Blog

Foreclosures Down 16% as Servicers Embrace Alternatives

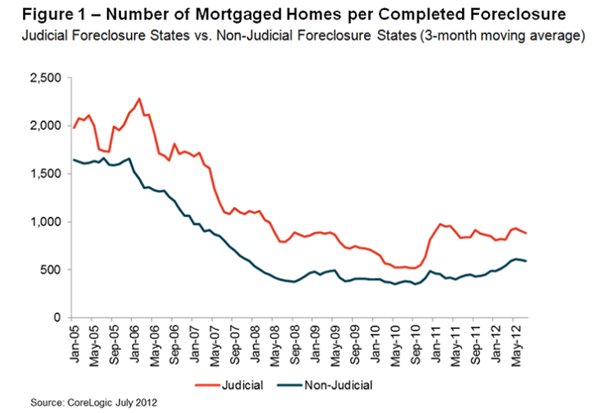

CoreLogic’s July NationalrnForeclosure Report, released today, reported completed foreclosures</bduring the month totaled 58,000 compared to 62,000 in June and 69,000 in Julyrn2011. The foreclosure inventory, anrnindicator of homes in any stage of foreclosure, was unchanged from June at 1.3rnmillion homes or 3.2 percent of all homes with a mortgage. On an annual basis, however, this was arndecrease from 1.5 million properties or 3.5 percent of mortgaged homes. </p

</p

</p

“The decline in completed foreclosures is yet anotherrnpositive signal that the housing market is continuing on a progressive path ofrnstabilization and recovery,” said Anand Nallathambi, president and CEO ofrnCoreLogic. “Alternative resolutions arernhelping to reduce foreclosures and often result in a more positive transitionrnfor the borrower and lower losses for investors and lenders.” </p

Mark Fleming, chief economist for CoreLogic noted that thern16 percent year-over-year decline in foreclosure is in part because servicersrnare increasingly relying on foreclosure alternatives such as short sales andrnmodifications. </p

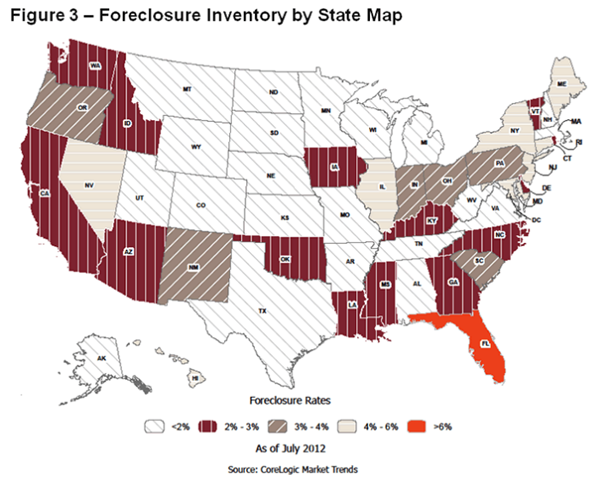

Completed foreclosures are concentrated in five states. California, Florida, Michigan, Texas, andrnGeorgia together accounted for 48 percent of all completed foreclosures in thern12 months ending in July. </p

The five states with the highest foreclosure inventory as arnpercentage of all mortgaged homes were Florida (11.2) percent, New Jersey (5.7rnpercent), New York (5.2 percent), Illinois (4.9 percent), and Nevada (4.7rnpercent.) </p

Sincernthe financial crisis began in September 2008, there have beenrnapproximately 3.8 million completed foreclosures across the country. Completedrnforeclosures are an indication of the total number of homes actually lost tornforeclosure.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment