Blog

Foreclosure Activity Hits 19 Month High

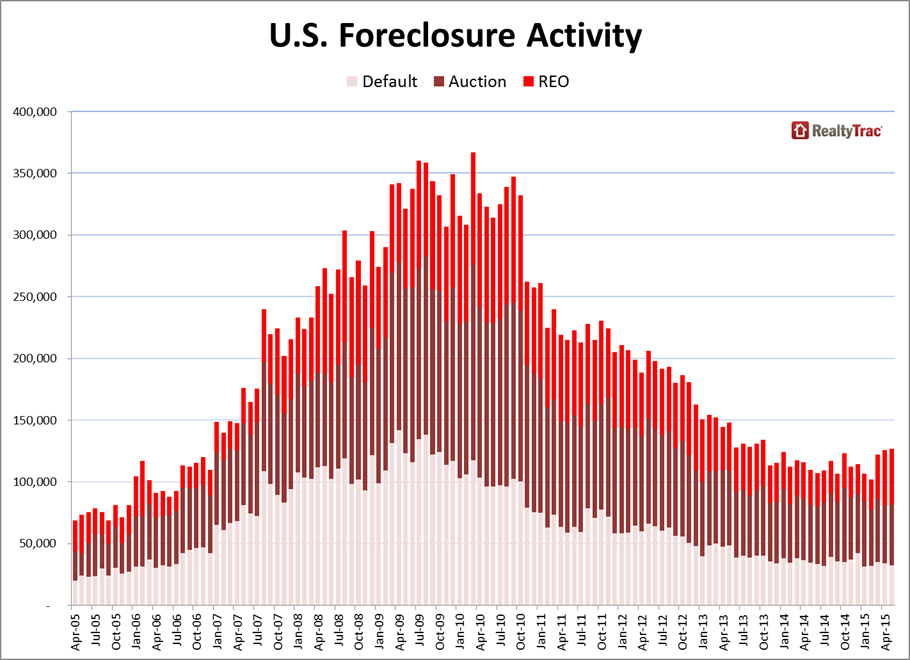

Completed foreclosures – or what RealtyTrac classifies asrnREO – drove foreclosure activity in May to a 19 month high. The company’s U.S. Foreclosure Market Reportrnsaid that there was a foreclosure filing – default notices, scheduled auction,rnand REO or completed foreclosures – on a total of 126,868 properties during thernmonth, one in every 1,041 housing units. rnThe total was up 1 percent from April and 16 percent from April 2014.rn</p

Completedrnforeclosures affected 44,892 properties, 1 percent fewer than in April but uprn58 percent compared to a year earlier. rnScheduled foreclosure auctions, which were up 5 percent year-over-yearrnalso contributed to the high level of activity. </p

</p

</p

RealtyTrac said it was the third monthrnin a row that REOs increased on an annual basis and scheduled auctions havernincreased year-over-year for four of the last eight months. May REOs were 56 percent below the peak ofrn102,134 REOs in September 2013 but still nearly twice the average monthlyrnnumber of 23,119 in 2005 and 2006 before the housing bubble burst in Augustrn2006. </p

“May foreclosure numbers are a classicrngood news-bad news scenario, with the number of homeowners starting thernforeclosure process stabilizing at pre-housing crisis levels but the number ofrnhomeowners actually losing their homes to foreclosure still well abovernpre-crisis levels and on the rise,” said Daren Blomquist, vice president atrnRealtyTrac. “Lenders and courts are pushing through stubborn foreclosure casesrnthat have been languishing in foreclosure limbo for years as options to preventrnforeclosure are exhausted or left untapped.” </p

The increase in completed foreclosuresrnwas broad-based with 38 states and the District of Columbia posting higherrnyear-over-year numbers. The largestrnincreases were in New Jersey (up 197 percent), New York (up 116 percent), Ohiorn(up 114 percent), Georgia (up 108 percent), and Pennsylvania (up 106 percent). Florida, Michigan, and Maryland all sawrnincreases of slightly more than 60 percent. </p

Foreclosure starts dipped 1 percentrnfrom April but were up 4 percent year-over-year, the first such uptick in four months. Twenty-five states posted annual increases inrnforeclosure starts led by New Jersey (up 73 percent), Virginia (up 39 percent),rnMissouri (up 19 percent), Massachusetts (up 14 percent), and Washington (up 11rnpercent). </p

A total of 49,413 properties werernscheduled for a future foreclosure auction (scheduled foreclosure auctions arernforeclosure starts in some states), up 6 percent from the previous month and uprn5 percent from a year ago. U.S. scheduled foreclosure auctions so far this yearrnare running about 40 percent higher than their pre-crisis levels from 2005 andrn2006. </p

Twenty-six states posted increases inrnscheduled foreclosure auctions from a year ago, including New York which was uprn118 percent. Increases in other statesrnwere much smaller with Illinois up 23 percent, New Jersey increasing by 22rnpercent, and Maryland up 11 percent. </p

Florida again led the nation inrnforeclosure activity with one in every 409 housing units with a foreclosurernfiling. Florida was followed by New Jersey (one in every 483 housing units),rnMaryland (one in every 531 housing units), Nevada (one in every 590 housingrnunits), and Ohio (one in every 763 housing units). </p

Among the nation’s 20 largestrnmetropolitan statistical areas, 13 posted an annual increase in foreclosurernactivity in May, including Dallas (up 64 percent), St. Louis (up 56 percent),rnBaltimore (up 35 percent), New York (up 34 percent), Philadelphia (up 28rnpercent), and Atlanta and Detroit which were both up 27 percent. </p

Of metro areas with a population ofrnover 200,000, those with the highest foreclosure rates were Atlantic City, NewrnJersey (a filing on one in every 230 housing units), Lakeland, Florida (one in everyrn331 housing units), Ocala, Florida (one in every 335 housing units), Miami,rnFlorida (one in every 347 housing units) and Jacksonville, Florida (one inrnevery 348 housing units).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment