Blog

Foreclosure Bottleneck Artificially Raising Delinquency Rate – Transunion

WIs it possible that the sluggishness ofrnthe foreclosure pipeline is actually camouflaging low mortgage delinquencyrnrates? TransUnion raised the possibilityrnyesterday in a presentation at its Financial Services Summit. Its analysis showed that stubbornly highrndelinquency rates may actually be as low as those of 10 years ago when thosernmortgages that had been in the system for 180 days or more are accountedrnfor. </p

In its regular delinquency report issuedrnon May 8 the company said the 60+ day delinquency rate in Quarter One was 4.56rnpercent, an improvement of 21 percent year-over-year and 12 percent from the 4th</supQuarter of 2012 and said both changes were the largest for the respectivernperiods it had observed since it began tracking the data in 1992. Still the Quarter One rate remained more thanrndouble the pre-crisis "norm" even when both auto and credit card delinquenciesrnwere well below 1 percent and had been hovering near record lows for threernyears.rn</p

“Some people may see the highrnoverall mortgage delinquency number and worry that mortgage borrowers are stillrna bad credit risk; but we don’t believe that’s the right conclusion,” saidrnTim Martin, group vice president of U.S. Housing in TransUnion’s financialrnservices business unit. </p

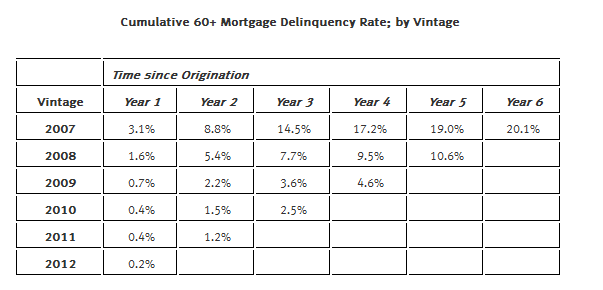

It is no surprise that the mortgagesrnoriginated during the last years of the housing boom have caused most of thernproblems with delinquency and foreclosure. rnTransUnion says that, as of this past February mortgages originated beforern2009 make up 50 percent of all outstanding mortgages but 86% of all mortgagerndelinquencies. Twenty percent of thernloans originated in 2007 have been delinquent at one time or another, 14.5rnpercent of them within their first three years. Loans originated in every year since thenrnshows a declining rate of delinquency at every “age” compared to the 2007rnvintage. For example, loans originatedrnin 2010 had experienced only about one-sixth the delinquencies by their thirdrnyear as the 2007 vintage. </p

</p

</p

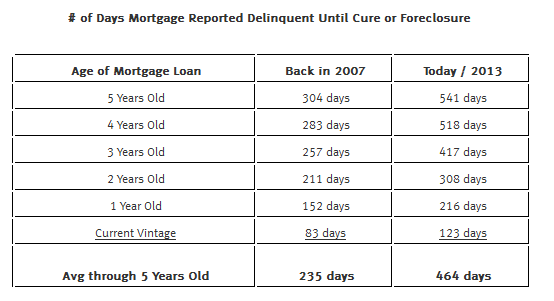

The company also found that thernnumber of days a mortgage was reported as delinquent to a credit bureau beforernit either cured or was foreclosed has increased dramatically. TransUnion provided this “snapshot” ofrndelinquent loans as they would have appeared in 2007 and earlier this year. </p

</p

</p

TransUnion conducted an analysisrnthat excluded loans that were more than 180 days past due and concluded thatrnthe mortgage delinquency rate would have peaked in 2009 at about 3.05 percentrnrather than the actual peak of 6.89 percent and would have been approximatelyrn1.68 percent in the first quarter rather than 4.56 percent. The last time thernmortgage delinquency rate was lower than 1.68% occurred in the second quarterrnof 2003 (1.67%).</p

TransUnion repeated this analysisrnfor select states based on their individual cure or foreclosure time lines andrnfound that those states with the longer timelines for each would have thernlargest improvements in delinquencies if these timelines were rolled back torn180 days. Looking at Q3 2012 data, NewrnYork would have a 1.64 percent delinquency rate rather than 5.48; Florida’srnrate would be 2.21 percent rather than 11.0 and the Illinois rate would be 1.78rnpercent rather than 5.32 percent. </p

“It’s no longer a creditrnquality or home price depreciation issue, and we are not adding many newrndelinquent mortgage borrowers into the pool these days,” saidrnMartin. “Instead, it’s an issue of the timelines to cure orrnforeclose. We are simply not draining the pool very fast; and the size ofrnthe ‘drain’ varies significantly by state.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment