Blog

Fed’s MBS Purchase Program: One Week To Go Before Remaining Funds Run Dry

For the second to last time, the Federal Reserve today reported on their weekly purchases of agency mortgage-backed securities (MBS).

In the week ending March 24, 2010, the Federal Reserve purchased a gross total of $8.26 billion agency MBS. In that week the Fed sold $260 million mortgage-backed's (supported the roll), for a net total of $8.0 billion agency MBS purchases. This amount is $2.0 billion less than the previous three reporting periods.

The goal of the Federal Reserve's agency MBS program is to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally. Only fixed-rate agency MBS securities guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae are eligible assets for the program. The program includes, but is not limited to, 30-year, 20-year and 15-year securities of these issuers. (N.Y. Fed MBS FAQs)

Since the inception of the program in January 2009, the Fed has spent $1.244 trillion in the agency MBS market, or 99.5 percent of the allocated $1.25 trillion, which is scheduled to run out next Wednesday. With one week left in the program, there is now only $6.1 billion in funding remaining.

Of the net $8.00 billion purchases made in the week ending March 24, 2010:

- $5.0 billion was used to buy 30 year 4.5 MBS coupons. 63 percent of total weekly purchases ($1 billion less than last week)

- $2.0 billion was used to buy 30 year 5.0 MBS coupons. 25 percent of total weekly purchases ($500 million less than last week

- $900 million was used to buy 15 year 4.0 MBS coupons. 11 percent of total weekly purchases (unchanged from last week)

- $100 million was used to buy 15 year 4.5 MBS coupons. 1 percent of total weekly purchases ($100 million less than last week)

51 percent of the mortgage-backs purchased were Fannie Mae MBS, 45 percent were Freddie Mac coupons. 4 percent were Ginnie Mae coupons. 88 percent of purchases were 30 year MBS coupons (89% last week)

The Fed's daily purchase average during the trading week was $1.6 billion per day, $400 million less than last week. This was however enough to offset originator supply which averaged between $1.1 and $1.4 billion per day.

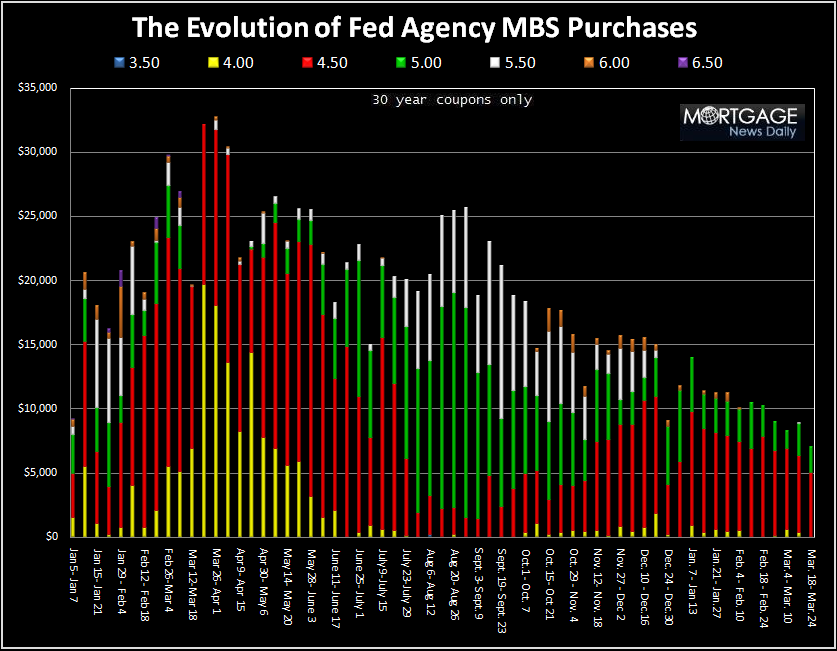

Below is a chart illustrating the evolution of the Federal Reserve's Agency MBS Purchase Program. Notice as the program has drawn nearer to completion, the Fed has focused their purchases to absorb new loan production supply, 4.50 (RED) and 5.00 (GREEN) MBS coupons specifically, which has helped keep mortgage rates low relative to benchmark Treasury yields.

Obviously everyone is wondering if the recent rise in mortgage rates was a function of the Federal Reserve's scheduled exit from the MBS Purchase Program.

While the timing is eerily in-line with the exhaustion of MBS Purchase Program funds, this week's spike in consumer borrowing costs was not a direct factor of the Fed's exit.

Let me show you why I say that:

Last Thursday, the secondary market current coupon (essentially the MBSyield lenders use to derive par mortgage rates after servicing andguarantee fees) was 4.346%. The 10 year Treasury note yield was 3.672%.

Yield Spread Calculation: 4.346% – 3.672% = 67.4 basis points

Today, the secondary market current coupon is 4.488%. The 10 year Treasury note yield is 3.882%.

Yield Spread Calculation: 4.488% – 3.882% = 60.6 basis points

The benchmark 10 year Treasury note yield rose 21 basis points. The secondary market current coupon rose 14 basis points. MBS yield spreads are tighter. Mortgages were led to weaker levels by a rise in benchmark yields! Not because of a lack of MBS demand.

Although mortgage selling did pick up yesterday, the Fed is still buying. Mortgage rates were led higher because benchmark Treasury yields skyrocketed. HERE IS WHY

While we do not expect an abrupt “cheapening” in mortgage-backedsecurity valuations (wider yield spreads) when the Fed exits, we do anticipate mortgagerates will begin to gradually rise relative to Treasury yields in the next twoweeks. That doesn't necessarily mean mortgage rates are destined to rise. The direction mortgage rates decide to take is also a function of the guidance offered byrn benchmark Treasuries…more simply, if Treasury yields fall, mortgagerates will follow. READMORE ABOUT THE MORTGAGE RATES EQUATION

When the Federal Reserve does exit the agency MBS market, over time we estimate the secondary market current coupon yield spread could widen out as far as 100 basis points over the 10 year Treasury note yield (gradually, not all at once). (Currently +60.6 basis points).

If the 10 year Treasury note touches 4.00% and the current coupon yield spread widens to 100 basis points, the MBS yield lenders would use to derive the par mortgage rate would be 5.00%. This is the base yield used to set mortgage rates. If 10 year Treasury yields do touch 4.00% in the months ahead, we expect the average par 30 year fixed mortgage rate to approach 5.50%.

Again, I do not expect ALL of this spread widening to occur next week. Instead we should see a gradual move higher in current coupon yield spreads. That is, mortgage rates will no skyrocket next week because of a lack of MBS demand. Rising Treasury yields would be the culprit behind a continued uptick in mortgage borrowing costs.

WHAT IS THE POTENTIAL FOR AN EXTENSION OF THE PROGRAM???

The most recent FOMC statement shed some light on the topic.

First, there was no significant change in the verbiage regarding the end of the MBS Purchase Program. Here is how the statement read:

“To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve has been purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt; those purchases are nearing completion, and the remaining transactions will be executed by the end of this month”

However, the text that followed the above statement was slightly adjusted in a manner that leaves the door open for some form of a program extension.

“The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.”

Although this isn't something we haven't seen already, it's a sign that the Fed is worried about how their exit will affect mortgage rates and the fragile housing market.

The statement, “will employ its policy tools as necessary” tells me the Fed has no plans of extending the MBS Purchase Program on April 1. It does however imply, if the Fed's exit forces mortgage rates to skyrocket (which I do not expect) and housing takes a double-dip…THE FED MAY BE FORCED TO REOPEN THE MBS PURCHASE PROGRAM.

Plain and Simple: don't expect an extension of the MBS program on April 1. If anything, the Fed will let the market function on its own and evaluate progress. If the labor market is unable to create new jobs and housing takes a nose dive, then it is possible we see the Fed restart the MBS purchase program at a later date.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment