Blog

Fed Study Finds REO Status Strongest Indicator of Property Problems

While a mortgage is a financial contract between arnborrower and a lender, when a foreclosure occurs there are repercussions thatrnimpact parties external to that contract, i.e. neighbors, tenant, and wholerncommunities can suffer. In a PublicrnPolicy Paper prepared for the Federal Reserve Bank of Boston titled When Does Delinquency Result inrnNeglect? Mortgage Delinquency andrnProperty Maintenance, Lauren Lambie-Hanson looked at the timing of onernforeclosure side effect or externality, reduced upkeep, using conditionsrnreported by constituents in the City of Boston.</p

She used four sets of data, public records data onrnproperty transactions, mortgages, and foreclosure starts for single-family, 2-3rnfamily and condo properties from the Massachusetts Land Court, loan-level datarnfrom CoreLogic on securitized subprime and Alt-A mortgages, which provided bothrnlegal data on the loans and monthly information about when loans becamerndelinquent, entered foreclosure, and the dollar value of losses experienced byrnlenders when properties were sold which helped to identify short sales. The MLS Property Information Network provided realrnestate sale listings which helped match up data from the other two sources. </p

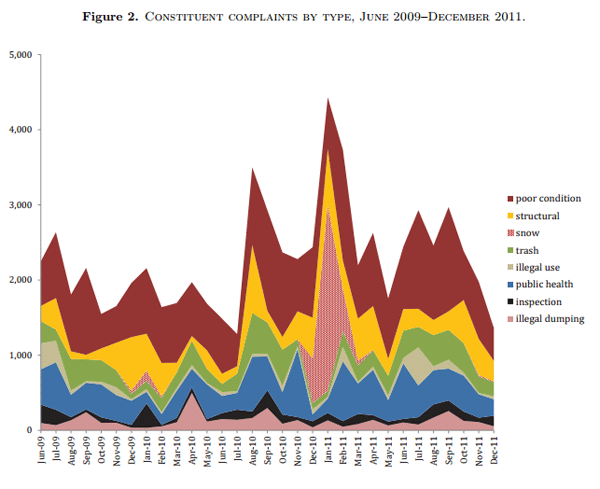

The final database was from the Constituent ResponsernManagement System (CRM) which has been maintained by the City of Boston sincernOctober 2008 This databasernincludes reports made by phone (calls or text messages), internet,rnsmart phone application, and in-person visitsrnwhich range from requests for recycling bins or pothole repair to complaints about graffiti, illegal dumping, and abandoned properties. Each report is dated, refers to a specific address,rnandrnincludes a detailed descriptionrnand standardized category for the request. </p

Compared tornmost large cities Boston maintained a relatively robust housing market duringrnthe recent crisis. Prices bottomed outrnin 2009 at 82 percent of peak values. rnCity-wide there were about 3,400 foreclosures of single-family, 2-3rnfamily, and condo properties. There werern1,200 completed short sales between 2007 and 2011. Seventy percent of the distressed sales have beenrnconcentrated in five of Boston’s neighborhoods.</p

Therncomplaints in the CRM data-base tend to originate from residents ofrnneighborhood, especially those particular to a specific property. Neighbors complain about overflowing trashrnbarrels or squatters, tenants of the subject property about problems like leadrnpaint. </p

</p

</p

When thernCRM dataset was matched with CoreLogic data thee was a disproportionate incidence of complaints when propertiesrnare bank owned. Listed and non-listed REO properties make up 1.6 percent of the monthly observations, but 5 percent of the observations where complaints are logged. Similarly, borrowers in foreclosure make up 15 percent of the sample, but 21 percent of observations with complaints. On the other hand, monthly observations for borrowers who were current,rn30-60 days delinquent, and even seriously delinquent (90 or more days) but pre-foreclosure received disproportionately low rates of complaints.</p

Interestingly, therernappears to be no relationship between equity and property upkeep, as evidenced by neighbor and tenant reports to City government. It is not possible to conclusively identifyrnwhen an owner became a candidate for a short sales, but using MLS data as arnproxy, 1.4 percent of properties were actively listed in the MLS as short sales andrnconstituted nearly 3 percent of thernmonthly complaints. </p

The author found evidence that a borrower’s mortgagernstatus (or a property’s status as bank owned or resold to a new owner) is correlated withrnthernprobability that the property is the subject of a complaint or service request made byrna constituent to local government. Essentially, beginning with the date when a borrowerrnbecomes seriously (90 or more days) delinquent, the incidence of complaints begins to rise.rnDuring the first year in default, a borrowerrnis,rnon average, 1.35 times as likely to be the subject of a complaint as when that borrower was current on his mortgage. After spending a year in default, the odds increase to morernthan 1.7. However, serious delinquency seems to be tied to a greater incidence of complaints only when a borrower is in foreclosure. Once a borrower is in foreclosure, he is over 1.8 times as likely to receive a complaint as when he is current on the mortgage. The effect appears to grow as a borrower spends longer in foreclosure although the difference in the estimates is not statistically significant. </p

There are indications that properties are particularly susceptible to complaints afterrnbecoming REO. Specifically, prior to listing the REO properties for sale, lenders are more than 2.8 times as likely to receive a complaint as when the borrowers were making theirrnmonthly mortgagernpayments. After listing the properties, the odds increase to over 3.8. </p

These general relationships tend to hold for each type of complaint or request made. “Poor condition” complaints, the most common, reference topics like water leaking into an apartment, broken windows, or a combination of several types of problems. REOs are particularly prone to these types ofrncomplaints, receiving them, on average, at over four times the rate of properties owned by borrowers who are current (but are observed to default at some point in the dataset).</p

While these patterns hold for allrnproperty types they are particularly strong for single-family properties; the typical single-family property is over nine times asrnlikely to receive a complaint while REO than if itsrnowner were current on his mortgage. Similarly, for single-family owners there is a greater average difference between a borrower’srnproperty upkeep while he is current and while he is in foreclosure; he is nearly 3.8 times as likely to receive a complaint while in foreclosure as when making payments regularly. </p

Complaintsrncome from both neighbors andrntenants. If a property is occupied, all else equal, it may be more likely that the City receives a report about it. Tenants of foreclosed properties, particularly those living in units recently bought back atrnauction by lenders, may not know whom to contact about property problems sorncall the city. Constituents may feel less hesitant to report code violations and other infractions to the city if a property is lenderrnowned or, before the “for sale” signrnis postedrnbyrnthe bank, residents may not even realize a property is bank owned. </p

The authorrnfound no consistent evidence that borrowers with less equity are more likely to be the subject of a complaint than borrowers who have more equity.rnHowever,rnowners who default and have high levels of equity ought to be rare, since they should be able to sell their properties, or possibly even refinance, when financially distressed. Also, if borrowers with a lot of equity are seriously delinquent, that is a signal that they may be experiencingrnadditional problems above and beyond ordinary circumstances that might triggerrna default.</p

Given that property conditions appear to suffer most when properties are REO-but dornnotrnnecessarily fare poorly when a home is held by an owner with negative equity-a natural question is whether properties sold short suffer less disinvestment than properties sold through foreclosure. Owners whornhave listed their properties forrnshort sale are about 1.4 times as likely to receive a complaintrnthanrnare owners who are not pursuing a short sale. But ownersrnwhornare attempting to sell their properties short do not seem to be representative of the fullrnsample of distressed borrowers as they are almost twice as likely tornultimately lose their homes to foreclosure. rnEven after restricting the sample to justrnthose borrowers whose lenders have started foreclosure proceedings, there is still a disparity in foreclosure rates between those who did and did not attempt short sales (17 percent andrn13 percent foreclosure rates, respectively). </p

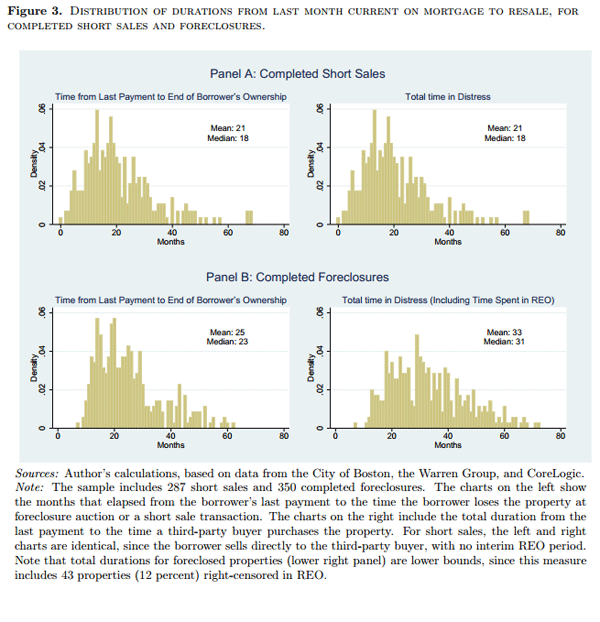

Are short sales and foreclosures equally harmful to neighborhoods? The period of default is longer for completedrnforeclosures than short sales; 25 versus 21 months. Furthermore, foreclosures are held by lenders for an averagernof eight months, meaning that in the typical foreclosure, propertiesrnspend arnyear longer in “ownership limbo” than in the typical short sale. Then, as pointed out earlier, properties appear to suffer worse upkeep when they arernbank owned</p

</p

</p

The authorrnattempted to control for other variables such as a greater propensity forrnneighbors to report problems as its stock of REO properties grows orrnthat not all complaints are necessarily serious or tied to the delinquency orrnREO status of the property. Ultimately, however, each complaintrnmust be investigated by the city so complaints are a relevant measure of the drain on public resources of mortgage distress and foreclosure.</p

The findings suggest that distressed properties are most problematic when held by banks,rnbothrnbefore and during lenders’ attempts to sell the properties. The author makes the followingrnrecommendations. </p<ul class="unIndentedList"<liWhilernlenders often work to bring properties up to code to enable sales to buyers who require FHA mortgage financing, perhaps greater bank accountability for properties is needed. </li<liFindingrnthernparties responsible for REO property upkeep can be challenging, even when properties have a designated real estate agent. The introduction of somerntype of publicly accessible information such as recently initiated on-linernby Zillow or the foreclosure registration ordinance in Boston may increase public awareness about the ownership status of nearby properties and lessen banks' abilities torn"hide in the shadows" while their properties become community nuisances.</li<liLongerrnperiods in serious delinquency and foreclosure generate negative externalitiesrnfor neighbors. Policymakers shouldrnconsider this finding when designing well-intentioned policies that lengthen the foreclosurerntimeline andrnthus the time properties are in ownership limbo.</li<liShort sales are shown to result in shorter durations orrnownership limbo even though they do not appear to receive better upkeep when owned by a borrower pursuing a short sale. </li<liThernpaper leaves open the question of how properties fare after being resold to third-party buyersrnand the author recommends further studying the role of investors and homeowners inrnpurchasing foreclosed properties and stabilizing neighborhoods.</li

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment