Blog

Five States Targeted for Additional G-Fee Increases

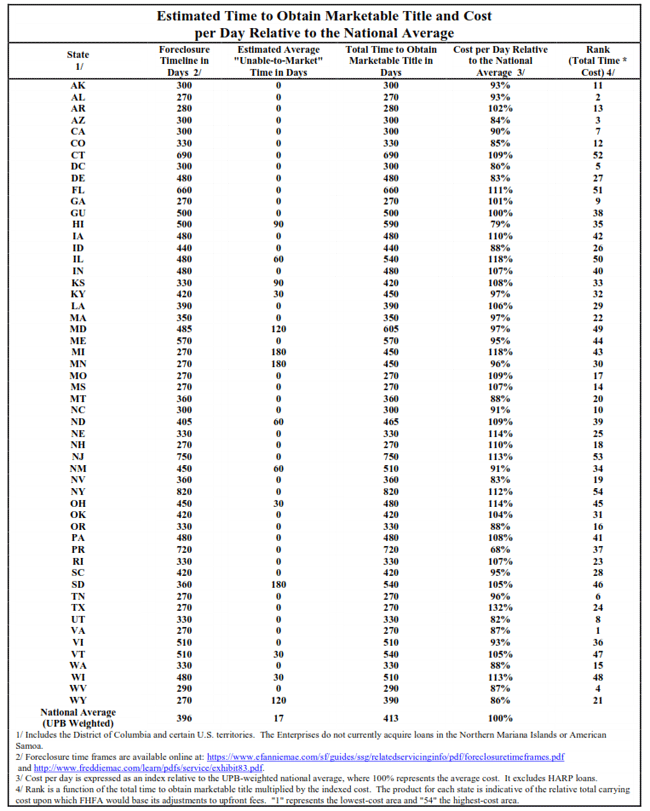

A federal regulator is proposing that five states with higherrnthan average foreclosure costs pick up part of the tab for those foreclosuresrnthrough higher Fannie Mae and Freddie Mac guarantee fees (g-fees). According to a press release late yesterdayrnfrom the Federal Housing Finance Agency (FHFA) the size of the g-feernadjustments “are intended to reflect the disparity in costs as compared to thernnational average.”</p

Under the proposal, the two government sponsored enterprisesrn(GSEs) would hike fees between 15 and 30 basis points on lenders inrnConnecticut, Florida, Illinois, New Jersey, and New York. Those states each have considerably longer timernframes to obtain marketable title than the national average as well as costsrnthat range between 9 and 18 percentage points above the national average. </p

FHFA said that the wide variations among states in the costsrnthe GSEs incur from mortgage defaults are attributable to three factors:</p

1. rnThe length of time needed to secure marketablerntitle to the property;</p

2. rnProperty taxes that must be paid untilrnmarketable title is secured, and</p

3. rnLegal and operational expenses during thatrnperiod.</p

Twenty one states have costs above the national average andrnseveral have costs above those in the five targeted states, however it appearsrnto be the time frame that is driving the disparity.</p

The agency said it recognizes that the GSEs have calculatedrnstate-level differences on a combination of their own experience and estimationrnand that actual costs in the future may vary over time. “Because of this variability, FHFA’s plannedrnapproach focuses on five states that are clear outliers among states in termsrnof their default-related costs.” Thernestimations also do not include any forward-looking impact of recently-enactedrnstate and local laws that might increase costs.</p

The increased fees would be charged to lenders as a one-timernupfront payment on each loan acquired by the GSEs and can be passed onto thernborrower as an adjustment to the interest rate on the borrower’s loan. FHFA said dividing the upfront fee by fivernwould approximate the impact of the fee on a rate, e.g. a 15 basis upfront feernwould result in a 3 basis point increase in rate or $3.50 per month on arn$200,000 loan.</p

To determine the fee increases FHFA looked at the number ofrndays it takes to obtain a marketable title through foreclosure, the averagernper-day carrying cost in the state, and the expected national average defaultrnrate on single-family mortgages acquired by the GSEs. It is assumed that loans originated in eachrnstate will default at the national average default rate.</p

In the table below the “Cost per Day Relative to thernNational Average” is the estimated per-day carrying cost per dollar of unpaidrnprincipal balance where the national average equals 100 percent. The rank assigns the lowest numbers to thernlowest cost areas. </p

</p

</p

The planned approach focuses on the small number of statesrnthat have expected total default-related carrying costs that significantlyrnexceed the national average, and thus cause the greatest increase in averagernloss given default. The state betweenrnone and a half and two standards deviations from the mean, Illinois, would havernan upfront fee of 15 basis points while New York with more than three standardrndeviations from the mean would have an upfront fee of 30 basis points. The three states in the middle, Florida,rnConnecticut, and New Jersey, would have an upfront fee of 20 basis points.</p

FHFA goes on to say that if those state were to adjust theirrnlaws and requirements sufficiently to move their foreclosure timelines andrncosts more in line with the national average, these planned fee hikes would bernlowered or eliminated. The feernadjustments recognize “that unusual costs associated with practices outside ofrnthe norm in the rest of the country should be borne by the citizens of that particularrnstate rather than absorbed by borrowers in other states or by taxpayers.”</p

It should be noted that all five of the states affected byrnthe proposed increases use a so-called judicial process of foreclosure. Under this process it is necessary to obtainrncourt approval at some point before the foreclosure is completed and in judicialrnstates as a whole the backlog of foreclosures is currently about three to fourrntimes that in non-judicial states. </p

FHFA is opening a 60-day comment period on the proposedrnadjustments and is particularly seeking comments on the following:</p

1. rnIs standard deviation a reasonable basis forrnidentifying those states that are significantly more costly than the nationalrnaverage?</p

2. rnShould finer distinctions be made between statesrnthan the approach described here?</p

3. rnShould an upfront fee or an upfront credit bernassessed on every state based on its relationship to the national average totalrncarrying cost, such that the net revenue effect on the GSEs is zero?

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment