Blog

February Home Price Gains were Widespread

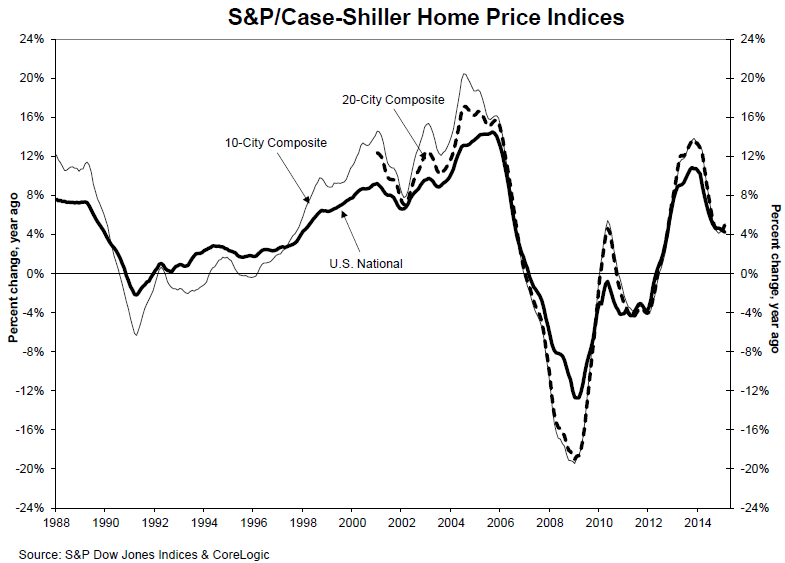

S&P Dow Jones called February increases as measured by itsrnCase-Shiller Home Price Indices “widespread.” The National Home Price Indexrnwhich covers all nine U.S. Census division was 4.2 percent higher than a yearrnearlier, slightly less than the 4.5 percent annual increase posted in January,rnbut both the 10-City and 20-City Composites posted higher annual gains.</p

The 10-Ciity Composite was up 4.8 percent compared to February 2014 andrnthe 20-City Composite rose 5.0 percent. rnThe two indices had posted annual increases of 4.3 percent and 4.5rnpercent respectively in January. </p

Denver had the highest annual increase at 10.0 percent, its firstrndouble-digit gain since August 2013 and San Francisco’s number was up 9.8rnpercent from a year earlier. Seventeenrncities had higher annual increases than in January but in San Diego, Las Vegas,rnand Portland, Oregon the pace of 12 month changes slowed.</p

On a month-over-month basis the National Index was up a slight 0.1 percentrnbut both city measures had “significant” gains of 0.5 percent, the largestrnmonthly positive changes for each since July 2014. Sixteen of the 20 cities reported upticks forrnthe month but Cleveland, Las Vegas, and Boston fell 1.0, 0.3, and 0.2 percentrnrespectively. Chicago’s level wasrnunchanged. </p

</p

</p

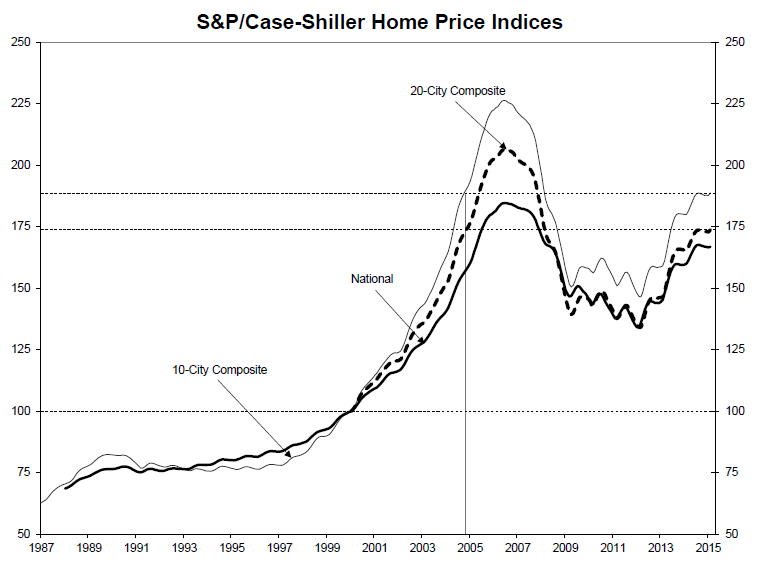

David M. BlitzerrnManaging Director and Chairman of S&P’s Index Committee said, “Home prices continuernto rise and outpace both inflation andrnwage gains. The S&P/Case-Shiller National Index has seen 34 consecutive months with positivernyear-over-year gains; all 20 cities have shown year-over-year gains everyrnmonth since the end of 2012. While prices arerncertainly rebounding, only tworncities – Denver and Dallas -rnhave surpassed their housingrnboom peaks. Nationally, prices are almostrn10% below the high set in July 2006. Las Vegas fell 61.7% peak to trough and has the farthest to go to set a new high; it is 41.5% below its high. If a complete recoveryrnmeans new highs all around, we’re not there yet.</p

“A better sense of where home prices are can be seen by starting in Januaryrn2000, before the housing boom accelerated, and lookingrnat real or inflationrnadjusted numbers. Based on the S&P/Case-Shiller National Home PricernIndex, prices rose 66.8%rnbefore adjustingrnfor inflation from Januaryrn2000 to February 2015; adjustedrnfor inflation, this is 27.9% or a 1.7% annual rate. The highest price gain over the last 15 years was in Los Angeles with a 4.3% real annual rate; thernlowest was Detroitrnwith a -3.6% real annual rate. While nationally, prices are recovering, new construction of single family homesrnremains very weakrndespite low vacancy rates among bothrnrenters and owner-occupied homes.”</p

As of February average home prices for thern20 cities included in the two composite indices are back to autumn 2004 levelsrnbut remain 15-17 percent below their June/July 2006 peaks. Since hitting their March 2012 cities in thern10-City Composite have recovered by 28.8 percent and prices in those cities inrnthe 20-City Composite have climbed 29.5 percent.</p

</p

</p

The Case-Shiller Indices are constructedrnto track the price path of typical single-family homes located in each of the 20rnmetropolitan areas. Each index combinesrnmatched price pairs for thousands of individual houses from the availablernuniverse of arms-length sales data. ThernNational HPI tracks the value of single-family housing within the U.S. Thernindices have a base value of 100 in January 2000, thus Detroit’s current valuernof 96.88 means values there are at 96.88 percent of its January 2000 base whilernprices in Los Angeles with an index of 227.68 have more than doubled in thatrntime frame.</p<p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment