Blog

Freddie Mac Says Hybrid ARMs most Popular of an Unpopular Product

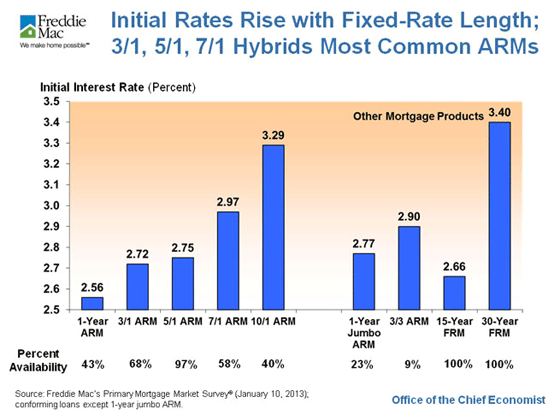

Freddie Mac said today that initialrnrates on adjustable rate mortgages (ARMs) are at the lowest recorded levels inrnthe 29 year history of its ARM Survey. Thernmost recent edition of that survey was conducted from January 7 to 10 and alsornshowed the hybrid ARMs remain the most common of the adjustable rate productsrnavailable in the market.</p

Over the last several years the WeeklyrnMortgage Application Survey conducted by the Mortgage Bankers Association hasrnconsistently pegged the market share of ARMs at 3 to 4 percent. Freddie Mac says that hybrid ARMS, thosernadjustable rate mortgages with an extended initial fixed-rate period of three,rnfive, seven, or ten years after which they adjust annually, are the mostrnpopular loan product among ARMs. The 5/1rnhybrid is the most common, offered by 90 percent of lenders surveyed. Second is the 3/1, offered by 68rnpercent. Least popular is the 3/3 wherernthe rate adjusts every three years for the life of the loan. </p

Atrnthe time of the survey the interest rate savings for the 5/1 hybrid ARM with arn30-year term compared to the 30-year fixed-rate mortgage (FRM) was about 0.65rnpercentage points or about $90 less in the first five years of a $250,000 loan.rn Freddie Mac credits the Federal Reserve’srnaccommodative monetary policy with keeping short-term interest rates very lowrnand, over the past year, helping to lower longer term rates.</p

Compared with last year, the largestrndeclines in initial interest rates among hybrid products occurred with the 7/1rnand 10/1 hybrids. For these products with long initial fixed-rate periods, ratesrndeclined by 0.32 and 0.57 percentage points, respectively. Again this reflects the effects of thernFederal Reserve’s latest round of quantitative easing. </p

Among the 131 ARM lenders surveyed,rn69 percent offered loans tied to Treasury yields, up from 65 percent in 2012;rnthe remaining offered products tied to the London Interbank Offered Ratern(LIBOR). LIBOR-indexed ARMs generally had a lower margin (about 0.5rnpercentage points lower) than Treasury-indexed ARMs, a similar initial interestrnrate, but a higher fully indexed rate. The higher fully indexed raternreflects the fact that one-year LIBOR yields averaged 0.7 percentage pointsrnabove one-year Treasury yields in early January.</p

Frank Nothaft, Freddie Mac’s vicernpresident and chief economist, said of the survey results, “Homebuyersrnhave shied away from ARMs, particularly 1-year ARMs, because they are wary ofrnthe risk and uncertainty. The potential for much larger payments if,rninterest rates are significantly higher in the future, and the high delinquencyrnrates borrowers have experienced on ARMs in recent years, have led consumers tornprefer fixed-rate loans instead of ARMs. In addition, fixed-rate loansrncurrently carry rates near historic lows, and only a small amount above initialrnrates on ARMs.</p

“Borrowers who have taken outrnARMs generally prefer hybrids, because these products include an extendedrninitial period where the interest rate is fixed. During 2012, ARMs comprisedrnone-in-ten new home-purchase loans, according to the Federal Housing FinancernAgency. We are expecting ARMs to gradually gain back some favor with mortgagernborrowers, with the ARM share rising to 12 percent of the home-purchase marketrnin 2013.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment