Blog

Fed Reports Results of First Dodd-Frank Bank Stress Tests

The Federal Reserve has completed itsrnthird round of stress tests of American banks. rnThe tests originated in 2009 in the midst of the financial crisis butrnthe most recent round was the first of the annual tests now required by thernDodd-Frank Wall Street Reform and Consumer Protection Act. The tests are designed to estimate thernoutcomes that might be experienced by large banks under extremely adverserneconomic conditions. The tests are arntool to help bank supervisors measure whether a bank holds sufficient capitalrnreserves to support its activities under such conditions and the results arernnot forecasts or expected outcomes. </p

Eighteen bank holding companies (BHCs)rnwere subjected to a severely adverse stress scenario which presumed a peak unemploymentrnrate of 12.1 percent, a drop in equity prices of more than 50 percent, arndecline in housing prices of more than 20 percent, and a sharp market shock forrnthe largest trading firms. Over the nine-quarter planning horizon eachrnBHC maintains its pre-test common stock dividend payments and common stockrnissuance is limited to that associated with expensed employee compensation. </p

The results suggest that, over the ninernquarters, aggregate losses at the BHCs are suggested to be $462 billion includingrnlosses across loan portfolios, securities held in the BHCs’ investmentrnportfolios, trading and counterparty credit losses from the global market shock,rnand other losses. </p

Projected net revenue before provisionsrnfor loan and lease losses (pre-provision net revenue or PPNR) over the ninernquarters is $268 billion, which is net of losses related to operational-riskrnevents and mortgage repurchases as well as expenses related to disposition ofrnowned real estate of $101 billion. Takenrntogether the high projected losses and low projected PPNR results in projectedrnnet income before taxes of -$194 billion.</p

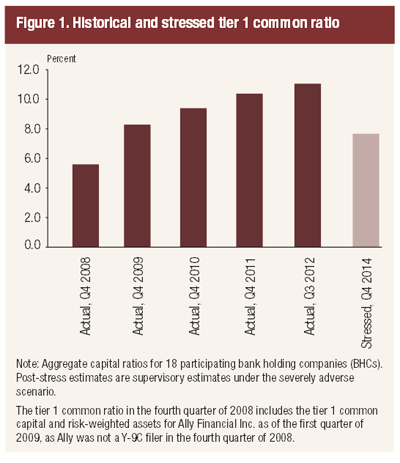

These net income projections resulted inrnsubstantial projected declines in regulatory capital ratios for nearly all ofrnthe BHCs under the severely adverse scenario. rn The aggregate tier 1 common ratiornwould fall from an actual 11.1 percent in the third quarter of 2012 to arnpost-stress level of 7.7 percent in the fourth quarter of 2014, includingrnassumed capital actions for the 18 BHCs.</p

Despite the large hypothetical declines, the aggregate post-stress capitalrnratio exceeds the actual aggregate tier 1 common ratio for the 18 firms ofrnapproximately 5.6 percent at the end of 2008, prior to the first governmentrnstress tests conducted in early 2009</p

“The stress tests are a tool to gauge the resiliency of the financialrnsector,” Federal Reserve Governor Daniel K. Tarullo said. “Significantrnincreases in both the quality and quantity of bank capital during the past fourrnyears help ensure that banks can continue to lend to consumers and businesses,rneven in times of economic difficulty.” </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment