Blog

FHA Loans Continue Driving Delinquency Cure Rates

The Lender Processing Service (LPS)rnFebruary Mortgage Monitor found thatrnloan prepayment rates, historically a good indicator of refinancing activity,rnhave declined as interest rates have gradually trended higher. Although prepayments dropped by nearly 10rnpercent in February they are still very high by recent historical standards andrna very similar pattern exists for all of the more recent vintage loans. The prepayment rate for GNMA loans and to arnlesser extent portfolio loans appear to have remained somewhat immune to rate fluctuations.rn </p

</p

</p

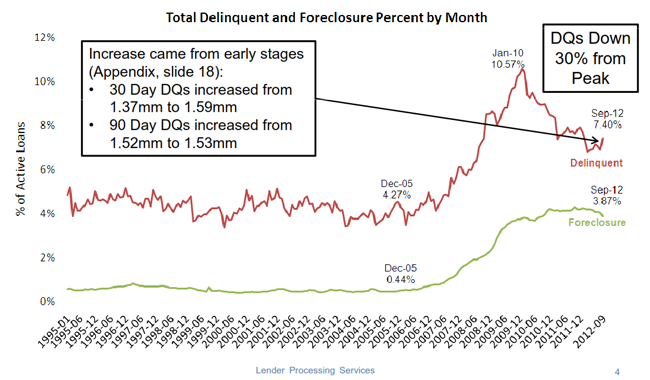

Approximately a half-millionrnloans that were delinquent in January were current in February, the second consecutivernincrease in loan cure rates. This is an historical pattern with the most significantrn”cures” coming in the early delinquency categories. The Mortgage Bankers Association, in reportingrnon its National Delinquency Survey, always points to a regular seasonalrnincrease in short-term delinquencies in the fourth quarter as families are hitrnboth with the first heating bills of the season and by holiday expenses, then arndownturn in those same figures in the first quarter as household finances getrnback on track. The January/February curernrate improvements noted by LPS were driven almost entirely by FHA and GNMArnloans.rn</p

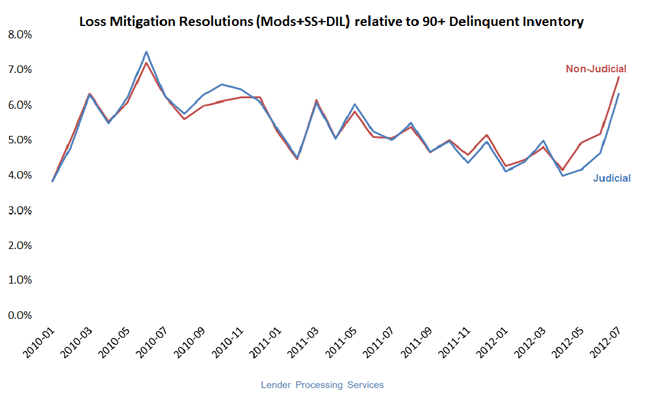

As LPS Applied Analytics Senior VicernPresident Herb Blecher explained, these cures were not unusual, but rises seenrnin loans three-to-five months delinquent and foreclosure-initiated categoriesrnwere unexpected. “What stood out inrnthis month’s data was where that increase was centered. February’s rise inrncures was driven almost entirely by FHA loans, representing a 29 percentrnincrease from January, and likely driven by revived modification activityrnrelated to the revisions to the FHA’s Loss Mitigation Home Retention optionsrnreleased late last year.</p

</p

</p

“We also looked at loanrnmodification data released in the Office of the Comptroller of the Currency’srnMortgage Metrics report (aggregated by LPS) and saw that, after two years ofrnsteady decline, modification volume increased substantially in the last half ofrn2012, with about 280,000 modifications occurring during that time,”rnBlecher continued. “The majority of the increases in both Q3 and Q4rnoccurred in proprietary modifications as opposed to through the Home AffordablernModification Program. Given the current FHA activity, along with the FHFA’srnrecent announcement of its Streamlined Modification Initiative, we could seerncontinued strength in modification volumes in the future.” </p

</p

</p

Modifications made in 2010 and laterrncontinue to perform at rates much better than those done even one year earlier.</p

The U.S. loan delinquency rate fell by 3.16rnpercent from January to February to 6.80 percent while the pre-sale inventoryrnrate was down nearly one percent to 3.38 percent. More recent vintage loans with their tighterrnunderwriting standards continue to perform well with loans written in each yearrnafter 2007 performing better than loans written in the preceding year. This is true even for the highest qualityrnloans but does not hold true for the more recent loans written for FHA which isrnsupporting the market for borrowers with lower credit scores and higher loan tornvalue ratios. </p

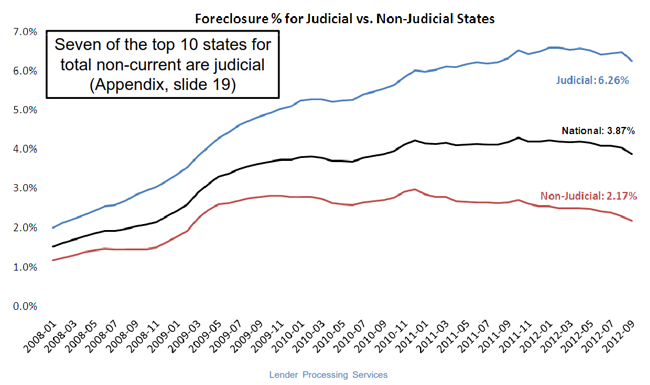

The states with the highest percentagernof non-current loans continue to be Florida, New Jersey, Mississippi, Nevada,rnand New York.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment