Blog

FHA's Galante Asks Congress For Increased Authority To Hold Lenders Accountable

On Wednesday thernHouse Financial Services Committee held a second in a scheduled series of hearings to lookrninto the financial condition of the Federal Housing Administration (FHA). The sole witness at the hearing titled “Bailout, Bust, or Much Ado about Nothing?: A Look at thernFederal Housing Administration’s 2012 Actuarial Report” was Carol Galante,rnAssist Secretary of the Department of Housing and Urban Development and ActingrnFHA Commissioner. </p

Galante briefly recounted thernhistory of the housing collapse, FHA’s response to that event, and its role inrnthe current state of housing recovery which, according to Moody’s Analytics,rnprevented house prices from falling an additional 25 percent resulting in 3 million more job lossesrnandrna reduction of economic output of $500 billion. rnIt has also continued to service its historic target population,rninsuring 1.2 million single family mortgages worth $213 billion in 2012, 79rnpercent of which were for first-time buyers and accounting for 50 percent ofrnhome purchase mortgages forrnAfrican American borrowers and nearly as many for Hispanic and Latino households. </p

FHA’s market share, however is declining as the economy recovers and private capital returns to the market. New endorsementsrnin 2012 continued to decline from the peakrnlevels of 2009. rnIts market share of refinance and purchase transactions was 14.6 percent in 2012 but the dollarrnvolume was the lowest since the start ofrntherncrisis and is now at 2002-2003 levels;rnmore indicative of thernreduction in the size ofrnthernmarket than of abnormal levels ofrnFHA activity.</p

Home Equity Conversion Mortgage (HECM) insurance endorsements in FY 2012 were also down byrn25 percent from FY 2011 levels, to 54,591 loans, the third consecutive year HECM volume declined.</p

Galante saidrnthat FHA’s contribution hasrnnot been without stress. An independent actuarial review conductedrnby Integrated FinancialrnEngineering (IFE)rnand released in November 2012 measures the economic net worth of FHA’s portfolio at the end of the fiscal year and found it had a capital reserve ratio of a negative 1.44 percent, and the Fund’srneconomic valuernstands at negative $16.3 billion. </p

FHA’s Mutual Mortgage Insurance (MMI)</bFund operates with two primaryrnsets of financial accounts:rna Financing Account, which reflects the business transactions related to insurance operations,rnandrna Capital Reserve Account, whichrnreflects secondary reserves to coverrnunexpected increasesrninrnprogram costs, including higher claim expenses, orrnlower fee collections.rnThe CapitalrnReserve Account was established tornassist in managing to the two-percent capital ratio requirement enacted by Congressrninrn1990. Under what is called "permanent indefinite budget authority" FHArnhas access to the U.S. Treasury for anyrnfunds needed to pay claim obligations.</p

The Fund isrnsubject to two distinct portfolio valuationsrneach year which project allrnfuture revenues and expenses basedrnupon a forecast of loan performance under defined economic conditions. Onernis performed by an independent actuary the other isrnthe annualrnsubsidy re-estimate performed by the Administration andrnpublished in the President’s Budget.</p

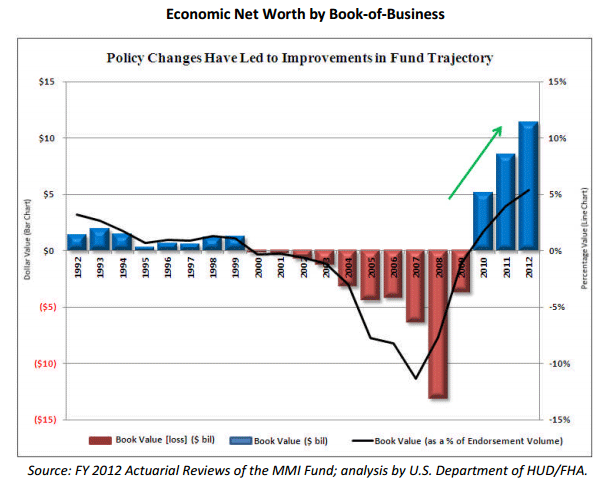

Loans originated from 2007-2009 continue to be the primernsource of stress to the Fund,rnwith fully $70 billion in claims attributable to these books ofrnbusiness alonernbut the actuary attests to the high quality and profitability of booksrninsured since 2010. Thus,rneven though books of business insured since 2010 are thernstrongest in agency history, there isrnstill work to be done in mitigating the impact of olderrnbooks ofrnbusiness. </p

The actuary’srnfindings regarding the economic net worth of the fund is of serious concernrnbut it will not determine whether FHA willrnneed to draw on permanent and indefinite budget authority from the Treasury, Galante said. The President’s budget will outline thernAdministration’s expectation about such assistance and the ultimate need will be borne out in the actualrnperformance of the FHArnsingle family program and the steps FHA takesrnto increase revenue or reduce losses.</p

The President’srnbudget submission last year anticipated a Treasury draw of nearly $700 million</bbut at the end ofrnFYrn2012 the Capital Reserve Account held $3.3rnbillion because of policy changesrnthat substantially improved the value ofrnthernFund. Likewise, the series of additionalrnchanges FHArnhas announced arerndesigned to reduce the likelihood that FHA will need Treasury assistance at the end of FYrn2013.</p

Galante said the actuarial assessmentsrnestimate that the economic value of the Fund as of the end ofrnFYrn2012 is negative $16.3 billion against an active portfolio ofrn$1.13 trillion.rnTherneconomicrnvalue of the forward portfolio was estimated at negative $13.5 billion,rnthernHECM portfolio at negative $2.8 billion. These economic valuesrnrepresent capital reserve ratios ofrnnegative 1.28 percent and negative 3.58 percent respectively. The actuary projects that the MMI Fund capitalrnreserve ratio will be positive by FY 2014 and reachrn2.0 percent during FY 2017 assuming no changesrninrnpolicy or other actions by FHA. Policyrnchangesrnthat were announced when the actuarial report wasrnreleased are expected to acceleraterntherntime to the Fund’srnrecovery.rn</p

The low capital ratio today anticipatesrnthat the current pool of insured loans still hasrnsignificant foreclosure and claim activity yet to occur. Projected losses for 2007-2009 vintage loans alone total $70 billion in claims. </p

Loans with seller-funded down payment assistance have beenrnparticularly costly to the Fund and are projectedrnto cost $15 billionrnmore through their elevatedrnclaim rates. In fact the Actuary estimates that hadrnFHA had not insured any seller-funded-downpayment loans, the net economic value ofrnthernMMI Fund would be positivern$1.77 billion today. Congress eliminated seller-rnfunded down payment loans in 2008. </p

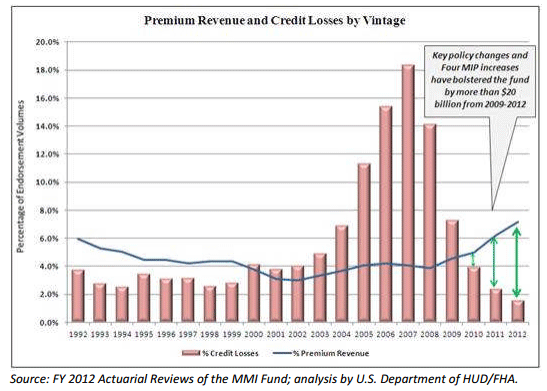

The loan endorsements in fiscalrnyears 2010 through 2012 arernexpected to produce significant net revenues that will partially offset losses from older loans. The contrast in quality between these pre-rnandrnpost-2009 loans is based,rnatrnleast in part, on the impact of key policy changes whichrnhave added overrn$20rnbillion to the Fund since 2009. </p

FHA has taken tornsignificant actions to date to improve the health and trajectory of the MMIrnFund, Galante said. The changes to FHA policy since 2009 are projectedrnto have improved the economic value of the Fund by at least $20 billion. </p

A first step was to improve FHA’s monitoring and oversight ofrnlenders including substantial improvements to risk analysis and policy changesrnto focus on high risk areas. As a result record numbers ofrnlenders have been withdrawn from FHArnprograms, andrnthere were substantial improvements in lender compliance,rnandrna number of settlements with lendersrnandrnservicersrnfor violations ofrnorigination orrnservicing requirements. rnFHA has also taken recent steps to increase oversight of lenderrnadvertising.</p

FHA has also worked to strengthen its credit policies, implementing Congress’srnelimination of seller-fundedrndown payment assistance programsrnand enacting increased down payment requirements for borrowers with credit scores below 580. FHArnhas also proposed regulations to reduce the amount ofrnallowable sellerrnconcessionsrnthat increase risks from inflated appraisals,rnrequired manual underwritingrnfor borrowers with credit scores below 620 and debt to income (DTI) ratios over 43 percent,rnmade enhancements to FHA’s TOTAL Scorecard,rnandrnproposed anrnincrease in the required downrnpayment forrnborrowers seeking loans in excess of $625,500. rn</p

Galante said that, while it was a difficult choice, FHA has increased mortgage insurance premiumsrnfive times since 2009. The most recent increase in response to the FY 2012 actuarialrnreview willrnaddrnan average $150 to borrowers’ annualrncosts but the combined increases have yielded more than $10 billionrnto the Fund. </p

FHA has alsorntaken steps to controlrncosts and limit losses throughrnimprovementsrntornits REO disposition processes</bandrnloss mitigation strategies. Better oversight of REO contractorsrnandrncompliance monitoring alongrnwith measures to promote competition and continuity have reduced the gap between appraised valuesrnand REO sales pricesrnbyrn62% and the time in inventory hasrnfallen by 45%. </p

Last year FHA implemented arnsignificant expansion of its program to sell non-performing loans in pools via auction to investors. rnThe Distressed Asset Stabilization Program (DASP)rnexpands the number of loansrnsold in each sale andrnintroduces innovations to promote stability in hard hit areas. The initial results from the first DASP salernwere positive and the Actuary estimatedrnmore than $1 billion in improved economic value fromrnthis initiative over the next two years. </p

</p

</p

FHA is implementing a series of additional actions to continue improving the Fund’srntrajectory over both the short and long term which are projected to provide billions of economic value forrnthernMMI Fund in FY 2013.</p<ul

Galante said it is also vitalrnto take additionalrnstepsrntornstrengthen new booksrnof business to ensure the long term health of the MMI Fund. rnAccordingly, in the second quarterrnof FY 2013,rnFHA will implement the following policies forrnnew originations.</p<ul class="unIndentedList"<liFHA willrnno longer cancel mortgage insurancernpremiums (MIPs) on loans forrnwhich the outstandingrnprincipal balance reaches less thanrn78%rnof the originalrnprincipal balance while continuing 100 percent coverage. It is estimated that $10 billion in revenuesrnwill be lost in the 2010-2012 vintagesrnas a result ofrntherncurrent cancellation policy and that 10%-12% of allrnclaims losses mayrnoccur after MIP cancellation. </li<liFHA will increase annualrnmortgage insurance premiumsrnbyrnan additional 10 basis points.rnThis premium increase, $13 per month for the average FHA borrower, which FHArnplansrnto implement in 2013 will add significant revenue to the Fund and ensure thatrnFHA does not take on additional market share whilernnot affecting borrowerrnaccess to credit or threateningrnthe emerging housing recovery.</li<liFHA intends to develop new policies whichrnincentivize, or in some cases require, borrowers to complete a pre-purchase housingrncounseling programrnprior to the purchase ofrna home usingrnFHA-insured financing. </li</ul

Galante saidrnthat changes in borrowerrnutilization of the HECM program and the FY 2012 actuarial review show substantial stressrninrnthe HECM program. Underrnits current regulatory authorityrnover FHA has limited ability to address root-cause issuesrnand will, therefore, be forced to make blunt changes to the program on an interim basis. FHArnwill take immediate action to ensure that HECM consumersrnarernbetter protected and able to sustain their reverse mortgage while also protecting the Fund. </p<ul class="unIndentedList"<liIn administrative guidance datedrnJanuary 30, 2013,rnFHArnconsolidatedrnthe Fixed Rate Standard program with the Fixed Rate HECM Saver product, whichrnwill result in a reduction ofrnthernmaximum amount ofrnfunds available to arnHECM borrower.</li<liRecently larger numbers of estate executors of HECM borrowers have beenrnchoosing to convey these propertiesrntornFHA rather than sell them, adding costs and reducingrnrecoveries for FHA. By incentivizing the sale ofrnproperties by executors,rnFHA is able to avoidrnproperty management, maintenance,rnandrnmarketing costs associated with the REOrndisposition process, thereby reducing losses to the Fund on these properties.</li<liOver a longerrnterm, either through the granting of the legislative authority described below or via the much longer rule making process, FHA willrnalso pursue other materialrnchanges to ensure the long-term viability of the HECM program including: limiting the draw at origination to mandatory obligations (i.e. closing costs, mortgagernliensrnandrnfederal debt); performing a financialrnassessment ofrnborrowers asrna basis for loan approval andrndetermining the suitabilityrnof various HECM productsrntornprotect consumers from acquiring loans not fit for theirrnsituation; and establishing arntax and insurance set-aside to ensure anrnability to pay taxes and insurance on the mortgaged property. </li</ul

Galante said FHA neededrnCongressional help to increase its ability to hold lenders accountable for non-compliance with FHA policy and provide greaterrnflexibility for thernagency to make changes as emerging needs and trends are identified and avoid unnecessary lossesrnbefore they occur. Congressional approval is needed, she said,rnfor the following:rn</p<ul

</li

</li

</li

</li

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment