Blog

Fed Attempts To Quantify Why Mortgage Rates Lag MBS Improvements

The Federal Reserve Bank of New York held a workshoprntoday on The Spread between Primary and Secondary Mortgage Rates: Recent Trends and Prospects. William Dudley, the Bank’s president toldrnparticipants the bank had organized the workshop because the topic of the primary-secondary mortgage rate spread isrnimportant for current efforts by the Federal Open Market Committee (FOMC) tornfoster faster economic growth.</p

Because unemployment remains high,rnthe FOMC took action at its September meeting to provide additional monetaryrnaccommodation including a new program to purchase an additional $40 billion arnmonth of agency mortgage-backed securities (MBS) and in October it announced itrnwill continue its purchases of agency MBS, undertake additional assetrnpurchases, and employ its other tools as appropriate until there is arnsubstantial improvement in the outlook for the labor market in a context ofrnprice stability.</p

Dudley explained that the impact of monetaryrnpolicy on economic activity depends on the extent it is effectively transmitted</bto key sectors of the economy and MBS purchases affect the economy most effectivelyrnthrough the housing and mortgage markets, lowering the secondary market rate atrnwhich mortgage-backed securities trade and putting downward pressure on thernprimary mortgage interest rate. This in turn enables borrowers tornrefinance at lower rates and increases demand for home purchases, thusrnsupporting house prices and household wealth, which in turn may increase accessrnto credit. </p

This has indeed happened since thernSeptember FOMC meeting, Dudley said. Yieldsrnon new agency MBS are down about 45 basis points and the Freddie Mac survey 30-yearrnprimary rate has declined 23 basis points to 3.32 percent. The declinesrnare even larger if dated from the August FOMC meeting when expectations ofrneasing increased. </p

But this easing has been impeded byrntwo factors. Dudley called the creditrnstandards for mortgages since the housing bust “overcorrected” and said, coupledrnwith the number of underwater mortgages it is impossible for some people torntake advantage of the low interest rates. rn </p

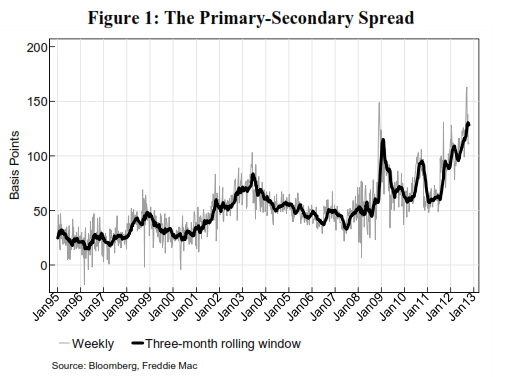

But the purpose of the workshop, hernsaid, is to focus on the second impediment; the significant widening of thernspread between yields on MBS in the secondary market and primary mortgagernrates. In order for actions taken byrnFOMC to have their full impact on the economy, they need to pass through fromrnthe secondary to the primary rate. “To the extent that the primary-secondary raternspread widens, the reduction in pass-through limits the full impact of thernpolicy actions.”</p

The spread through the late 1990srnand early 2000s was in the range of 30 to 50 basis points but more recently andrnespecially in the past 18 months the spread has increased substantially andrnafter the September FOMC meeting it rose above 150 basis points. This spike was not surprising, Dudley said, becausernthe primary market may be slower to react and it has now retracted to its pre-meetingrnlevel of about 120 basis points which is still high by historic standards.</p

</p

</p

The spread is influenced by a numberrnof elements such as the value attached to servicing rights and the annual GSErnguarantee fee which has increased in what Dudley called a necessary and overduernre-pricing of the credit guarantee provided to investors. While they differ by mortgage and by seller,rnthe average effective guarantee fee has increased from 20 to 25 basis points tornnearly 50 basis points today but that still leaves a significant part of thernspread to be otherwise explained. </p

</p

</p

Dudley referenced the new study onrnthe subject, The Rising Gap betweenrnPrimary and Secondary Mortgage Rates written by several Fed staff amongrnothers and available here,rnand summarized it for his audience. The study,rnhe said, comes up with a measure of originator profits and unmeasured costs or OPUCsrnand evaluates a number of factors that could explain the historically elevatedrnlevels of the latter. The study concludes:</p

“The rise in OPUCs is mainlyrndriven by higher MBS prices,rnwhich are not offset by corresponding increases in measurablerncosts. Conversely, a decline in the value of mortgage servicingrnrights may have reduced OPUCs to some extent, and thus contributed to the widening primary-secondary spread. Among harder-to-measure costs, we find that putback risk and pipeline hedging likely cannot explain the full rise in OPUCs. Absent other cost increasesrnthat we cannot measure well, such as operatingrncosts, the rise in OPUCs reflects to some extent an increase in originator profits.rnWhile market concentration alone does not seem to explain the rise in these profits,rncapacity constraints do appear to play a significant role. Additionally, we provide evidencernsuggesting that originators have enjoyed pricing power on some of their borrowers looking to refinance over the past year.”</p

The financial crisis and the housingrnbust created headwinds to the recovery in part through adverse impacts on thernmechanisms of monetary policy transmission. It is important, hernconcluded, that the forces that have been acting on the primary-secondaryrnspread be correctly identified and, to the extent possible, quantified. He urged the workshop participants to bringrntheir broad range of informed perspectives to the table and be as open, frankrnand precise in their discussions in order to draw some conclusions about thernfactors influencing the spread. .

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment