as a thorn in the side of recovery. In other words, whenrnthe FOMC says things like “the recovery may not feel like a recoveryrnfor some time,” this is likely one of the considerations behind suchrncaution.

Tighter lending guidelines, less home equity, and a weak labor market are all reasons to be concerned about continued high delinquency rates.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment