Blog

Foreclosure Inferno Contained, but Dangerous Flare-ups Still Popping Up: RealtyTrac

Foreclosure activity blipped up slightlyrnin February but continues to recede on a year over year basis. RealtyTrac, the Irvine California firm thatrntracks legal filings for the process, reported this morning that defaultrnnotices, scheduled auctions, and bank repossessions or foreclosure sales werernreported on 154,281 U.S. properties in February, one in every 849 U.S. housingrnunits. This was an increase of 2 percentrnfrom January but was 25 percent below the level in February 2012. </p

“At a high level the U.S. foreclosure inferno</bhas been effectively contained and should be reduced to a slow burn in the nextrntwo years," said Daren Blomquist, vice president at RealtyTrac. "But dangerousrnforeclosure flare-ups are still popping up in states where foreclosures havernbeen delayed by a lengthy court process or by new legislation making it morerndifficult to foreclose outside of the court system. Foreclosure starts havernbeen steadily building in those states over the last several months and likelyrnwill end up as bank repossessions or short sales later this year.</p

“These new foreclosure hotrnspots include states like Washington, where seven straight months of risingrnforeclosure activity pushed the state’s foreclosure rate to fifth highestrnnationwide -the highest it’s ever been in our report – and Maryland, whererneight straight months of rising foreclosure activity placed the state’srnforeclosure rate among the top 10 nationwide for the first time since Julyrn2010,” Blomquist noted.</p

</p

</p

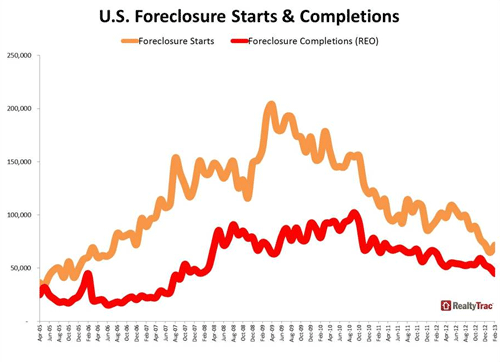

Foreclosure starts jumped 10 percentrnin February after three straight months in which they declined but were 25rnpercent below starts one year earlier. rnBank repossessions were down 11 percent month-over-month to the lowestrnlevel since September 2007 and were 29 percent lower than one year earlier.</p

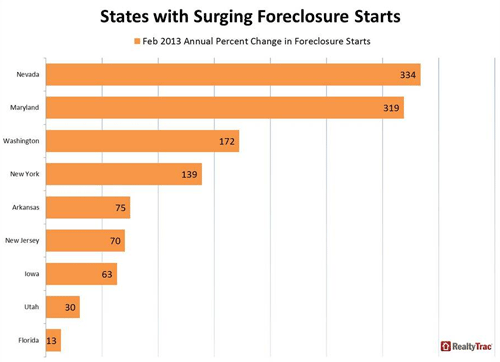

As Blomquist noted, the foreclosurernstory in the U.S. is now a state-by-state one and the list of troubled statesrnare not necessarily the usual suspects from the last seven years. There were huge annual jumps in foreclosurernstarts in perpetually troubled Nevada (up 334 percent), New York (139 percent)rnand New Jersey (70 percent) but Maryland which is not a familiar name onrnRealtyTrac reports was up 319 percent year over year.</p

</p

</p

Ohio is another state with emergingrnproblems. Overall foreclosure activityrnincreased by 26 percent in February and was up 12 percent from the previousrnyear and the state is now in fourth place nationally. Activity there has increased on an annualrnbasis in 11 of the last 13 months. </p

Washington State saw its seventhrnstraight month of increased activity on an annual basis. There were 4,362 filings in the state, one inrnevery 656 housing units, in February, a 123 percent increase from February 2012rnand, as noted, the state is now fifth in the nation for foreclosure activity. </p

In other states the foreclosure epidemicrnis merely continuing. Florida posted the nation’s highest state foreclosurernrate for the sixth consecutive month in February, reporting one in every 282rnhousing units with a foreclosure filing during the month. In Nevada, with foreclosure starts at arn17-month high the state remained the second highest state for overall filingsrnfor the fifth month in a row following nearly five years in the top spot. One in every 320 units in the state had arnfiling in February.</p

Despite the third straightrnmonth-over-month decrease in foreclosure activity, Illinois posted the nation’srnthird foreclosure rate for the second month in a row. A total of 12,671rnIllinois properties, one in every 417, had a foreclosure filing in February,rndown 10 percent from the previous month and down 5 percent from February 2012.</p

</p

</p

There were improvements in bankrnrepossessions in 32 state compared to a year ago with big improvements in Oregonrn(down 78 percent), Massachusetts (down 69 percent), Nevada (down 59 percent),rnGeorgia (down 58 percent), and California (down 49 percent).</p

Although California foreclosurernstarts rebounded 47 percent in February from an 88-month low in January,rnoverall foreclosure activity in the state was down from a year ago for the 15th</supstraight month, dropping the foreclosure rate down to No. 13 nationwide.rnFebruary was the first month since December 2006 where the Californiarnforeclosure rate was not ranked among the top 10 state foreclosure ratesrnnationwide.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment