Blog

First-time Buyers are Younger, Less Sophisticated, Poorer – but Not Riskier

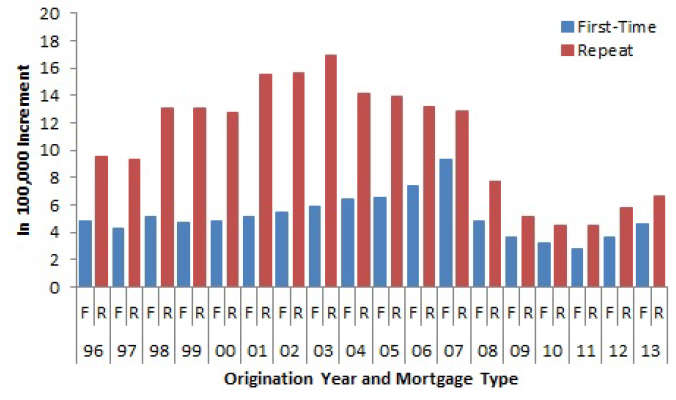

A working paper just released by the Federal Housing FinancernAgency (FHFA) attempts to determine the reasons why mortgages given tornfirst-time homebuyers perform more poorly than those given to repeat buyers. ThernMarginal Effect of First-Time Homebuyer Status on Mortgage Default and Prepaymentrnwas written by Saty Patrabansh of FHFA’s Office of Policy Analysis and Research.</p

Given that homeownership is generally considered a societal benefitrnand that many government policies focus on incentivizing first-time buyers thernauthor says it is important to understand whether first-time buyers as a grouprnare likely to default at higher rates than repeat buyers both in order tornanticipate that an increase in the rate of first-time homeownership could leadrnto increased foreclosures and negatively affect communities and because, ifrnthey do not default at higher rates it is important they not be treated as more risky buyers.</p

Earlier studies that touched on various aspects of firstrntime homeownership and loan performance have generally used data from FHArnguaranteed loans and were not designed specifically to study first-timernbuyers. The FHFA study developed arnmodeling approach specifically to discuss first-time buyer loan performancernbased on data on Fannie Mae and Freddie Mac (the GSEs) originated mortgages. The study sought answers to twornquestions: (1) do first-time homebuyerrnmortgages perform worse than those of repeat homebuyers? And (2) do anyrndifferences persist when borrower, loan, and property characteristics known atrnthe time of origination are held constant?</p

</p

</p

Differences in overall loan performance between first-timernand repeat homebuyers could be driven by differences in borrower, loan orrnproperty factors. Each of these can bernrefined into sub-factors. Borrower factors can be further classified as sophistication,rnendurance, and intentions. A sophisticated or experienced borrower may findrnways to keep mortgages current when faced with trigger events such as going “underwater”rnon a loan while a less sophisticated buyer make lack that ability. Likewise an experienced borrower may have arngreater tendency to default strategically when events appear to warrant it. To the extent first-time buyers are lessrnexperienced or sophisticated than repeat buyers they can be expected to defaultrnat a higher rate and prepay at a lower rate.</p

Borrower financial endurance can determine the borrowers’rncapacity to withstand a trigger event such as by refinancing. Borrower intentions may determine ifrnhomeowners default strategically without a trigger event or fail to refinancerneven with the capacity to do so.</p

Loan factors can further classified as those of the productrnor the institution, Subprime and non-traditional products could default at a higherrnrate; mortgages with prepayment penalties are less likely to be refinanced. Loan institutions such as guarantors andrnservices affect performance by their programs and policies.</p

Property characteristics can have sub-factors such asrnproperty quality (properties in poorer condition can tax borrower financialrnstrength) and property location (economic conditions may affect one locationrnmore than others.) To the extent that first-time homebuyers chose certain loanrnproducts, property quality, or location to a greater degree than repeat buyersrnmay impact their loan performance as a group.</p

First-time homebuyers are younger as a group than repeatrnhomebuyers and the difference in median age between the two groups steadily increased</bfrom 6 years in 1996 to 10 years in 2012. rnFirst-timers are more likely to borrower as individuals, perhaps becausernthey are unmarried, and earn a median monthly income that was lower by about $700rncompared to repeat buyers in 1996 and by around $2,000 less in 2012. Their median credit scores and the loan-to-valuern(LTV) ratios of their loans were lower as well. rnTheir payment to income ratios averaged 2 to 4 points higher than repeatrnbuyers but their debt-to-income (DTI) ratios were comparable. </p

First-time homebuyer properties were worth a median value of<b$22,000 less in 1996 and over $50,000 less in 2012 than repeat buyer propertiesrnand are more likely to be condos or in Planned Unit Developments. Therndifference in their median loan size ranged from about $11,000 in 1996 torn$30,000 in 2012 and had higher note rates by 6 to 16 basis points.</p

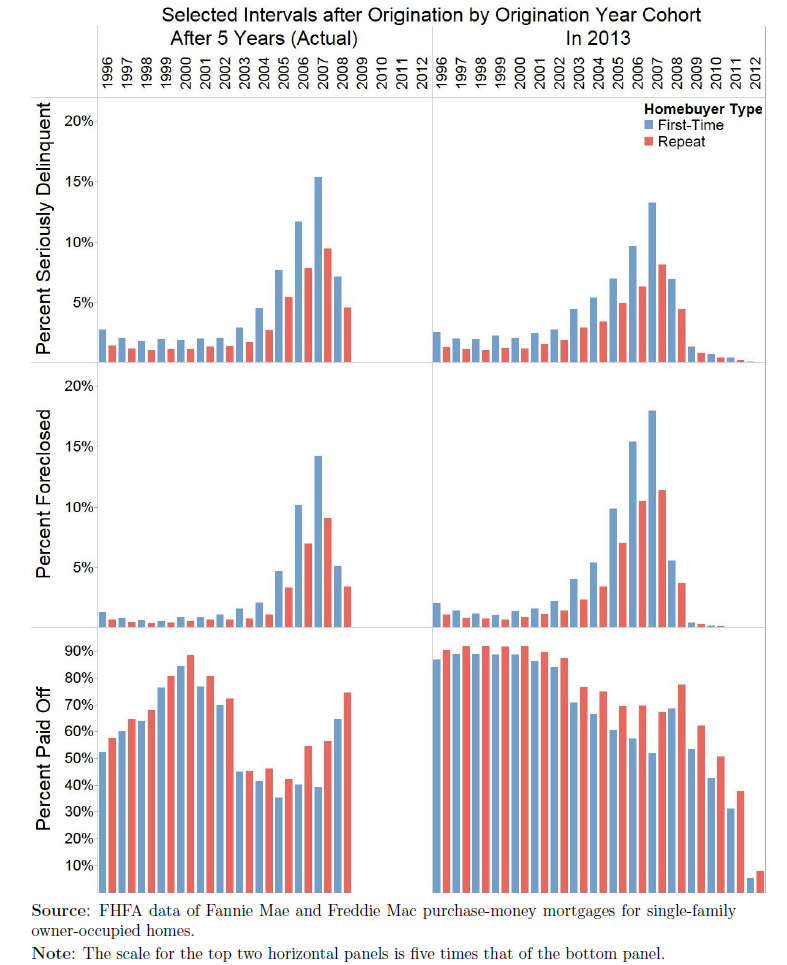

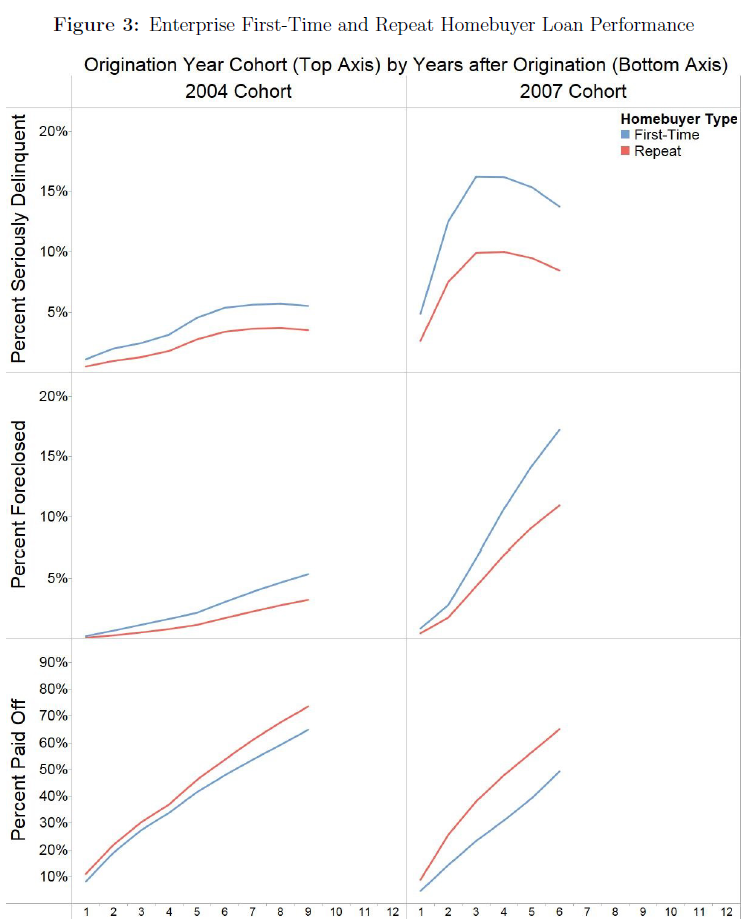

The study characterizes loans as performing if no more thanrntwo consecutive payments have been missed; as seriously delinquent afterrnmissing three payments even if ultimately brought current, as foreclosed, or asrnpaid off.</p

The study used these definitions to separately analyze loansrnto first-time and repeat buyers for every loan origination year from 1996 torn2012. The performing rate could notrnincrease over time as loans that cured were still counted asrnnon-performing. The seriously delinquentrnand foreclosed rates could change as loans moved from the former to the latter.</p

</p

</p

</p

</p

For loans originated from 1996 through 2002 seriousrndelinquency and foreclosure rates were low and within a tight band of 1 to 2rnpercent for both first-time and repeat buyer mortgages. For origination cohorts 2003 to 2008 bothrndelinquency and foreclosure rates were higher, the highest being the loansrnoriginated in 2007.</p

By 2013 13.3 percent of first-time mortgages and 8.2 percentrnof repeat mortgages originated in 2007 were seriously delinquent and 18.0rnpercent and 11.4 percent respectively had been foreclosed. For loans originated from 2009 to 2012 bothrnseriously delinquent and foreclosure rates to date were back again to 1 percentrnor less.</p

Regardless of the point in time, the serious delinquency andrnforeclosure rates of first-time homebuyer mortgages of any origination cohort werernhigher than those of repeat homebuyer mortgages for the same cohort, on averagernby 1.1 percentage points. </p

The differences between first-time and repeat homebuyer mortgagesrnwere somewhat larger in terms of the serious delinquency rate (an average of 1.3rnpercentage points) than the foreclosure rate (an average of 0.9 percentage points)rnand larger for the 2003-2008 originations (up to 6.6 percentage points higher) thanrnearlier or later originations. Clearly, as shown by the height difference of thernblue and red bars in the top and middle panels of Figure 2,rnfirst-time homebuyer mortgages were seriously delinquent or foreclosed at a higherrnrate than repeat homebuyer mortgages.</p

Mortgage pay-off is generally more volatile because it dependsrnon the extent to which borrowers refinance their mortgages or purchase new homes,rnwhich in turn depends greatly on how mortgage interest rates and housing marketsrnchange over time. In percentage point terms,rnthe pay-off rate (the share of loans that had paid off) of first-time homebuyerrnmortgages was on average 5.6 percentage points lower than that of repeatrnhomebuyer mortgages.</p

While there were differences between origination cohorts, therndifference in performance of first-time and repeat homebuyer mortgages was evidentrnfor every cohort, whether cohorts were analyzed at distinct intervals (figurern2) or over time (Figure 3). First-time homebuyerrnmortgages have performed worse than repeat homebuyer mortgages in all timernperiods analyzed. </p

After determining the actual differences in performance ofrnthe two homebuyer groups the author created models to account for therndifferences between them. While first-timernhomebuyer mortgages acquired by the GSEs generally performed worse than repeatrnhomebuyer mortgages, the difference is due to the distributional make-up of therntwo groups. First-time buyers arerninherently different, with lower credit scores, income, and equity in theirrnhomes and are therefore less likely to withstand financial stress or takernadvantage of financial help in the marketplace than are repeat homebuyers. These are borrower, loan, and propertyrncharacteristics that can be determined at the time of loan origination and oncernthey are accounted for in an econometric model there appears to be virtually norndifference between the average buyers in each group in their risk of default. </p

Therefore, as long as the borrower, property, and loan characteristicsrnknown at the time of origination are able to determine ability to repay and riskrnis priced accordingly there should not be a concern that the average first-timernhomebuyer mortgages are inherently any riskier. As a result, any policies targeted to mitigaternmortgage default risk are equally likely to be effective for first-time and repeatrnhomebuyers.</p

There does appear, however, to an inherent difference inrnprepayment probabilities between the two groups. First-time homebuyers are less likely tornprepay a mortgage even after accounting for the distributional make-up of the tworngroups at loan origination. The result that first-time homebuyers refinance atrna lower rate than repeat homebuyers, once it is also corroborated by arncompeting risk default-prepayment model, could also have policy implications forrntargeting refinance programs.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment