Blog

Fewer Consumers Think it's a Good Time to Buy or Sell

Consumer sentiment toward housingrnappeared to turn a bit negative in August. rnFewer participants in Fannie Mae’s National Housing Survey thought itrnwas now a good time to either buy or sell a house; expectations about continuedrnhome price gains ratcheted down, and views about the overall economy were lessrnpositive than in July.</p

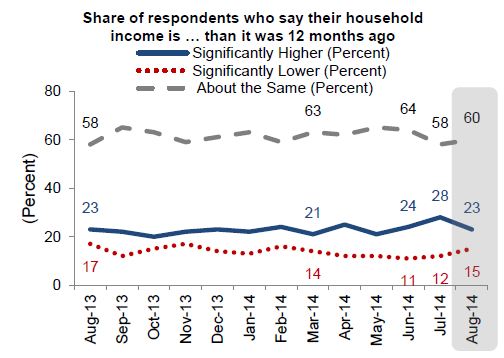

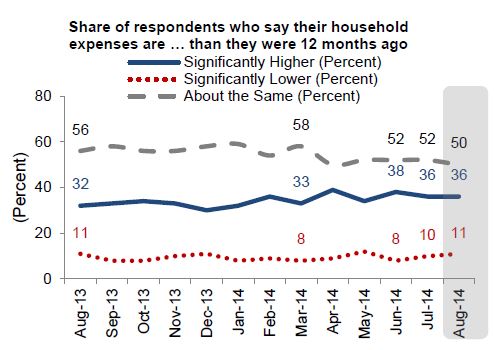

Fannie Mae said respondents’ view ofrntheir own income both retrospectively and prospectively turned more bearish despiternongoing improvements in the labor market. But while attitudes softened, theyrnsuggest that housing activity may result in a modest recovery in 2015 afterrnsome pullback this year. Those who feel the overall economy is on thernright track was unchanged at 35 percent but those giving “wrong track” answersrnfell 3 percentage points to 56 percent.</p

</p

</p

</p

</p

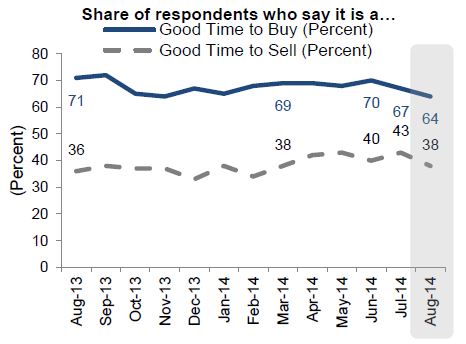

The share of consumers who said this isrna good time to buy a home dipped for the second consecutive month. Sixty-four percent of respondents viewrnconditions as good for a home purchase, down 3 percentage points from July andrn6 points from June. The responses matchedrnthe all-time survey low. Those who viewrnit as a good time to sell dropped 5 percentage points.</p

</p

</p

The “good time to buy” number might actuallyrnreflect a little optimism as buyers look forward. The number of respondents who expect interestrnrates to fall increased by 4 percentage points to 50 percent and that view of increasedrnaffordability is not matched by expectations for home price increases. </p

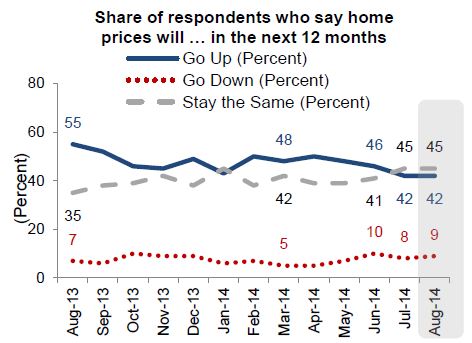

Forty-two percent of respondents said they expected furtherrnhome price gains, unchanged from July but down from 48 percent in March. Those who think prices will drop went from 8rnto 9 percent. Among those expecting pricernincreases the amount of that increase continues to shrink and was at 2.1rnpercent in August compared to 3.4 percent a year earlier. </p

</p

</p

Expectations about rents however reversed July’s one monthrndecline. Rents are expected to increasernby 53 percent of respondents, up from 51 percent the previous month, and thernaverage amount of the increase expected went to 4.1 percent from 3.8 percent.</p

The share of respondents who think it would be<beasy to get a home mortgage today increased by one percentage point. The share who say they would buy if they wererngoing to move fell to 64 percent, while the share who would rent increased torn32 percent-the narrowest gap in over a year.</p

“The August National Housing Survey results lend support tornour forecast that 2015 will likely not be a breakout year for housing,” saidrnDoug Duncan, senior vice president and chief economist at Fannie Mae. “The deteriorationrnin consumer attitudes about the current home buying environment reflects arnshift away from record home purchase affordability without enough momentum inrnconsumer personal financial sentiment to compensate for it. To date, thisrnyear’s labor market strength has not translated into sufficient income gains torninspire confidence among consumers to purchase a home, even in the currentrnfavorable interest rate environment. Our third quarter Mortgage LenderrnSentiment Survey results, to be released later this month, are expected to showrnwhether mortgage demand from the lender perspective is in line with consumerrnhousing sentiment.”</p

The National Housing Survey has been conductedrnon behalf of Fannie Mae every month since June 2010. Over 1,000 Americans, homeowners both withrnand without mortgages and renters are polled by phone to assess their attitudes toward owning and renting a home, home and rentalrnprice changes, homeownership distress, the economy, household finances, andrnoverall consumer confidence.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment