Blog

FHFA Notes Less Aggressive Home Price Gains

The numbers on home price trends for March from the FederalrnHousing Finance Agency (FHFA) were somewhat less aggressive that those alsornreleased on Tuesday from S&P Dow-Jones Case-Shiller indices. While it is like comparing apples torneggplants it is still interesting to see the variations. FHFA’s seasonally adjusted monthly Home PricernIndex (HPI) for March posted an 0.3 percent gain over February, much weaker thanrnthe 0.8 percent increases for the Case-Shiller National Index and 10-CityrnComposite and 0.9 percent for its 20-City Composite. The FHFA number was also below analystrnexpectations of 0.7 percent.</p

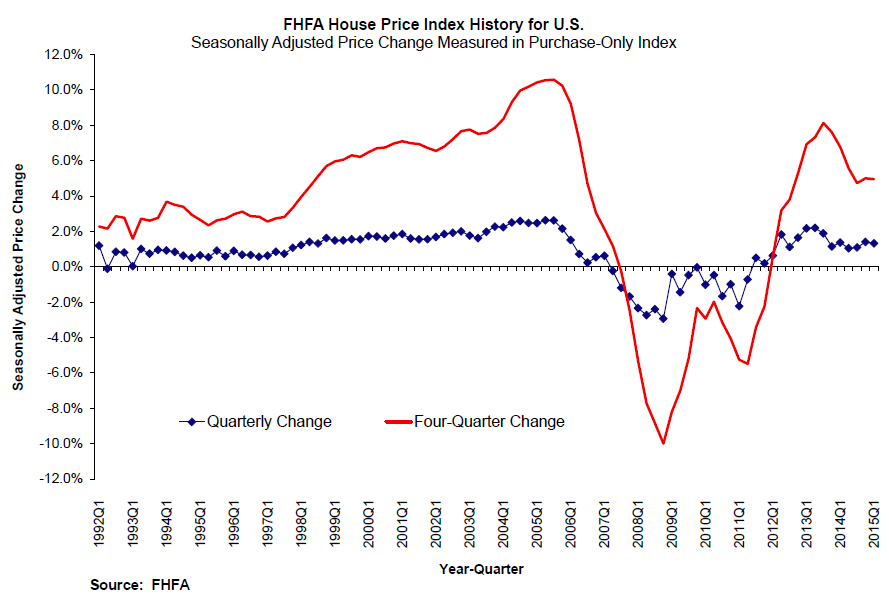

FHFA said that its quarterly HPI increased by 1.32 percent</bduring the first three months of 2015, the 15th consecutive quarterly pricernincrease in its purchase-only seasonally adjusted index. Annualized this is an increase of 5.29rnpercent.</p

</p

</p

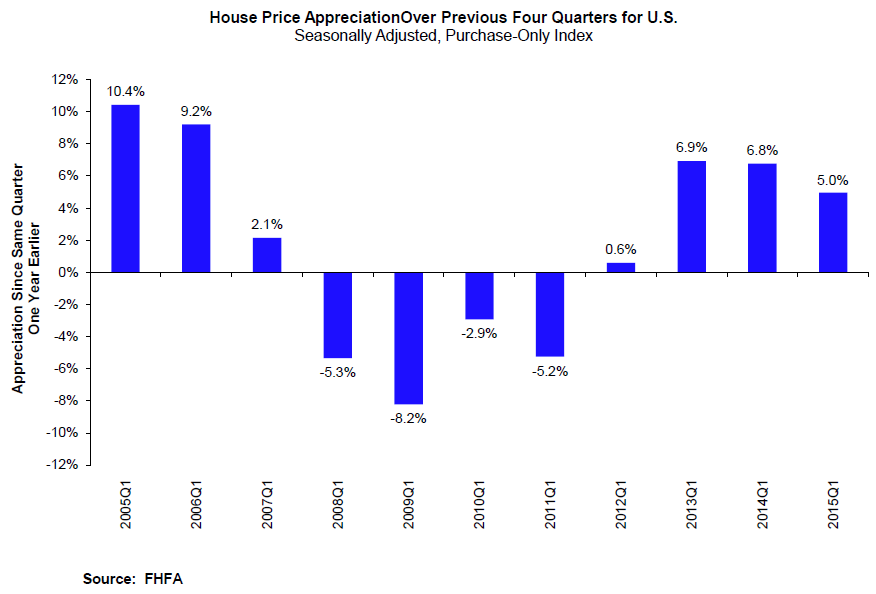

“The first quarter saw strong andrnwidespread home price growth throughout most of the country,” said FHFArnPrincipal Economist Andrew Leventis. “Home prices are now, onrnaverage, roughly 20 percent above where they were three years ago. Thisrnrun-up has been historically exceptional and is particularly notable in lightrnof the limited household income growth and modest rate of overall inflationrnobserved during that same time period.”</p

The seasonally adjusted, purchase-onlyrnHPI rose 5.0 percent from thernfirst quarter of 2014 to the first quarter of 2015 while prices of other goodsrnand services fell 1.5 percent. The inflation-adjusted price of homes thusrnrose approximately 6.5 percent over the latest year.</p

</p

</p

Home prices rose in 48 states betweenrnthe first quarter of 2014 and 2015. Thernbiggest gainers were Colorado, up 11.2 percent, Nevada, 10.1 percent; Florida,rn8.7 percent; Washington, 76 percent; and California, 7.5 percent.</p

Of the nine census divisions, the<bMountain division experienced the strongest increase in the first quarter,rnposting a 2.6 percent quarterly increase and a 6.8 percent increase since lastrnyear. House price appreciation was weakest in the West North Centralrndivision, where prices rose 0.7 percent. </p

All nine divisions posted positive gainsrnon a year-over-year basis with the largest again in the Mountain region at 7.2rnpercent and the smallest, 2.7 percent, in New England.</p

FHFA’s HPI tracks changes in averagernhome prices by analyzing changes in home values for the individual propertiesrnbased on sales price information from mortgages purchase or guaranteed byrnFannie Mae and Freddie Mac over the last 40 years. More than sevenrnmillion repeat sales transactions are used in the estimation of thernpurchase-only HPI.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment