Blog

Freddie Mac Portfolio Shrinks. Making Room for Delinquency Buyouts

Freddie Mac's total portfolio contracted again during February, declining by 2.6 percent from the January figures. The portfolio's value was $2.243 trillion at the end of February compared to $2.247 trillion in January but was still larger than at the end of February 2009 when it totaled $2.208 trillion.

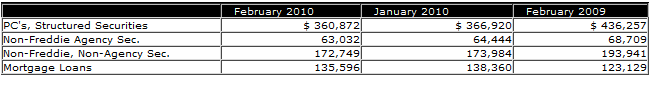

The unpaid principal balance on the corporation's investment portfolio also dropped from $743.7 billion at the end of January to $732.2 billion last month. One year ago the unpaid principal of the portfolio was $822.0 billion. The size of the investment portfolio's components in February compared to January and February 2009, expressed in $millions, were:

The company reported that the net amount of mortgage-related investment portfolio mortgage purchase (sale) agreements entered into during the month of February totaled $(1.997) million, down from $238 million reported in January. Refinance-loan purchase and guarantee volume was $22.6 billion in February, unchanged from January.

Delinquencies continued to rise. Single family delinquencies reached a rate of 4.08 percent during the month, up from 4.03 percent in January and 2.13 percent a year earlier. Non-credit enhanced loans had a delinquency rate of 3.18 percent compared to 3.13 percent in January while credit enhanced loans were delinquent at a rate of 8.59 percent, up from 8.52 percent. The multi-family portfolio had a delinquency rate of .17 percent, compared to .15 percent in January.

During the month Freddie Mac announced that it would bernpurchasing substantially all of the single family mortgage loans that were 120rndays or more delinquent from its PCs. Accordingrnto the February figures, it appears that the purchase will involve approximatelyrn31,700 fixed rate mortgages with an aggregate unpaid principal balance of $5.8rnbillion and 6,072 adjustable rate loans with balances totaling $1.5 billion. These buyouts are expected to appear on Freddie Mac's Monthly Summary next month. READ MORE

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment