Blog

Fed White Paper Offers Advice on Restoring Housing Market

In a letter to the chairs and ranking members of thernSenate Banking and House Financial Services Committees on Wednesday, Federal ReservernChairman Ben S. Beranke said “Restoring the health of the housing market is arnnecessary part of a broader strategy for recovery.” The letter accompanied a white paper developedrnby the Fed which Beranke called a “framework for thinking about certain issuesrnand tradeoffs that policymakers might consider.”</p

In its opening pages the white paper titled The U.S. Housing Market: Current Conditions and Policy Considerations</iacknowledges that much of the weakness in the housing market is related to poorrnlabor market conditions and will take time to be resolved but outlines threerndimensions along which policymakers could takernaction to ease some of the pressures on the housing market:rn</p

1. Moderating therninflow of properties into the large inventory of unsold homes </p<ul class="unIndentedList"</ul

The largerninventory of foreclosed or surrendered properties (REO), perhaps representingrnone-quarter of the 2 million vacant homes for sale in the second quarter ofrn2011, is putting downward pressure on house prices, and exacerbating the lossrnin household wealth. The continuedrninflux of new REO, perhaps as many as 1 million properties per year in 2012 andrn2013, will continue to weigh on house prices for some time. To the extent that REO holders discountrnproperties in order to sell them quickly, the near-term pressure on home pricesrnmight be even greater.</p

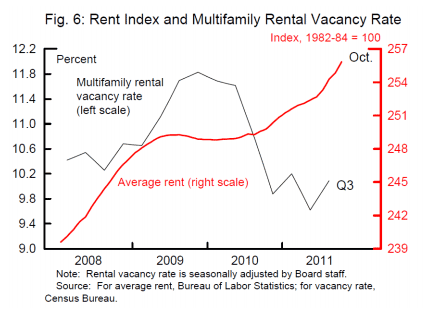

At the samerntime, strengthening rental markets in some areas are reflecting the decline inrnhomeownership with vacancy rates falling and rents rising in many markets. The price signals in the markets, that is therndecline in house prices and the rise in rents, suggest that it might bernappropriate in some cases to convert foreclosed homes into rental propertiesrnand, at this time, with no indication that the downturn in homeownership beingrnlikely to reverse in the immediate future, there are indications of arnlonger-term need for expanded rental housing stock. </p

</p

</p

Although smallrninvestors are currently buying and converting foreclosed properties to rentals,rnthis is a limited solution and larger-scale conversions have not occurred forrnat least three interrelated reasons. First,rnit can be difficult for an investor to assemble enough properties within arnsensible geographic area to achieve efficiencies of scale. Second, attracting investors to bulk salesrnhas typically required REO holders to offer significantly higher discountsrnrelative to those given owner occupants, in part because it can be difficult torninvestors to obtain financing for such sales, and third, the supervisory policyrnof GSE and banking regulators has generally encouraged sales of REO propertiesrnas early as practicable.</p

Intertwined in these issues is thernunresolved role of the government sponsored enterprises (GSEs) Fannie Mae andrnFreddie Mac which, because of their outsized presences, affect not only theirrnown holdings but the larger market with their actions. Despite the mandate of the Federal HousingrnFinance Agency (FHFA) as conservator of the GSEs to minimize taxpayer losses,rnsome actions that cause greater losses to the GSEs in the near term might bernadvantageous if they lead to a quicker and more vigorous recovery. The paper presents a number of suggestionsrnfor dealing with inventory held by the three principal government relatedrnagencies while suggesting it will discuss properties held by federallyrnregulated banks at a later date.</p

An REO to rentalrnprogram that relies on sales to third-party investors will be more viable ifrnthe cost-pricing differential can be narrowed which might be done by (a)rnstructuring sales as competitive auctions; (b) making sales packages morernattractive to a variety of investors, or (c) providing investors with the debtrnfinancing. In the latter case REOrnholders could probably increase sales prices by providing financing but thisrnmay be at the cost of reducing their future income stream.</p

The paper alsornsuggests some innovations for reducing the amount of time that a vacantrnproperty remains in inventory such as auctioning the rights to acquire a futurernstream of properties that might be foreclosed in a given neighborhood ratherrnthan auctioning existing REO holdings or to encourage deed-for-lease programs whichrncircumvent the REO process entirely by exchanging a deed-in-lieu for arnrent-back arrangement.</p

Another solutionrnmight be for the REO holder to convert the properties to rentalsrnthemselves. The value of this suggestionrnmay become more apparent as the inventories increase. The paper also suggests that land-banking,rnperhaps with the assistance of federal subsidies, could be an option forrnlow-value properties.rn</p

2. Remove some ofrnthe obstacles preventing creditworthy borrowers from accessing mortgage credit. </p<ul class="unIndentedList"</ul

The paperrntouches only lightly on this topic, saying that the regulators have been inrnconsultation with the GSEs and originators about the sources of the apparentrntightness in lending standards and that balance is needed between prudentrnlending and appropriate consumer protection on one hand and not undulyrnrestricting credit on the other.rn</p

3. Limit the number of homeowners who are pushed intornan inefficient and overburdened foreclosure pipeline. </p<ul class="unIndentedList"</ul

Beyond thernpersonal suffering, foreclosures can be a costly and inefficient way to resolvernmortgage payment obligations because they can result in “deadweight losses”,rni.e. costs that do not benefit anyone such as neglect and deterioration ofrnproperties and neighborhoods and the impact of that in putting additionalrndownward pressure on prices. Somernforeclosures might be avoided if loan modifications are pursued morernaggressively and servicers given greater incentives to do so. Where modifications are not feasible therernshould be more expedient ways to exit from homeownership.</p

Many homeowners who could benefit fromrnrefinancing are unable to do so, and the paper credits recent changes in HARPrnwith helping in this area but suggests possible further expansion to borrowersrnwhose existing mortgages are not guaranteed by the GSEs even though this raisesrna host of risk management issues.</p

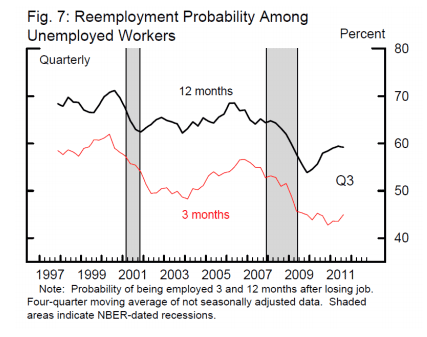

The Fed suggests changes to the HAMPrnloan modification program as well. Onernwould be to eliminate the 31 percent debt-to-income (DTI) floor that currentlyrnexists in the program. Another isrneliminating the focus on modifications for borrowers who have becomernunemployed, concentrating instead on payment deferment through the period ofrnunemployment which might avoid permanent foreclosures arising out of arntemporary situation.</p

</p

</p

The paper also suggests that the focus of HAMP onrnnet present value to the lender is short sighted and there may be other typesrnof modifications which may be socially beneficial even if not in the bestrninterests of the lender. This, theyrnconcede, may be a tough sell to lenders and likely to involve more taxpayerrnfunds.</p

Large scale modifications involving principalrnreduction may be too costly to consider. rnThe paper calculates that the 12 million underwater mortgages in therncountry represent about $425 billion in negative equity and targetingrnunderwater borrowers who are likely to default raises issues of fairness inrnaddition to expenses. An alternativernwould be aggressively facilitating refinancing for underwater borrowers who arerncurrent on their loans, expanding modifications for borrowers who arernstruggling with payments, and providing a streamlined exit from homeownershiprnfor borrowers who want to sell their homes.</p

Expanding short-sale and deed-in-lieu opportunities</bhave many advantages but the barriers to short sales include willing buyers atrnprices acceptable to the REO holder and a timeline that allows the transactionrnto close before the foreclosure. Deeds-inrnlieu are often not pursued because of complications such as junior liens, dealingrnwith deficiency claims, and the burden of additional REO. On the other hand, borrowers may not evenrnrealize the existence of such an alternative and instead remain in their homes throughrnthe entire drawn-out foreclosure process. rnFiguring out ways to surmount these obstacles is crucial.</p

The paper also addresses the shortfalls in loanrnservicing that have been widely discussed and some of the solutions that havernbeen proposed such as changing the compensation structure, making changes tornthe MERS registry, and better monitoring the servicers.</p

It is clear from the conclusion to the paper thatrnthe Fed is not just searching for short-term solutions to the current marketrndisruptions, but a fundamental restructuring of the system so that thesernproblems are better packaged for management in the future. “The challenge for policymakers is to findrnways to help reconcile the existing size and mix of the housing stock and therncurrent environment for housing finance. rnFundamentally, such measures involve adapting the existing housing stockrnto the prevailing tight mortgage lending conditions or supporting a housingrnfinance regime that is less restricting than today’s while steering clear ofrnthe lax standards that emerged during the last decade.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment