Blog

Fed’s Exit from MBS Program on Course as Planned

The Federal Reserve yesterday released an outline of their plan to remove the financial marketplace from the supportive influences of accomodative policy. Part of this outline included a statement on the fate of the Agency MBS Purchase Program.

Here are the comments:

“The Federal Reserve purchasedrn$300 billion of Treasury securities and currently anticipates concludingrnpurchases of $1.25 trillion of agency MBS and about $175 billion of agency debtrnsecurities at the end of March”

Plain and Simple: NO CHANGE IN TONE FROM BERNANKE ON THE END OF THE MBSrnPURCHASE PROGRAM. Funds are still on schedule to run out at the end of March.

While this is a necessary step in the overall recovery process, there will still bernconsequences to manage.

Even though we have been reminded that the Treasury is providing confidence boosting GSE backing,rnthe general “up in the air” condition of Fannie and Freddie combined with the loss ofrnFederal Reserve MBS funding are expected to push mortgage rates higher.

The timing of this move has increased nervousness about the outlook for housing. The Fed will be exiting the mortgage market just as the spring/summerrnhome buying season is expected to pick up steam. Naturally, the question everyone wants addressed is:

HOWrnMUCH WILL RATES RISE?

Without going into servicing valuations and best executions options, mortgage rates are dependent upon the mortgagernbasis. The mortgage basis can be generally thought of as a guidance giver forrnmortgage rates. Rates will generally be a factor of:

- The direction and movement of benchmark Treasury yields

- The perception of risk in holding mortgage-backedrn securities as an investment (loss of principal investment)

- Supply and Demand in the agency MBS market

The first part of the equation,rnthe direction and movement of benchmark Treasury yields, is a factor of Federal Reserve interest rate policy expectations, stock sentiment, and the generalrnpolitical tone regarding the Budget Deficit.

Barring any unexpected shifts inrneconomic outlooks (MND's: slow choppy growth, dependent on job creation andrninnovation), we expect the 10 year note to hold to a range…with the upperrnlimits of that range being 3.85%. It is possible that the confines of thisrn'fence' could be broken briefly in times of panic or 'over-exuberation', but werndo not anticipate any major movements in the next 3 months.

Why only three months? Investor confidence is cautiously improving and economic activity has just stabilized…but the marketplace is still extremely sensitive to shocks. Outlooks are based on assumptions which are based on assumptions. The “double dip” door is not completely shut yet. Forecasting any further out is still a guessing game.

The second part of the mortgagernrates equation, the perception of MBS and GSE debt investment risk, isrnalmost entirely a factor of the labor market and the political developmentsrnregarding Fannie Mae and Freddie Mac. While the GSEs are still under therncare of the FHFA and US Treasury, let’s not forget, by all measures both institutions are insolvent, and in the absence of the government’s intervention and their semi-explicit guarantee, they would be unable to function normally. At some point they will have to bern”dealt with”.

We all know the US government won't the GSEs fail, this was proven in September 2008 when Fannie and Freddie were placed in conservatorship. However, the absence of more clarity and detail surrounding the political developments of the GSEs is enough to erode investor confidence. In general, its thernperception of the unknown that adds risk to investing in agency MBS and agency debt. That perception of risk will manifest itself via higher mortgage rates relative to benchmark yields. This topic was discussed in greater detail on The Voice of Housing. Read it HERE

This issue could be largelyrnavoided if jobs are created and the housing market is able to gain traction. Housing needs consumer demand! We don't see the jobs market turning around in the next three months, so this option doesn't provide much help in slowing the pace of rising mortgage rates.

The third part of the mortgagernrates equation, supply andrndemand in the TBA MBS market, is a bit more complicated. Sincernrefinance activity peaked in mid-2009, we have observed a progressivernslowdown in loan production. More originators are dropping out of thernindustry while others continue to fight for every loan application. While we have been communicating this observation since late summer, we need the MBA to provide somern”official” backing to our outlook. Michael Fratantoni, MBA's VP ofrnResearch and Economics, summed up the mortgage environment PERFECTLY:

“Althoughrnrates remain low, there appears to be a smaller pool of borrowers whornare willing and able to refinance at today's rates.”

Onrnthe refinance front, demand will be low as many qualifiedrnborrowers already refinanced at record low rates while others are happyrnto let their ARMs reset at index plus margin (assume 1 yr LIBOR plusrn2.25. That = 3.10% payment). This leaves the focus on purchases. In the months to come we expect consumer housing demand to increase marginally from currently low levels,rnthis will create new loan supply in the secondary mortgage market, but not nearly as much as 2009.

Overall, mortgage loanrnproduction is expected to slow 40% in 2010.

Based on basic supply and demand theory, if MBS supply remainsrnmuted, less investor demand will be required to stabilize liquidity andrnvaluations. So while mortgage rates would be expected rise due to thernabove discussed additional risks associated with investing in MBS, thernrise could be less than expected because of a lack of qualifiedrnborrowers ( lack of new MBS supply).

SO WHO PROVIDES FUNDING SUPPORT TOrnMORTGAGE ORIGINATORS LOOKING TO HEDGE THEIR PIPELINE???

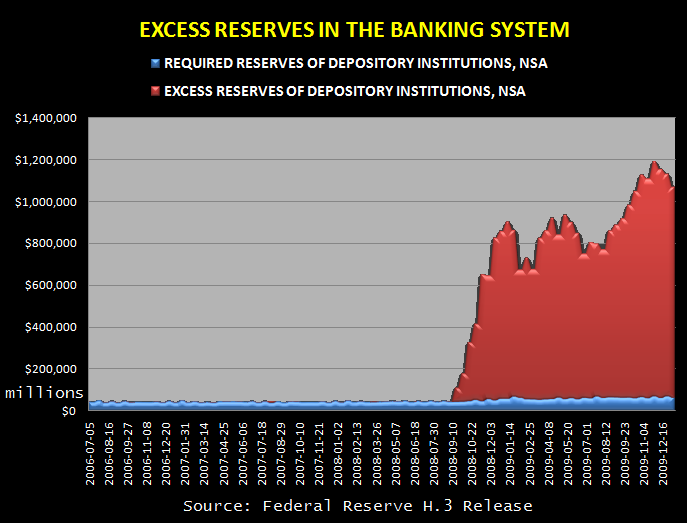

Regardless of rich MBS valuations relative to benchmarks, domestic and international banks have proven themselves to be a stable source of demand side MBS support. Adding confidence to that outlook is the fact that the Federal Reserve's MBS purchases have left the banking system in a highly liquid condition, withrnU.S. banks now holding more than $1.1 trillion of reserves with Federal ReservernBanks.

If banks continue to be net buyers of Agency MBS, this is their funding source.

If/when yield spreads (relative value) cheapen up as the Fed makes their move toward stage left, there will be more incentive for hedge funds and money managers to become more neutral players too (instead of being mostly sellers). What MBS coupon hedge funds and money managers focus their demand on is partially a function of yesterday's Freddie Mac announcement that they will be purchasing 120+ late loans from their MBS securities. This means there will be an increase in prepayment speeds. If Freddie and Fannie carry out these purchases quickly, the benefits to mortgage rate influential MBS valuations will be short-lived. However, if Fannie and Freddie drag these purchases out over a few months, it will help keep MBS demand focused closer to the coupons that support low mortgage rates. READ MORE ABOUT MBS PREPAY SPEEDS

One last point in regards to MBS supply and demand. Yesterday the Fed told us that they had no near term plans to start selling the assets they have accumulated over the past year (Treasury debt, Agency MBS, Agency debt).

Here is the quote:

“I currently do not anticipate thatrnthe Federal Reserve will sell any of its security holdings in the near term, atrnleast until after policy tightening has gotten under way and the economy isrnclearly in a sustainable recovery. However, to help reduce the size of ourrnbalance sheet and the quantity of reserves, we are allowing agency debt and MBSrnto run off as they mature or are prepaid”

Berliner recently called attention to some under the radar effects the Fed's asset purchases have had on the interest rates market. He noted that “the MBS purchase program improved the risk profile of the fixed-income markets by transferring risk to the Fed’s balance sheet….This ultimately dampened the duration swings resulting from market moves and reduced the volume of hedging trades necessary for investors to collectively maintain portfolio durations.”

Plain and Simple: the Fed's asset purchases reduced interest rate volatility. Lenders do not like interest rate volatility….less of it helps keep mortgage rates low relative to Treasury yields. Because the Fed is not planning on offloading their holdings anytime soon, interest rate volatility should remain low. READ HIS COMMENTARY

There will be demand for agency MBS when the Fed exits the secondaryrnmortgage market. However, investors will likely let MBS valuations cheapen uprnbefore becoming buyers again. This will force mortgage rates higher. It is inevitable. In regards to the question “HOW MUCH DO THEY RISE”. MNDsrninner circle believes the spike won't be as sharp as many anticipate (relative tornbenchmark Treasuries that is). If the 10 year Treasury note moves as far asrn4.00%, we estimate the par 30 year fixed mortgage rate will move asrnhigh as 5.50%.

But do mortgage rates even matter ?

Yes they matter, but not as much as most think. Rates are low right now and many analysts are calling for higher rates in the near future…that should be boosting home buyer demand right now, before rates rise. Yet purchase demand continues to put along near 12 year lows. Low rates are not helping right now…will they make much of a difference in two months? While mortgage rates are easy to pin the blame on, the problem runs much deeper than borrowing costs. Housing needs qualified borrowers, its all about JOBS JOBS JOBS.

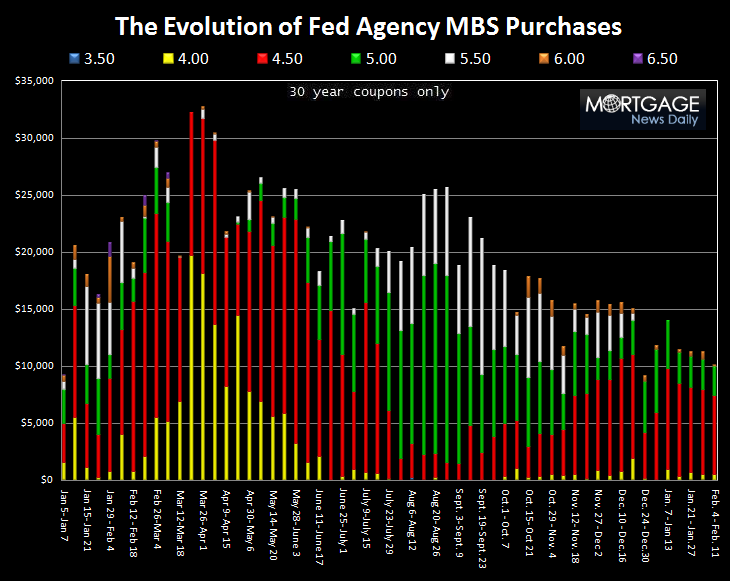

The Fed has spent $1.183 trillion of the allocated $1.25 trillion. That is 94.7% of funding. While the reduction in buying support is already obvious on via weekly purchase totals, it has yet to affect extremely rich agency MBS valuations. With seven weeks to go in the program, the Fed will continue to slow the pace of their daily participation, we are watching and waiting for it to affect mortgage rates.

$66 billion left to spend….

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment