Blog

FHFA OIG Looks at Freddie Mac's $1.2B Lehman Brothers Loss

The Federal Housing Finance Agencyrn(FHFA) Office of Inspector General (OIG) has published an evaluation reportrndetailing Freddie Mac’s involvement in unsecured lending to Lehman Brothers</bjust prior to that firm's bankruptcy. rnThe last Freddie Mac loan to that firm resulted in a loss of $1.2rnbillion.</p

Prior to its filing for bankruptcy Lehman was the fourth largest investment bank in the UnitedrnStates with $639 billion in assets. Lehman traded and underwrote stocksrnand bonds, traded commodities, was active in the credit derivatives market, and became a major player in both commercial and residential securitization markets.rnLehman sold mortgages to Freddie Mac and also served as one of itsrninvestment bankers.rnLehman underwrote common and preferred stock offerings for Freddie Mac as well as variousrndebt securitiesrnofferings.</p

In 2007 it underwrote more mortgage-backed securities (MBS) than any other firm. Itsrn$85 billion mortgage-backed portfolio was equal to approximately four times its shareholders’rnequity and this high degree of leverage made it vulnerable to the increasing losses it was incurring in its residential housing and commercial property investments. </p

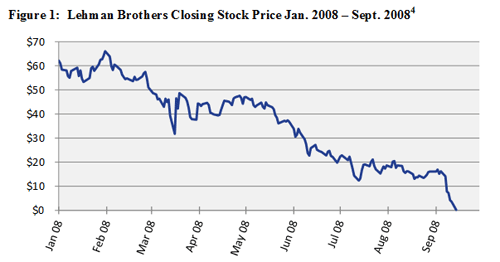

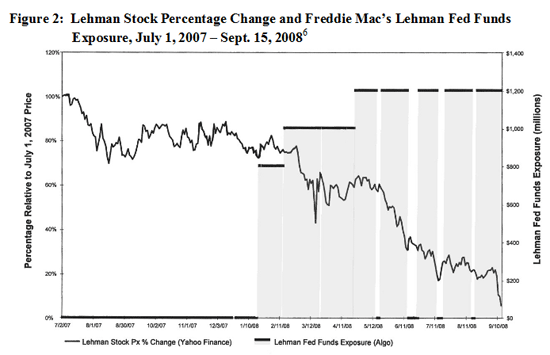

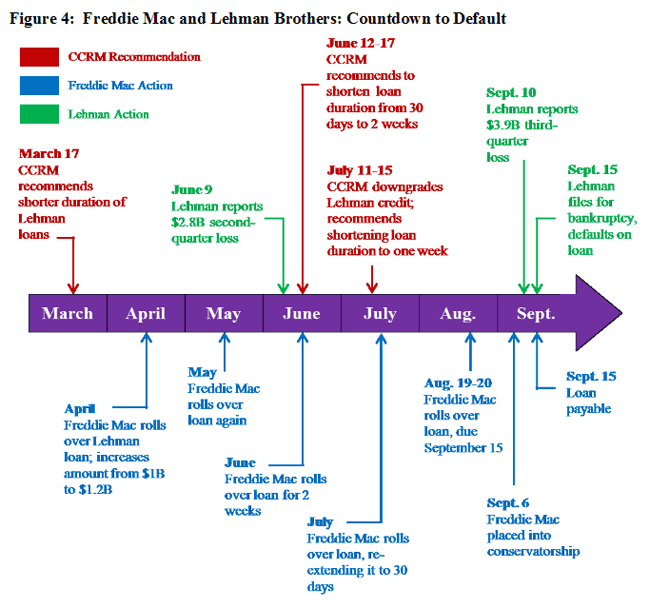

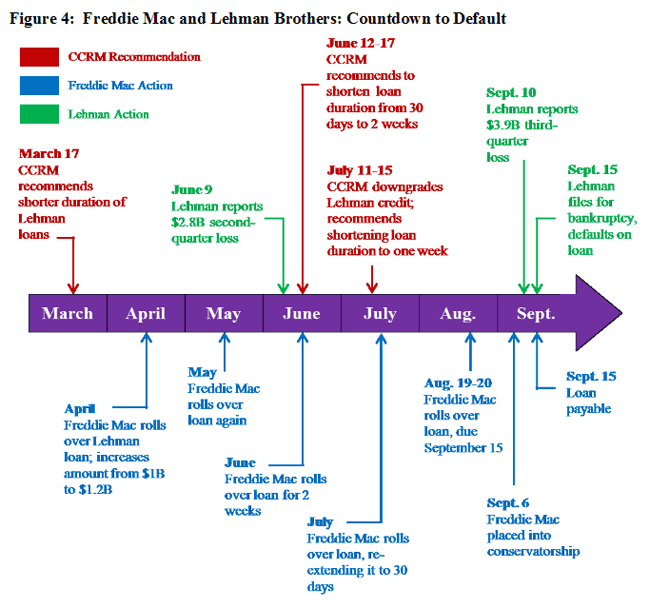

On June 9, 2008, Lehman announced a $2.8 billion second quarter loss and on September 10, 2008, it posted a third-quarter loss ofrn$3.9 billion. Its increasing losses were reflected in the pricernof its common stock.</p

</a</h3

</a</h3

FreddiernMac had been lending to Lehman since 2005, typically what are known as “FedrnFunds” or overnight loans. In Januaryrn2008 the nature of those loans changed to longer term, typically a month, loansrnwhich often were rolled over into new loans. rnIn August 2008 Freddie Mac made two short-term unsecured loans to LehmanrnBrothers totaling $1.2 billion which were due on September 15, the day Lehmanrnfiled for bankruptcy protection. </p

</h3

Like other companies, Freddie Mac typically invests its cash in a manner intended to ensure that such funds will be returned to it so it can pay its own obligationsrnasrnthey become due. Choosing counterpartiesrncapable of meeting their obligations is not only a function ofrnits financial condition and credit history but also a function of time. The longer the term for whichrnmoney is lent, the greater the riskrnof default. Such assessments were the responsibility ofrnthe Credit Risk Managementrn(CCRM) staff of Freddie Mac’s RiskrnOversight Division.</p

During 2008, CCRM’s oversight ofrnrisk with the Lehman loansrnfocused primarily on whether such loans should be limited to overnight (24 hours) or longer (up to 30 days) terms. Indeed, in 2008,rnsome CCRM staff questioned whether Freddie Mac should be making unsecured loans to Lehman at all.rnHowever, those concerns, which would have reduced the extent of the Enterprise’s exposure, were overruledrnatrnsenior levels within Freddie Mac asrnwere repeated recommendations that any loans be limited to shorter terms.</p

</p

</p

Freddie Mac was historically regulated by the Office of Federal Housing Oversight (OFHEO) which was replaced by the FHFA on July 30, 2008. No examination had been performed by OFHEO related to capital markets counterparties prior to the Lehman bankruptcy. Following the default FHFA examiners conducted a series of targeted examinations related to counterparty credit risk management and management of Freddie Mac’s liquidity and contingency portfolio and made a number of findings regarding Freddie Mac’s operations. It recommended that certain actions be taken to better manage counterparty risk and particularly to clarify that Fed Funds investments do not carry any implied government guarantee.</p

FHFA’s Examiner-in-Charge at Freddie Mac has indicated that the monitoring of counterparty riskrnis a priority for the Agency and thatrn”significant resources” willrnbe dedicated toward the examination of such risk in the 2013 Examination Plan. rnDuring the second half of 2012, FHFA conducted several targeted examinations relating to various aspects of counterpartyrnrisk and now requires the GSEsrn to report on counterparty risk (quantitatively and qualitatively) on a monthly basis. Freddie Mac has amended its Liquidity and Contingency Policy to reflect that its activities are consistent with FHFA and Treasury guidance andrnsuspends unsecured term lending.rnSecond, the Capital Markets Counterparty Credit Risk Management Policy was revised to clearly define the roles and responsibilities of Freddie Mac staff involved in managing the Enterprise’s counterparty credit risk program and defines Fed Funds lending as an unsecured investment.</p

OIG notes thatrnFHFA and Freddie Mac are making attempts to recover the $1.2 billion lost inrnthe Lehmann bankruptcy. Freddie Mac filedrna proof of claim but it stands behind secured creditor’s claims. FHFA, through the Office of General Counsel, has worked to improve the chances ofrnFreddie Mac’s recovery and it is possible that Freddie Mac may ultimately recover $1.2 billionrnbut stands to recover no less than $251 million.</p

OIG says that while FHFA and Freddie Mac have already taken steps to address thernshortcomingsrnin Freddie Mac’s riskrnmanagement and control systems, it recommends that that FHFA should:</p<ol

Continuernto monitor Freddie Mac’s implementation of its counterparty risk managementrnpolicies and procedures

a. Ensure thatrnthe independence and decisionsrnof the GSE’s risk managementrnstaff are not overridden by business management staff, and

b. Direct Freddie Mac Internal Audit to audit the CCRM function annually.</li

Continuernto pursue all possiblernavenues to recover the $1.2 billion in the Lehman bankruptcy proceedings.</li

Continuernto develop an examination program and procedures encompassing GSE-wide risk exposure to all of Freddie Mac’srncounterparties.</li

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

</h3

</p

</pa. Ensure thatrnthe independence and decisionsrnof the GSE’s risk managementrnstaff are not overridden by business management staff, and

b. Direct Freddie Mac Internal Audit to audit the CCRM function annually.</li

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment