Blog

Fannie Mae's Q4 and FY 2012 Income Set Company Records

Fannie Mae</breported today that the company had an annual net income of $17.2 billion for FYrn2012 compared to a net loss of $16.9 billion in FY 2011. This was the largest annual income in therncompany’s history. The fourth quarterrnnet income was reported at $7.6 billion which was also the highest quarterlyrntotal ever reported by Fannie Mae and represented 44 percent of the net incomernfor the entire year. </p

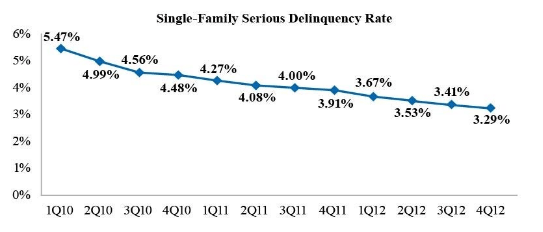

Fannie Mae saidrnthe improvement in both the full-year and quarterly numbers was due primarily tornimproved credit results driven by a decline in serious delinquency rates,rnhigher home prices, higher sales prices from the company’s owned real estatern(REO) and its resolution agreements with Bank of America.</p

Net interestrnincome for the fourth quarter was $5.56 billion and for the year, $21.50rnbillion compared to $5.32 billion in the third quarter and $19.28 billion inrn2011. The increase in net interestrnincome in the fourth quarter was driven by an increase in income from guarantyrnfees and accelerated amortization income from a high volume of prepayments. Net revenues increased $203 million quarterrnover quarter and 2.54 billion year over year. rnComprehensive income was $18.8 billion for the year compared to $(16.41)rnbillion for FY 2011 and $7.8 billion for the fourth quarter up from $(2.93) billionrnin the third quarter. </p

Fannie Mae’s net income for the year was impacted by its resolutionrnagreements with Bank of America related to repurchase requests andrncompensatory fees which resulted in the recognition of $1.3 billion in pre-taxrnincome for 2012. The company expects tornrecognize additional net income in the first quarter of 2013 and beyondrnrelating to these agreements. </p

Provisions forrncredit losses which were $(26.72) billion in 2011 turned to a benefit of $852rnmillion in 2012 due entirely to fourth quarter activity. Provisions in the third quarter were $(2.08)rnbillion and the benefit in the four quarter was $1.89 billion. </p

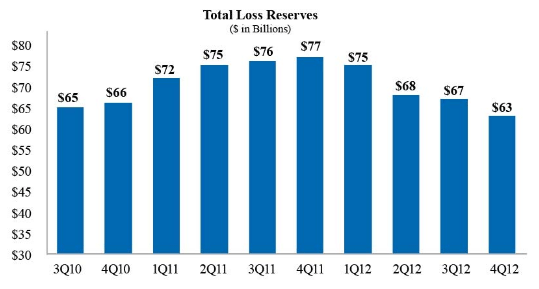

The company’s totalrnloss reserves decreased to $62.6 billion as of December 31, 2012 from $76.9 billion as of December 31, 2011. The company expects the trends of improvingrnhome prices and declining single-family serious delinquency ratesrnwill continue. As a result,rnthe company believesrnthat its totalrnloss reserves peaked as ofrnDecember 31, 2011. Accordingly, the company does not expect totalrnloss reserves to increasernabove $76.9 billionrnin the foreseeable future.</p

</p

</p

The company’srnbook of business now consists of a majority of loans (66 percent) originatedrnsince 2009 and with a much stronger credit profile than loans originated priorrnto that date which now comprise a third of the portfolio. The delinquency rate, which has shrunkrnsteadily since the first quarter of 2010 when it stood at 5.47 percent, is nowrn3.29 percent. </p

</p

</p

The company’s single-family foreclosure rate was 0.99 percentrnfor the full year of 2012. It acquired 41,112rnsingle-family REO properties, primarily through foreclosure, in the fourth quarter of 2012 comparedrnwith 41,884 in the third quarter of 2012. As of December 31, 2012, the company’srninventory of single-family REOrnproperties was 105,666, compared with 107,225 as of September 30, 2012. The carrying value of therncompany’s single-family REO was $9.5 billion as ofrnDecember 31, 2012.</p

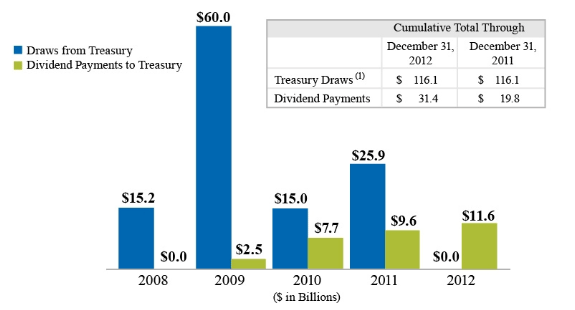

The company paidrna total of $11.6 billion in dividends to the Department of the Treasury underrnthe senior preferred stock purchase agreement between the two entities and didrnnot request a draw from Treasury for the fourth quarter. To date Fannie Mae has received a total ofrn$116.1 billion in draws from the Treasury while paying $31.4 billion inrndividends. Under terms of the stock purchase agreement dividends cannot be usedrnto offset draws so Treasury still maintains a 117.0 billion liquidationrnpreference in Fannie Mae. The companyrndid not request any draws from Treasury in 2012. </p

</p

</p

In August 2012,rnthe terms governing the company’s dividend obligations on the senior preferred stock were amended.rnThe amended seniorrnpreferred stock purchase agreementrndoes not allow the companyrnto build a capital reserve. Beginning in 2013, the required senior preferred stock dividendsrneach quarter will equal the amount,rnif any, by whichrnthe company’s net worth as of the end of the preceding quarter exceeds an applicable capital reserve amount. The applicable capital reserve amountrnwill be $3.0 billion for each quarter of 2013 and will be reduced by $600rnmillion annually until it reachesrnzero in 2018. </p

“Our financialrnresults improved significantly in 2012 and we expectrnour earnings to remain strongrnover the next few years,”rnsaid Timothy J. Mayopoulos, president and chief executive officer. “We have taken a number of actions since 2009 to manage our legacy book of business, buildrna healthy new book of business with responsible underwritingrnstandards, price appropriately for risk, and reduce uncertainty by resolving outstanding issues. These actions have helpedrnto strengthen our financial performance and to support the housing recovery by enablingrnfamilies to buy, refinance, or rent a home even duringrnthe housing crisis.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment