Blog

Freddie Mac sees Continued Healthy Multi-family Market

Home ownership, which has alreadyrndropped 2.7 percent since the start of the current housing crisis, is expectedrnto decline another 1 to 2 percentage points if the current slow recoveryrncontinues. This is one conclusionrnreached by Freddie Mac’s Multifamily Research Group in its market demandrnforecast for the next three years that was released on Monday.</p

The multifamily housing market definedrnas buildings with over five units weakened somewhat during the recession butrnnot to the same extent as the single family market and directly benefitted fromrnthe decline in the homeownership rate. rnThe shift of households from homeownership to renters increased therndemand for rental units and rents have increased (about 4.9 percent in 2011)rnwhile vacancies dropped from over 7.3 percent in 2009 about 5 percentrntoday. Supply remains low with onlyrn167,000 construction starts in the sector last year, far below the averagernvolume of 260,000 units in 2001-2010.</p

It is unclear how long favorablernconditions will last. There is morernconstruction on the way, it is always possible that improving conditions willrnswing the pendulum back in favor of homeownership, and a significant conversionrnof single-family houses to rental properties could also impact demand.</p

Freddie Mac’s economists lookedrnat both the renters and owner’s share of the residential housing market basingrnits predictions on three different economic scenarios; 1) no economic recovery,rn2) A base scenario with economic growth slightly slower than long run averages;rn3) An accelerated Recovery. </p

In each of these scenarios somernrenters will chose multifamily apartments and others will rent single-familyrnhomes, especially those with larger households. rnDemographic issues will also play a role; for example, households withrnchildren or those who have previously been homeowners are more likely to choosernsingle-family rentals. .In 2011, there were about 38rnmillion renter households and 16rnmillion of them lived in multifamily rentals.rn</p

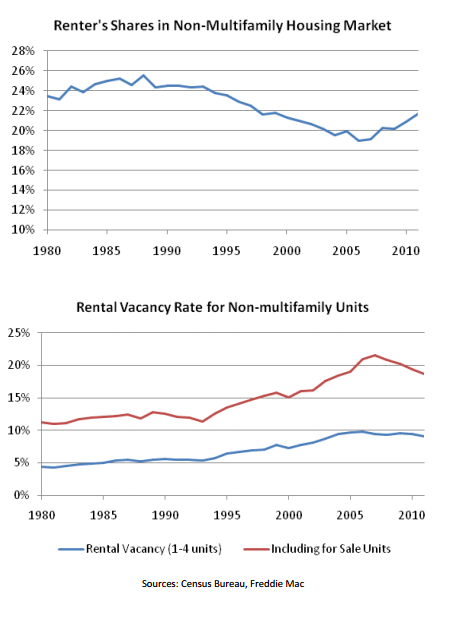

Renters generally make up morernthan 20 percent of single family occupants but this number dropped below 20rnpercent when homeownership was peaking. rnNow renters are becoming a bigger share of the residential housing marketrnand the share of renters in residential homes is approaching levels that wererntypical in the 1980s and 1990s.</p

</p

</p

Otherrnfactors that will play a role in influencing multifamily demand include newrnhousehold formation rates, migration, foreclosure activity, and macroeconomicrnfactors such as unemployment, housing affordability, and new home construction.rn</p

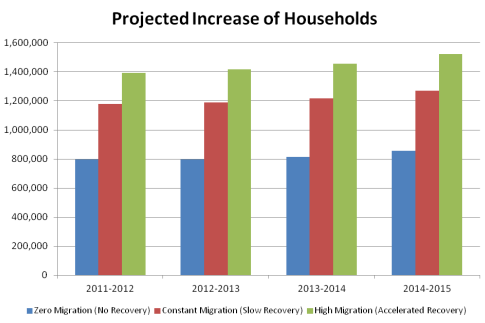

Internationalrnmigration is a key to overall population growth and this is influenced byrneconomic growth. The Census Bureaurnpredicts that immigration over the period of 2011 to 2015 could increasernpopulation by 5.6 million to 13.3 million. rnThernvariation in population growth across different age groups also hasrnimplications for rental housing. When agernspecific household data and population growth estimates are combined to thernstudy expects there will be approximately 1.2 million new households createdrnannually over the subject period assuming constant migration. In the accelerated growth scenario there willrnbe increased immigration and faster household formation on the part of youngrnadults, increasing the demand for rental units. rnNone of the scenarios account for any pent-up demand which couldrnincrease the demand for rental housing substantially.</p

</p

</p

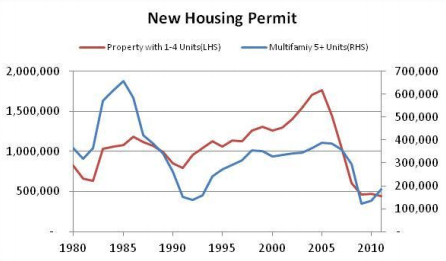

On the supply side, newrnconstruction has plummeted since the end of 2007. In 2011 single-family builders deliveredrn455,000 new units compared to 1.7 million in 2006 and the construction ofrnmulti-family units also declined. Nowrnmulti-family construction has jumped, permits increased 60 percent from 2010 torn2011 to 440,000 but that is far below the 30-year average of 1.0 millionrnpermits. Despite increasing constructionrnand the high number of distressed properties for sale, the number of vacantrnunits has declined </p

</p

</p

It will take timernfor single-family constructionrntorncatch up with the longrnrun average of 1 millionrnnew units per year. For our forecastingrnand scenario analysis,rnwe assumernthe following new single-familyrnhousing supply volumes from 2012 to 2015:</p

1. No recoveryrnscenario: a constantrn450,000 new single-family units.</p

2. Slow recoveryrnscenario: new single-familyrnunits rising from therncurrent level of 450,000 units to 750,000rnunits in 2015, with an average of 600,000 units per year from 2012 to 2015.</p

3. Accelerated growth scenario: new single-family units risingrnfrom the current level ofrn450,000 units to 1,000,000 unitsrnin 2015, with anrnaverage of 750,000 units per year from 2012rnto 2015.</p

Foreclosures increase bothrnthe supply of housing available andrnthe demand for housing. Generally, a higher foreclosure rate is an indicator of a weaker homeownership market. Thernauthors make the following assumptions in terms of the foreclosure rates:</p

1. No recoveryrnscenario: a 4.4% foreclosurernrate (the same rate as in 2011).</p

2. Slow recoveryrnscenario:rna gradually declining foreclosurernrate from 2012’s 4.2% to 3% in 2015.</p

3. Accelerated growth scenario:rna rapidly decliningrnforeclosure rate from 2012’srn3.75% to 1.5% in 2015.</p

Generally, higher owner affordabilityrnpushes up homeownership and decreases demand in the rental market.rnHowever, an improvingrneconomy could cause increasedrnhouse prices, a higherrninflation rate, and higher mortgage ratesrn- all of which then lower affordability in thernowner market and lead to increased rental demand. On the other hand,rna deteriorating economy will likelyrnincrease affordability,rnbut weakness in therneconomy can slowrnthe decision to buy and, all else equal,rnincrease rental demand. The authors make the following assumptions regarding employment, mortgage rates, and household income:</p

1. No recoveryrnscenario: the unemployment raternstays at a highrnlevel of 8.3% and housing price does not increase, mortgagernrates do not change from 2012 to 2015 and there is also no householdrnincome growth.</p

2. Slow recoveryrnscenario:rnthe unemployment rate gradually declines from 8.2% to 6.5% with a mortgage rate increase of 1.7% from 2012 to 2015. Thernsingle-family housing prices growth also gradually risesrntorn3% in 2015 with 1% annual household income growth.</p

3. Accelerated growth scenario:rnthe unemployment rate declines rapidly fromrn8% in 2012 to 5.5% in 2015 withrna higher mortgage raterngrowth of 2.7% during the same period. Thernhouse price growth rises to 4% inrn2015 with a constant income growth of 3% per year.</p

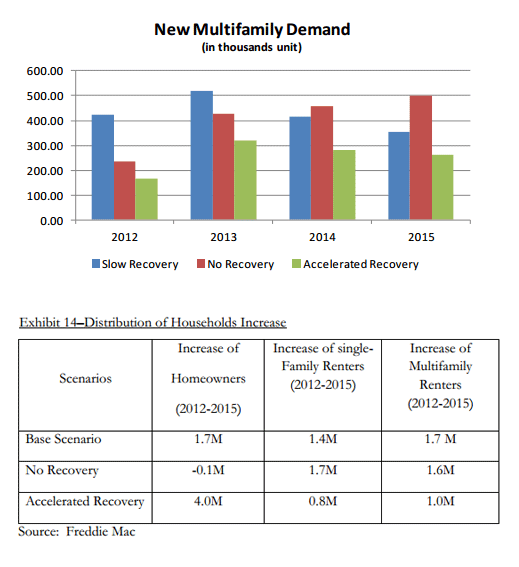

Given this rather complicatedrnframework and analysis, Freddie Mac makes the following predictions. </p<ul class="unIndentedList"<liInrnthe most pessimistic scenario, homeownership will drop another 1.4 percent fromrnthe current level of 65.5 percent. Thernmultifamily market will benefit from this despite continued economic stress andrnlower new household formation. Thernsingle family rental sector is relatively competitive with the multifamily sectorrndue to low price prices and the high foreclosure rate. Total new multifamily demand will still reachrn1.6 million from 2011 to 2015. </li</ul<ul class="unIndentedList"<liIf the overallrneconomy strengthens quickly therernwill be a rebound in homeownership. In 2015 it will rise to the 1999-2000 level. Withrnexpected high population growthrnthere will be a modest increasernof on average 250,000 units annuallyrnin multifamily renters. Unless there is arnmajor jump in multifamily new construction, the multifamily market will still be balanced. However, the single-familyrnrental market will see arnsignificantly smaller increasernof an estimated 800,000 households compared torn4 million growth inrnthe ownership market slowerrnthan the long-run average. Given this outlook thernhomeownership rate will continue to decline to around 65%rnlevel, which implies 3.1rnmillion new families or more thanrnhalf of total newrnhouseholds will move into rental units. Consequently,rnmultifamily demand willrnbe solid with a total of 1.7 million net new renters from 2011 to 2015. Considering that therncurrentrnmultifamily constructionrnpipeline is around 200,000 this year, this scenario suggests continued strengthrnin the multifamily market.</li</ul

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment