Blog

Freddie Mac Needs More Funding to Support Housing. Expects Prices to Fall Further

FreddiernMac released its financial reports for the first quarter of 2010 showing a netrnloss of 6.7 billion and announced that its Conservator, the Federal HousingrnFinance Agency (FHFA), will be asking the Department of the Treasury for a drawrnof $10.6 billion under the Senior Preferred Stock Purchase Agreement.

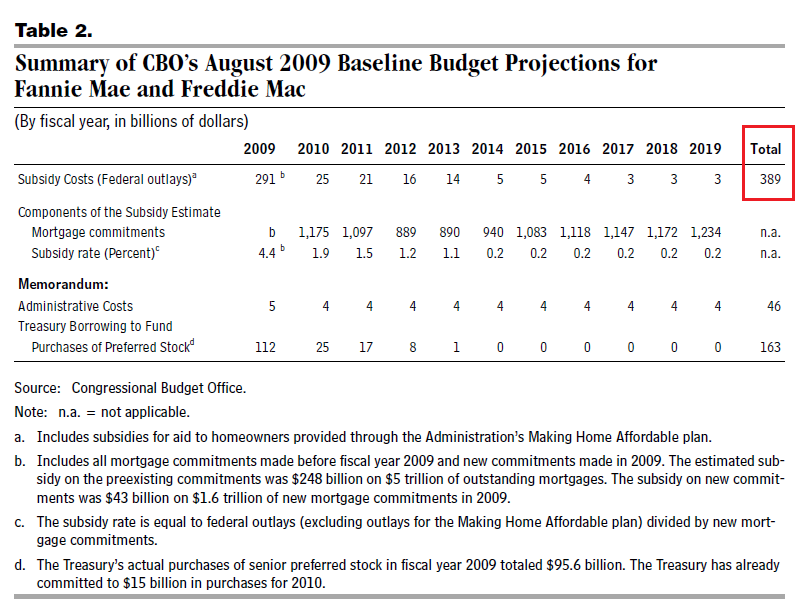

This request, which is proformarnas Treasury has already authorized nearly unlimited draws, will bring the totalrnborrowed from the Treasury by Freddie to $61 billion. Freddie said it expects to request additionalrndraws under the Purchase Agreement in future periods and the Congressional Budget Office estimates that the ultimate cost to taxpayersrnfrom bailing out Freddie Mac and Fannie Mae will be $389 billion through 2019.

The netrnloss attributable to common stockholders during the quarter was $8.0 billion orrn$2.45 per diluted common share. Thisrnreflects $1.3 billion in senior preferred stock dividends payable to Treasury. Freddiernhad reported a net loss of $6.5 billion or $2.39 per share for the fourthrnquarter of 2009.

The corporation's net worthrndeficit was $10.5 billion at the end of the quarter compared to positive netrnworth of $4.4 billion at December 31, 2009. This shift resulted from the losses and dividends outlinedrnabove but was also driven, Freddie said, by significant adverse impact of thernadoption of new accounting standards related to transfers of financial assetsrnand consolidation of variable interest entities (VIEs) effective at thernbeginning of the year. The change forcedrnFreddie tornmove all non-owned mortgages they guarantee onto their books and resulted in a decrease in totalrnequity of 11.7 billion.

Freddie also reported provision for credit lossesrnof $5.4 billion, down from $7.0 billion for the fourth quarter of 2009; derivativernlosses of $4.7 billion due to the decline in long-term rates during thernquarter; and net interest income of $4.1 billion. The last figure reflects an increase in thernaverage balance of non-performing mortgage loans for which the companyrnrecognizes debt funding costs but not interest income.

The company continued tornexperience deterioration in its single-family credit guarantee portfolio duringrnthe quarter with the single family delinquency rate including StructuredrnTransactions increasing from 3.98 percent in Quarter Four, 2009 to 4.13rnpercent. The increase was despite the positive impact of seasonal factors and arnhigher volume of loans completing modification or proceeding to foreclosurernduring the quarter. Single family netrncharge-offs increased to $2.8 billion from $2.4 billion, primarily due to anrnincrease in foreclosure transfers.

Single-familyrnnon-performing assets, including real estate owned properties and delinquentrnloans underlying the company's issued PCs and Structured Securities, increasedrnto $115 billion at March 31, 2010, compared to $103 billion at December 31,rn2009.

Freddie said its continuedrnsupport of the housing market during the quarter included approximately $97rnbillion in liquidity and increased efforts to prevent foreclosures. The corporation helped finance more thanrn390,000 single family homes and 50,000 units of rental housing; helpedrnrefinance 320,000 homes; and continued with its administration of the Home AffordablernModification Program. The company alsornassisted 71,000 homeowners to identify alternatives to foreclosure. Its efforts resulted in 44,076 loanrnmodifications, 8,761 borrowers receiving repayment plans; implementation ofrn8,858 forbearance agreement and 9,619 homes sold prior to foreclosure.

FreddiernMac CEO Charles E. Haldeman, Jr. said that Freddie Mac's support of the housingrnmarket is vital but expressed concern about the future of the housing market. “Though more needs to be done,”rnhe said, “we are seeing some signs of stabilization in the housing market,rnincluding house prices and sales in some key geographic areas, “But as we havernnoted for many months now, housing in America remains fragile with historicallyrnhigh delinquency and foreclosure levels, and high unemployment among the keyrnrisks.

“Though we are encouraged by signs of modestrnstabilization in some trends on the credit side of our single-family business,rngiven the many uncertainties in the economy, we remain cautious,” Kari said.rn”Credit quality remains a major focus for the company, and we are pleased thatrnnew business being delivered to us is of notably high credit quality.”

The company said it anticipatesrna further decline in home prices before the market begins a sustained recoveryand sees four big risks over the next year;

- An increase in distress sales as lenders try to reduce the backlog ofrndelinquent loans and owned real estate.

- Expiration of the homebuyers' tax credit.

- A probable increase in interest rates during the year, and

- The likelihood that unemployment rates will remain high.

The company also notedrnthat, home prices aside, credit losses will probably remain “significantlyrnabove historical levels for the foreseeable future due to the substantialrnnumber of borrowers in our single-family guarantee portfolio that currently owernmore on their mortgage than their home is worth in today's market.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment