Blog

Fed Study Confirms Rapid Home Price Appreciation Influenced Mortgage Choices

The housing boom and its accompanyingrnprice appreciation significantly distorted buyer choices about mortgagernfinancing according to an Economic Letter</iauthored by two economists with the Federal Reserve Bank of San Francisco. This distortion was most notable in thosernmarkets with the highest house price appreciation where the authors noted pricerngains directly influenced mortgage choices. rn</p

Fred Furlong, a group vice president in the Economic Research Department andrnYelenarnTakhtamanova, an economist in the EconomicrnResearch and Public Information Departments at the San Francisco bank foundrnthat, in high-appreciation markets, the pace of home price increases wasrnstrongly linked to the popularity of adjustable rate mortgages but in otherrnmarkets house prices had no impact on mortgage choice. The higher price appreciation also muted therninfluence of fundamental drivers of mortgage choice such as mortgage interestrnrate margins, perhaps because homebuyers in those markets expected to holdrntheir loans only briefly before refinancing. rn</p

</p

</p

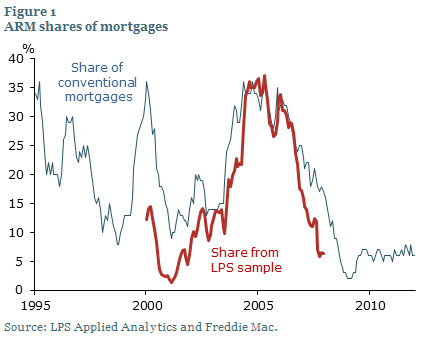

Fixed-raternmortgages (FRMs) have been the most popular loans in the U.S. but Figure 1 showsrnthat the adjustable rate mortgage (ARM) share of mortgages as reported by bothrnFreddie Mac and the LPS Applied Analytics database became more popular duringrnthe housing boom and especially during the years of greatest price appreciationrnwhich the authors defined as a two-year change in the CoreLogic Home PricernIndex greater than 20 percent. In thosernmarkets and among borrowers with lower credit ratings ARM shares were notablyrnhigher from 2000 to 2007 </p

</p

</p

Earlier research has shown the interestrnrates are key determinants of mortgage decisions and for various reasons FRMrntend to have higher initial rates than ARM. rnOne of these reasons is pricing for credit risk including credit scoresrnand income. The margin on an FRM is alsornrelated to conditions such as expected house price appreciation and volatilityrnand non-loan factors such as prepayment provisions and loan-to-valuernratios. Because of their shorter term ARMrnrates are based on a much simpler standard.</p

Individual borrowers are not necessarilyrnindifferent to the two loans types. rnEarlier research found that borrowers who are likely to move or who are financiallyrnconstrained are more likely to choose ARMs which generally have lowerrnrates. Option ARMS may be especiallyrnattractive to borrowers with incomes that vary from year to year. </p

Housing market conditions also couldrnaffect borrower mortgage choices. For example, rapid house price increasesrncould spur demand for homeownership. At the same time, such house pricernincreases, to the extent lenders ease down payment requirements, may make itrneasier for financially constrained borrowers to get credit which could change thernkinds of borrowers who choose ARMs. Itrnmay also have altered the sensitivity of mortgage choice to market metrics suchrnas the term premium or margins on ARMS and FRMs. Research shows that in speculative bubblesrndecisions about buying and financing real estate can be less systematicallyrnlinked to fundamentals such as pricing. </p

The authors examined how risingrnhouse prices affect mortgage choice using a random sample of 6.6 million firstrnlien mortgages originated from 2000 to 2007 from LPS data and created a modelrnallowing three choices; an FRM, a non-option ARM and an option ARM and made separaternestimates for home purchases and mortgage refinancing. The model used as key determinants of mortgagernchoice financial conditions including a measures of term premium, the slope ofrnexpected short term interest rate, and interest rate volatility and markup forrneach mortgage type. </p

House price appreciation is measuredrnas the two-year percentage change in the CoreLogic Home Price Index for therncounty in which the home is located and volatility is measured as the variationrnin the monthly percentage change in the corresponding county-level CoreLogicrnindex over the two years before a loan’s closing date. The model includesrncontrols for loan terms such as loan-to-value ratio, borrower characteristicsrnsuch as credit score, and year-specific effects.</p

</p

</p

Figure 3 shows that the modelrnestimates for non-option ARM shares track actual shares over the sample period.rnARM shares generally increased in both high- and low-appreciation markets fromrn2001 through early 2004. However, during the height of the housing boom, thernARM share was notably higher in high-appreciation markets.</p

</p

</p

Rising house prices affectedrnborrower mortgage choice in high- and low-appreciation markets by arnconsiderable amount. Borrowers were muchrnmore sensitive to the pace of appreciation in high-appreciation markets butrnthis had no significant effect on mortgage choice in low-appreciation marketsrnacross all credit risk groups. Forrnexample, for homebuyers in high-appreciation markets, a 15% house pricernincrease raised the probability of choosing an ARM by about 0.15 percentagernpoint. But that same house price increase had essentially no effect inrnlow-appreciation markets. </p

Borrowers purchasing homes in bothrnhigh- and low-appreciation markets mostly responded as expected to financialrnmarket metrics. However, in high-appreciation markets they tended to be lessrnsensitive to loan margins than in low-appreciation markets. Differences in therneffect of the ARM margin were evident, especially among borrowers with low FICOrncredit scores. The sensitivities of mortgage choice to some of the marketrnmetrics such as term premium also were statistically different in the high- andrnlow-appreciation markets. </p

The authors conclude that during thernhousing boom, borrowers increasingly opted for ARMs instead of FRMs and thisrnwas most pronounced in markets where house prices rose rapidly. In suchrnmarkets, house price gains were strongly correlated with a rising ARMs sharernfor home purchases. Moreover, in high-appreciation markets, the effects ofrnfundamentals such as mortgage interest rate margins were muted. This mutingrneffect was most apparent in ARM margins, that is, the interest rate spreadrnbetween ARMs and short-term Treasury yields.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment