Blog

Freddie Mac Finished Q2 in Black; No Treasury Draw Needed

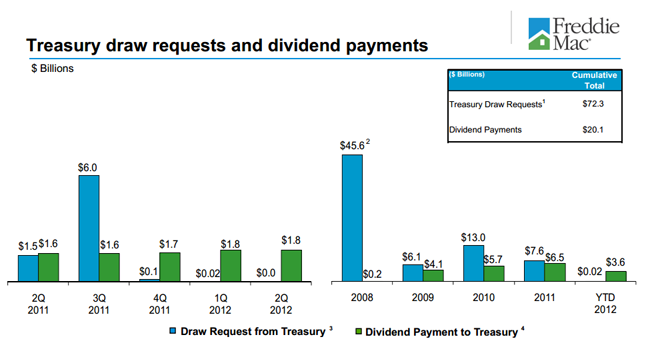

Freddie Mac announced this morning that it will not requirernany infusion of cash from the U.S. Treasury following its profitable secondrnquarter operations. The company will alsornpay $1.8 billion to the Treasury as a dividend on the 10% senior preferredrnstock the department holds. </p

During fiscal 2012 to date Freddie Mac has paid $3.6 billionrnin dividends while drawing $0.02 billion in financial support from therngovernment. In FY2011 it paid $6.5rnbillion and drew $7.6 billion. Since itrnwas placed in federal conservatorship in August 2008 the net draw has beenrn$52.2 billion. </p

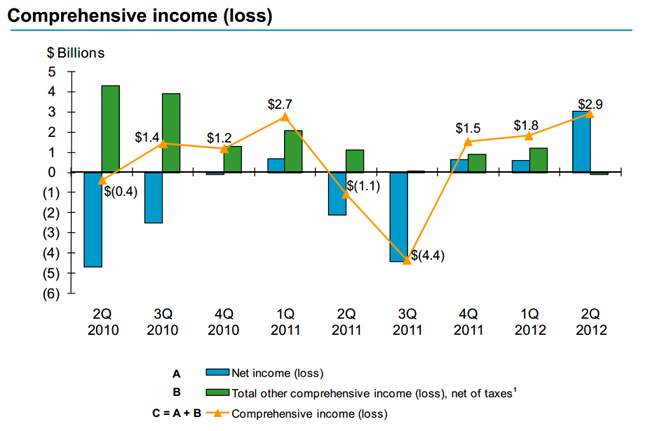

The government sponsored enterprise (GSE) reported netrninterest income during the quarter was $4.4 billion, a $0.1 billion decreasernfrom Q1. However provisions for creditrnlosses decreased from $1.8 billion to $0.2 billion and derivative losses fromrn$1.1 billion to $0.9 billion. rnNon-interest income rose from an $(0.4) billion loss to $0.1rnbillion. This resulted in net income forrnthe second quarter of $3.0 billion compared to $577 million one year earlierrnand comprehensive income of $2.9 billion compared to $1.8 billion. Freddie Mac had a net worth of $1.1 billion atrnJune 30, 2012.</p

</p

</p

During the first half of 2012 the company has assisted inrn781,000 refinancing transactions and 143,000 purchases of homes. It has also participated in financing 193,000rnmulti-family housing units. The companyrnprovided $215 billion in market liquidity so far this year, $163 billion ofrnwhich was for refinancing. Since 2009rnthe company has purchased about $1.1 trillion in refinance mortgages which itrnestimates have saved 5.2 million households approximately $2,500 per year inrninterest payments.</p

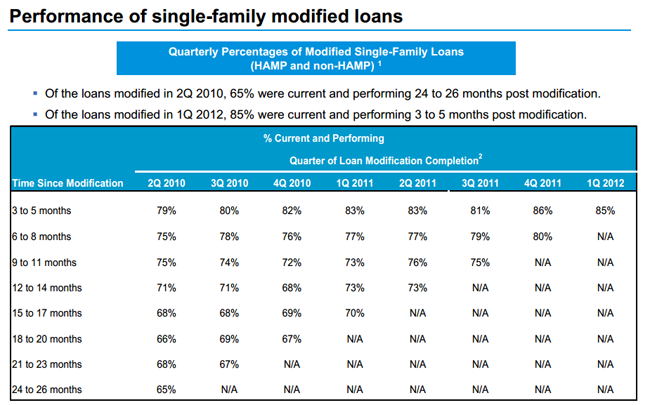

Foreclosure prevention efforts by Freddie Mac have reached 81,000rnfamilies thus far in 2012 and 697,000 since the beginning ofrnconservatorship. The cumulative totalsrnbreak down into 373,000 loan modifications, 117,000 repayment plans, 78,000rnforbearance agreements, and 129 short sales or deeds in lieu. As can be seen in the chart below, these loanrnmitigation efforts have, from the beginning been slightly more successful thanrnthe 50 percent generally expected from such programs. The success rate has grown fairly steadilyrnwith each quarter.</p

Harp 2.0 refinancing through Freddie Mac has reached overrn200,000 borrowers this year. This isrnover one-quarter of the total number of HARP refinancings since the programrnbegan in 2009. </p

</p

</p

Freddie Mac said it has continued to improve the creditrnquality of its portfolio. The averagernweighted loan to value (LTV) ratio of loans purchased in the second quarter forrnits Credit Guarantee Portfolio was 66 percent compared to 72 percent in thern2005-2008 period. The average weightedrncredit score was 762 compared to 723 during the housing boom.</p

The single family delinquency rate was 3.45 percent at thernend of the quarter, down from 3.51 percent at the end of the firstrnquarter. The Mortgage BankersrnAssociation reports that nationally the serious delinquency rate was 7.44rnpercent at the end of March 2012, so the Freddie Mac rate is well belowrnnational norms. The delinquency rate onrnmulti-family loans was 0.27 percent, up slightly from the Q1 figure of 0.23rnpercent but again, according to the company, lower than industry benchmarks.</p

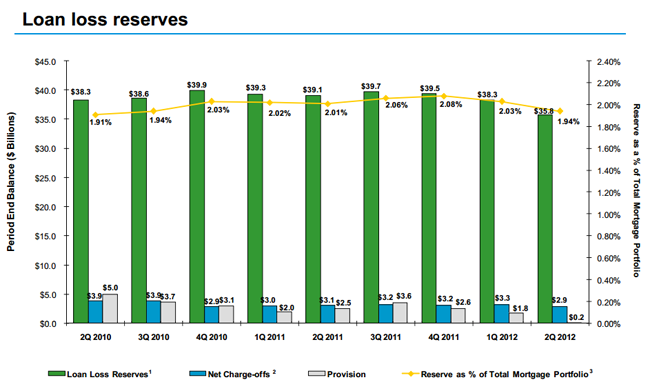

As noted above, provisions for credit losses shrunk fromrn$1.8 billion in the first quarter of 2012 to $0.2 billion in the currentrnquarter. The company now has loan lossrnreserves of $35.8 billion compared to $38.3 billion at the end of Q1.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment