Blog

FHFA's: GSE's Need for Treasury Draws Dwindling

Three different scenarios for predicting the level ofrnadditional financial support the two government sponsored enterprises (GSEs)rnFreddie Mac and Fannie Mae may require from the U.S. Treasury were presented todayrnby their conservator the Federal Housing Finance Agency (FHFA). The scenarios updated similar projectionsrnoriginally released in October 2010 and updated one year later. </p

FHFA said its projections are notrnexpected outcomes but modeled projections in response to “what if” exercisesrnbased on assumptions about GSE operations, loanrnperformance, macroeconomic and financial market conditions, and house prices.rn Norrndo the projections define thernfull range of possible outcomes. FHFA defines the effort as “a sensitivity analysis ofrnfuture financial resultsrnto possible house price paths.”</p

All threernscenarios make the following assumptions: </p<ul class="unIndentedList"<liFuturerninterest rates are implied by the forward curves as of June 30, 2012.</li<liAssetrnBased Securities and Commercial Mortgage Backed Security prices fall by 5rnpoints at the beginning of the period.</li<liAgencyrnMBS spread to swaps remain unchanged.</li<liThernsize of the retained portfolios are in accordance with the terms of the SeniorrnPreferred Stock Purchase Agreements (PSPAs) in force between the GSEs andrnTreasury and additions to the retained portfolios are limited to nonperformingrnloans bought out of pools backing the GSEs MBS and PCs.</li</ul

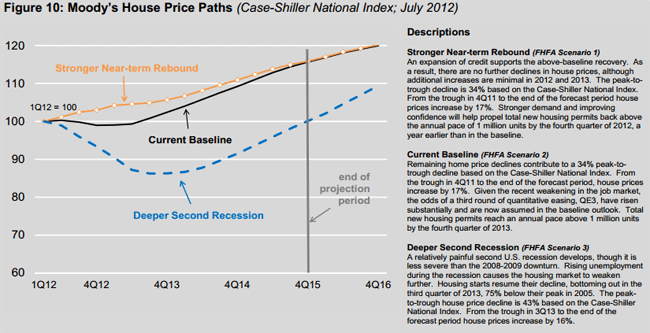

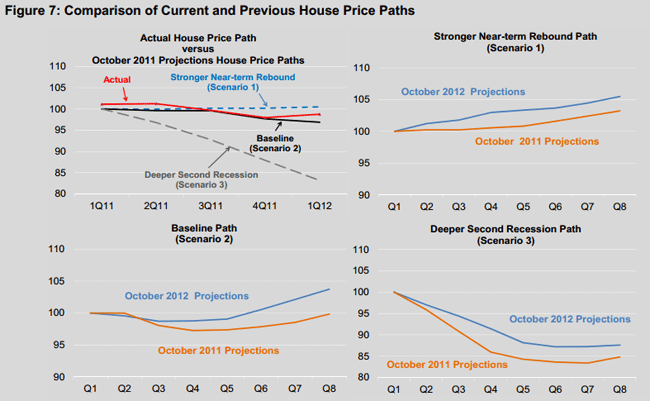

The differencernin the three scenarios is in the Moody’s price paths each employs. Scenario 1rnuses Moody’s “Stronger Near-term Rebound” house price paths; Scenario two usesrnthe “Current Baseline” price paths, and the third scenario is based on Moody’srn”Deeper Second Recession” house price paths.</p

</p

</p

Since the lastrnFHFA projections each of the assumptions have been updated to reflect therncurrent outlook for house prices, interest rates, trends in borrower behaviorrnand amendments to the PSPAs. Thernprojection period has been extended an additional year to 2015.</p

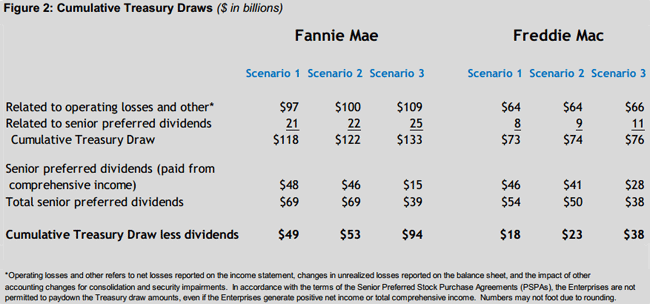

To date the GSEsrnhave drawn $187.5 billion from the Treasury. rnThe additional draws needed to carry the GSEs through to the end of 2015rnunder the three scenarios would put the cumulative totals into a range fromrn$191 billion to $209 billion including the money drawn in order to cover therndividends the GSEs are required to pay back to the Treasury. However, if dividends and the draws necessaryrnto support them were removed from the projections the cumulative draws wouldrnthen range from $67 billion to $138 billion. rn</p

In 2011’srnprojections the required draws through to the end of 2014 were $220 billion torn$311 billion. Changes to thernPSPAs, effective January 1,rn2013 replaced a fixed 10 percentrndividend on senior preferred stock with a sweep ofrnnet worth and effectively ends the contribution of dividends to projected Treasury draws.</p

</p

</p

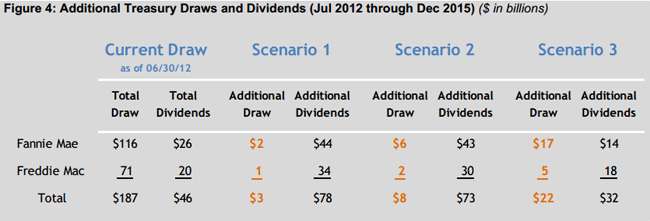

For the selectedrnscenarios in the current projectionsrnan additionalrn$3 torn$22 billion would bernrequired to support the Enterprises over the projection period. FreddiernMac would not requirernadditional Treasury draws afterrn2012 in any of thernthree scenarios. Fannie Mae wouldrnnot require additional Treasuryrndraws after 2012 inrntwornof thernthree scenarios. Furthermore, over the projection period the Enterprises pay additional dividendsrnof $78rnbillion in Scenario 1 to $32 billion in Scenario 3.</p

</p

</p

The current projections differrnfrom those one year ago in several ways. rnThey both cover a period of three and a half years but the current ones arernextended out through the end of 2015. Inrnaddition to covering a different time period, there has been the change to therndividend structure of the PSPA mentioned above. rn</p

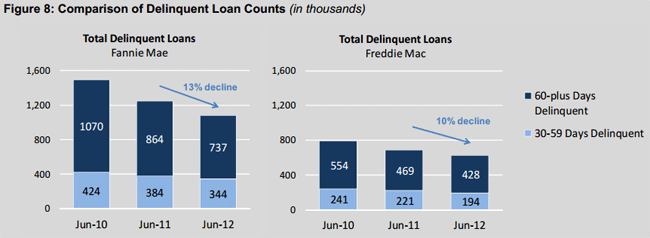

Other factors contributed to lowerrnprojected Treasury draws in the current projections. First, the projectedrnprovision for credit losses forrnall three scenarios is lowerrnin therncurrent projectionrnthan in the previous projection due tornimprovements in projected housernprice paths and in thernnumber of delinquentrnloans at the start ofrnthe projection period.</p

</p

</p

The actual housernpricernpath over the past yearrnwas more positive than thernhouse price paths used inrnthe Baseline (Scenario 2)rnand Deeper Second Recession (Scenario 3) house pricernpaths in the previous projectionsrnand in most cases Moody’s price paths are more objective than in previousrnprojections, and recent observedrntrends indicate higher REO sales pricesrnthan previously projected.</p<ul class="unIndentedList"</ul

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment