Blog

Foreclosure Prevention has aided 2.7 million Fannie and Freddie Borrowers

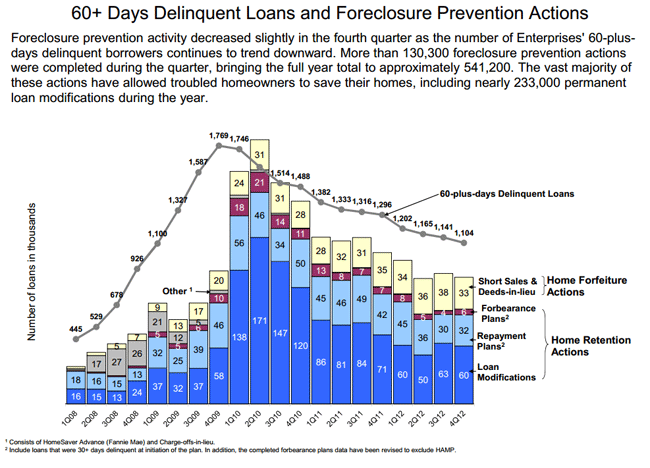

The Federal Housing Finance Agency (FHFA) says that Freddie Mac and Fannie Mae (the GSEs) assisted 130,000 homeowners with one or more of their foreclosure prevention programs in the fourth quarter of 2012. These actions brought the total for the entire year to 540,000 and to 2.7 million since the GSEs were placed in federal conservatorship in 2008.</p

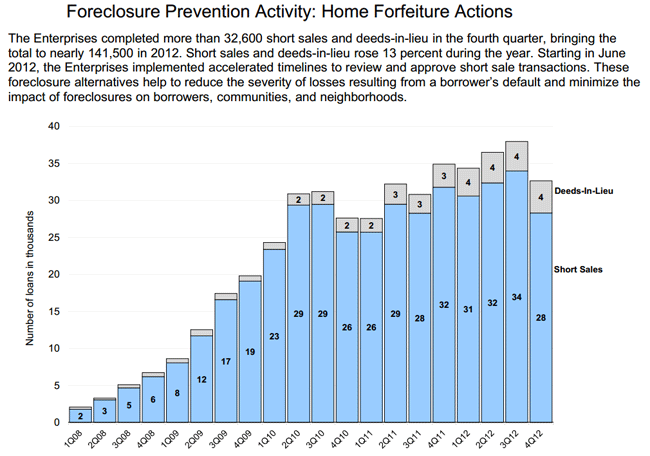

In the fourth quarter home retention actions numbered 97,689, including loan modifications, repayment and forbearance plans and there were 32,642 home forfeiture actions, most of which were short sales. In the third quarter there were 96,249 home retention actions and 37,966 short sales and deeds-in-lieu of foreclosure. In all of 2012 the GSEs completed 399,755 home retention actions, 232,993 of which were loan modifications and 141,464 short sales and deeds-in-lieu.</p

</p

</p

Short sales and deeds-in-lieu rose 13 percent during the year. Beginning in June 2012 the GSEs introduced accelerated timelines to review and approve short sale transactions which help to reduce the severity of losses to the GSEs and minimize the impact of foreclosures on borrowers, communities, and neighborhoods.</p

</p

</p

Forty-six percent of homeowners who received loan modifications in the fourth quarter had their monthly payments reduced more than 30 percent and one third of modifications included principal forbearance.</p

There are currently 25,775 homeowners in active trials through the Home Affordable Modification Program (HAMP) out of 1.018 million that began the program. Since the program started 568,458 trial modifications were converted to permanent status and 432,588 of those permanent modifications remain active while 7,285 of the loans were paid off and 128,585 defaulted.</p

In addition to modifications completed through the HAMP program the GSEs have completed 608,688 proprietary modifications since October 2009 and non-HAMP modifications accounted for more than 70 percent of all permanent modifications completed by the GSEs in the fourth quarter.</p

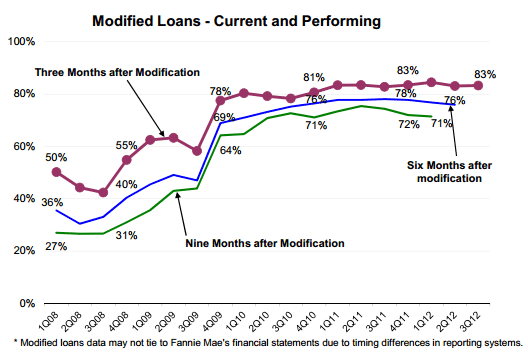

The modified loans continue to perform well, slightly more so for those done through HAMP. Nine months after modifications 78 percent of HAMP loans were current and performing and 11 percent were more than 60 days delinquent compared to 68 percent and 18 percent of non-HAMP modified loans</p

</p

</p

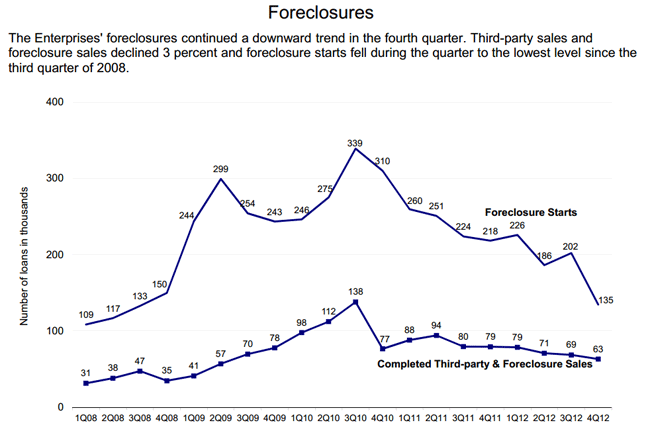

Overall mortgage performance continued to improve with early stage (30-89 days) and seriously delinquent loans declining through the quarter in every state except New Jersey and New York. Foreclosures also continued to trend down; third-party sales and foreclosure sales declined 3 percent and foreclosure starts fell to the lowest level since the third quarter of 2008.</p

</p

</p

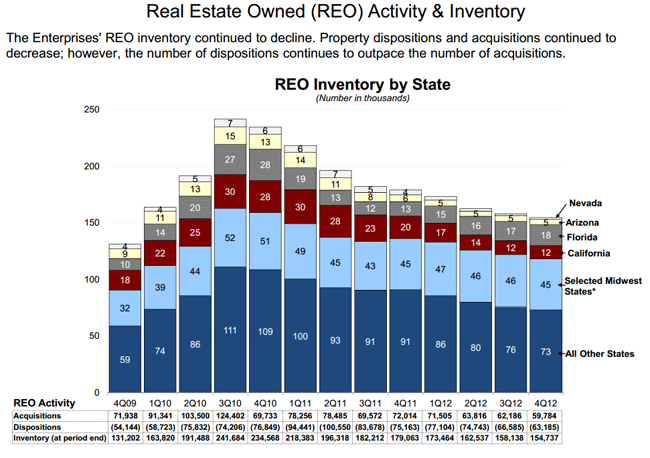

The GSEs also reduced their real estate inventories (REO) as property dispositions outpaced acquisitions during the quarter.</p

</p

</p

Here is the full report.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment