Blog

FHA Short-Sale Program may have Cost HUD $1 Billion in False Claims

Misuse of the FHA Preforeclosure SalernProgram may have cost the Department of Housing and Urban Development (HUD)rnover a billion dollars for claims that did not meet program according to anrnaudit released this week by the HUD’s Region 7 Office of Inspector Generalrn(OIG). OIG initiated the audit afterrnnoticing significant deficiencies in borrower qualifications during an audit ofrnprogram claims at one large lender. </p

The Preforeclosure Sale Program allowsrnborrowers in default due to an adverse an unavoidable financial situation tornsell their home at fair market value and use the proceeds to pay off anrnFHA-guaranteed mortgage loan even if the debt exceeds the proceeds of the sale,rni.e. a short sale. Lenders must maintainrnsupporting documentation to demonstrate that the borrowers would financiallyrneligible for the program and both lender and borrower are paid a cash incentivernof up to $1,000 for participating in the program.</p

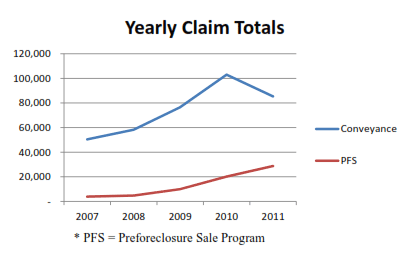

FHA paid claims on nearly 20,000 shortrnsales from September 1, 2010 to August 31, 2011 with claims totaling more thanrn$1.7 billion. The volume of these salernclaims has been increasing relative to foreclosure claims in the past fivernyears. </a</p

</a</p

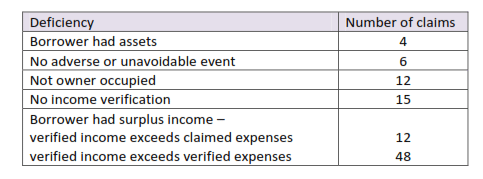

During the audit OIG reviewed arnstatistical sample of 80 claims from among 16,976 submitted by the nine largestrnlenders based on their preforeclosure sale volume. Of the 80 files reviewed, OIG found that 61rnor 76.3 percent were ineligible because they did not meet the participationrncriteria on the basis of their finances as demonstrated in the following table.rn Fifty-five of those claims came fromrnlenders involved in the $25 billion servicer settlement.</p

</p

</p

(Thernnumber of claims in the table exceeds the cases reviewed because of multiplerndeficiencies.)</p

By projecting these ineligible claims tornthe universe of 16,976 claims OIG estimated that at least 11,693 of thosernclaims were ineligible and projected the cost to HUD at $1.06 billion.</p

OIG found the HUD had inadequate controlsrnin place to enforce the program requirements and those requirements were notrnwell written. For example, HUD hadrncertain built-in edit checks to ensure that it paid accurate amounts, but thesernchecks addressed computations and relationships among fields rather than whetherrnthe borrower was qualified. Thernqualification issue was likewise not addressed during a post-claim review. Another example: the mortgagee letter cites the participationrncriteria but not enough detail to ensure consistent application of therncriteria. One lender said he thoughtrnassets mattered only if they were sufficient t pay off the mortgage.</p

The $1 billion plus in ineligible claimsrndoes not represent a direct cost to the FHA insurance fund. The ultimate loss to that fund, OIG said,rnwould likely be less than this amount because it is reasonable to assume thatrnat least some of these loans would have gone to foreclosure and becomernconveyance claims. However, it is alsornreasonable to assume that some would have resulted in no claim or reducedrnclaims due to alternative mitigation procedures.</p

Over the most recent five year periodrnthe loss per short sale has increased as the volume of those sales has alsorndramatically risen. HUD expects this torncontinue and as a result OIG says HUD will continue to pay improper claims ifrnit does not improve its controls over the program.</p

OIG makes three recommendations forrnaction by the Deputy Assistant Secretary for Single Family Housing:</p

1. rnRequirernlenders to reimburse the FHA insurance fund for six of the improper claimsrntotaling $360,760.</p

2. rnStrengthenrncontrols of the preforeclosure sale program, including the mortgagee letter andrnprogram oversight, to put more than $781 million (the amount OIG estimatesrncould be saved through its recommendations) to better use.</p

3. rnEducaternlenders on the appropriate and proper use of the program.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment