Blog

Foreclosure Activity Drops Sharply Thanks to New California Law

Foreclosurernactivity in much of the nation now appears to be accelerating downward,rndropping 7 percent in a single month according to RealtyTrac. Foreclosure filings nationwide – default notices,rnscheduled auctions, and bank repossessions – numbered 150,864 or one in everyrn869 U.S. housing units in January compared to 162,511rnin December. This was a 28.5 percentrndecrease from January 2012.</p

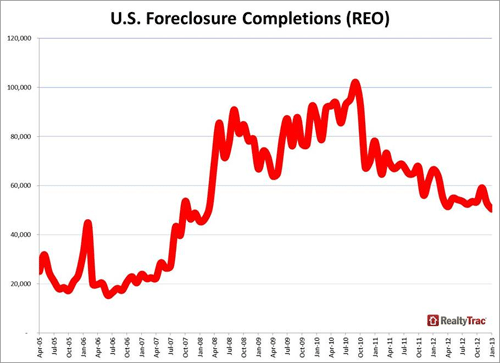

Foreclosure starts were down 11rnpercent from December and 28 percent compared to a year earlier and at thernlowest level since June 2006. Bankrnrepossessions or REO dropped 5 percent from the previous month and were down 24rnpercent from January 2012 to the lowest level since February 2008. </p

</p

</p

</p

</p

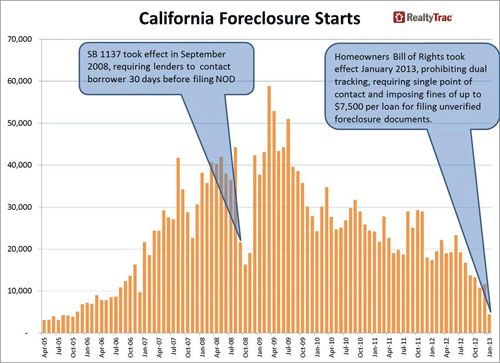

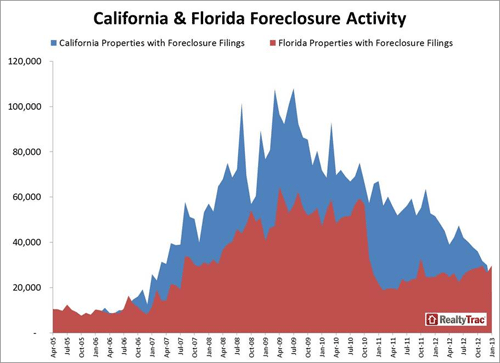

While overallrnactivity was down in most states, the size of the national decline can berntraced to California where a new law caused a 39.5 percent decrease in filings</bfrom December to January making it the first time since January 2007 thatrnCalifornia did not have the largest number of filings in the country. RealtyTrac Vice President Daren Blomquistrnsaid the new legislation that became effective on January 1 profoundly alteredrnthe U.S. foreclosure landscape. "Dubbed the Homeowners Bill of Rights, thisrnlegislation extends many of the principles in the national mortgage settlementrn- including a prohibition on so-called dual tracking and requiring a singlernpoint of contact for borrowers facing foreclosure – to all mortgage servicersrnoperating in California. In addition the new law imposes fines of up to $7,500rnper loan for filing of multiple unverified foreclosure documents. As a result,rnthe downward foreclosure trend in California accelerated into hyper speed inrnJanuary, decisively shifting the balance of power when it comes to the nation'srnforeclosure activity. </p

</p

</p

Scheduled foreclosure auctions increased rnfrom the previous month in 26 states and the District of Columbia, hittingrn12-month or more highs in several key judicial foreclosure states, includingrnFlorida, Illinois, Pennsylvania, and New Jersey, although foreclosure startsrnwere down on a year-over-year basis in Florida, Illinois and Pennsylvania.</p

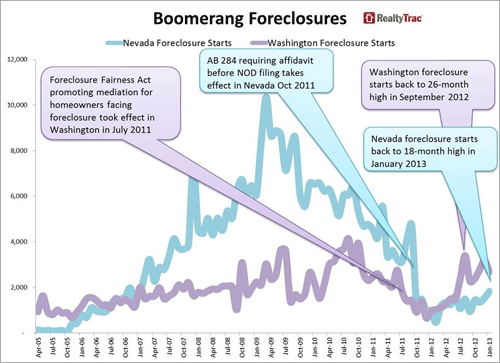

There were some stunning increasesrnin filings in several states where servicers finally worked through requirementrnof earlier legislation and resumed foreclosure starts or bankrnrepossessions. Arkansas had a 539rnpercent year-over-year increase in foreclosure starts and in Washington andrnNevada those filings increased 179 percent and 87 percent respectively. </p

</p

</p

Florida assumed California’s formerrnfirst place position in numbers of foreclosures; activity increased on anrnannual basis for the 11th time in the last 13 months, up 20 percent,rnand January filings increased 12 percent from December. One in every 300 Florida housing units had arnforeclosure filing in January, more than twice the national average</p

It is hard to imagine that, afterrnleading the nation in the rate of filings for over four years there could bernany properties left on which to foreclose, but Nevada posted the nation’srnsecond highest foreclosure rate in January. rnOverall activity was down 43 percent from a year ago but foreclosure startsrnwere up 19 percent over December and 87 percent year-over-year to a 16-monthrnhigh.</p

A 32 percent month-over-month jumprnin scheduled foreclosure auctions helped the Illinois foreclosure rate rise tornthird highest among the states in January. One in every 375 Illinois housingrnunits had a foreclosure filing during the month.</p

In addition to California there werern33 states where there were double digit decreases in foreclosure activity sincernJanuary 2012 and six where the drop was greater than 50 percent. The largest decreases were in Massachusettsrn(67.2 percent) Oregon, Delaware, and Hawaii (61 percent each).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment