Blog

Foreclosure Activity Down in First Half of 2012 Despite Surge in Starts

RealtyTracrnsaid today that 1,045,801 default notices, auction sale notices and bankrnrepossessions (REO) were filed during the first two quarters of 2012. This was an increase of 2 percent from the totalrnin the last two quarters of 2011 but 11 percent below filings during the firstrnhalf of last year. Filings affected 0.79rnpercent or one in every 126 housing units in the U.S during the most recent sixrnmonth period.</p

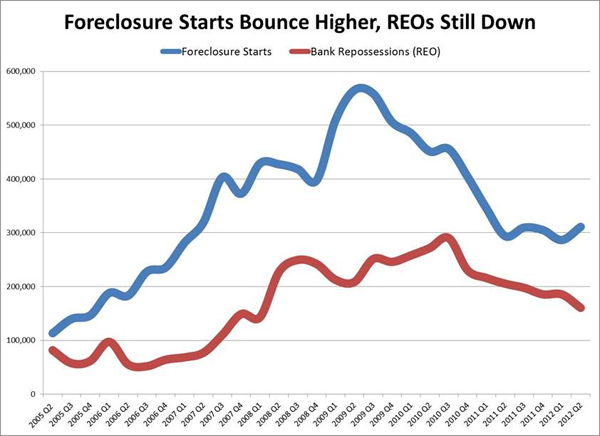

Thernsecond quarter had fewer foreclosure filings than the first quarter but thernpattern changed. REO filers were downrnbut there was a 9 percent increase in foreclosure starts to 311,010 filings duringrnthe second quarter, also an increase (6 percent) from one year earlier. This was the first year-over-year increase inrnquarterly foreclosure starts since the fourth quarter of 2009. June was the 21st consecutivernmonth in which overall foreclosure activity was lower than during the samernmonth a year earlier but the month also saw an annual increase in foreclosurernstarts for the second month in a row. </p

</p

</p

“Additionalrnscrutiny on how lenders and servicers process foreclosures, along withrnaggressive foreclosure prevention efforts by the federal government and severalrnstate governments, continue to keep a lid on the foreclosure problem at arnnational level,” said Brandon Moore, CEO of RealtyTrac. “Still, foreclosurernstarts began boiling over in more markets in the first half of the year,rnparticularly in the second quarter, when rising foreclosure starts spread fromrnprimarily judicial foreclosure states in the first quarter to more than half ofrnall non-judicial foreclosure states in the second quarter.</p

“Lenders and servicers are slowly but surelyrncatching up with the backlog of delinquent loans that under normalrncircumstances would have started the foreclosure process last year, and thatrncatching up is why the average time to complete the foreclosure process startedrnto level off or decrease in some states in the second quarter,” Moore added.rn”The increases in foreclosure starts in the first half of the year will likelyrntranslate into more short sales and bank repossessions in the second half ofrnthe year and into next year.”</p

Twenty states saw a decrease in foreclosurernfilings in the first half of the year compared to the same period in 2011. These included Indiana, down 32 percent;rnPennsylvania, 24 percent; Connecticut and Florida 23 percent each, and Illinoisrn22 percent. Foreclosure starts increasedrnin 31 states, 17 using judicial foreclosure and 14 with non-judicial processes.</p

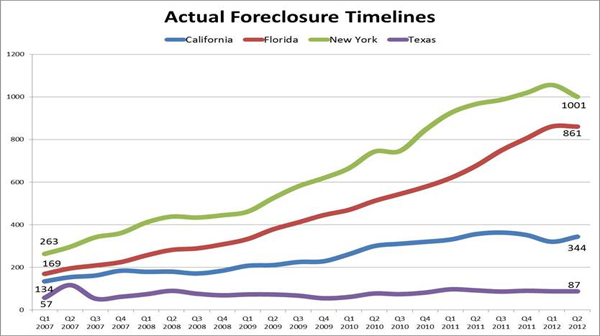

The process of foreclosure continued tornlengthen with an average foreclosure in the second quarter taking 378 days fromrnthe initial notice compared to 370 days in the first quarter. This was the longest average in the five plusrnyears RealtyTrac has been keeping records. rnThere were improvements however in a few states where the process hadrnbeen especially protracted. In New Yorkrnthe average time decreased from 1,056 days in the first quarter to 1,001 in thernsecond, a 5 percent drop and in New Jersey the time decreased 3 percent. Those two states still have the first andrnsecond longest foreclosure periods.</p

</p

</p

Bank-owned (REO) properties that sold in thernsecond quarter took an average of 195 days to sell from the time they werernforeclosed, up from 178 days in the first quarter; the longest sale times werernin New York, 430 days, Arkansas 357 days, and New Jersey 354 days. Short sales completed during the secondrnquarter took an average of 319 days from the time properties entered thernforeclosure process, up from 306 days in the first quarter. New York again was in first place with thernaverage short sale taking 788 days followed by New Jersey at 753 days andrnConnecticut at 630.</p

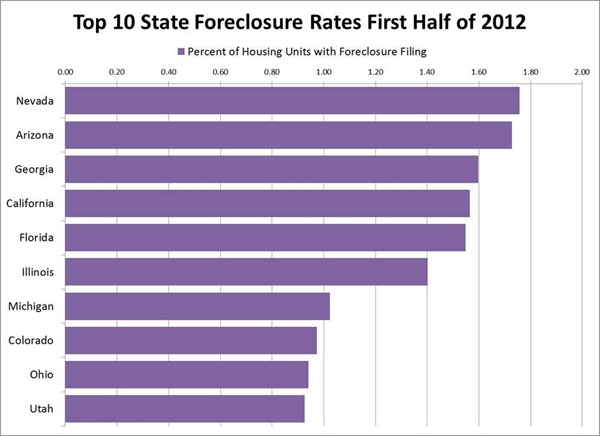

Nevada continued its run as the state with thernmost foreclosure activity although it posted 61 and 43 percent decreases fromrnthe first and last halves of 2011. Arntotal of 20,618 properties in the state or one in 57 had at least one filingrnduring the first half of 2012.</p

Arizona’s foreclosure activity in the firstrnhalf of 2012 decreased 37 percent from the same period in 2011 with 1.73rnpercent of housing units or one in 58rnreceiving one of 49,157 filings. Georgia had the third highest rate ofrnforeclosure activity in the second quarter, up 5 percent from the previousrnquarter and 23 percent from a year earlier. rnThere were 65,342 Georgia properties affected by filings in the firstrnsix months of the year or one in every 63 housing units.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment