Blog

Freddie Mac Survey: Most Rates Up Slightly in Past Week

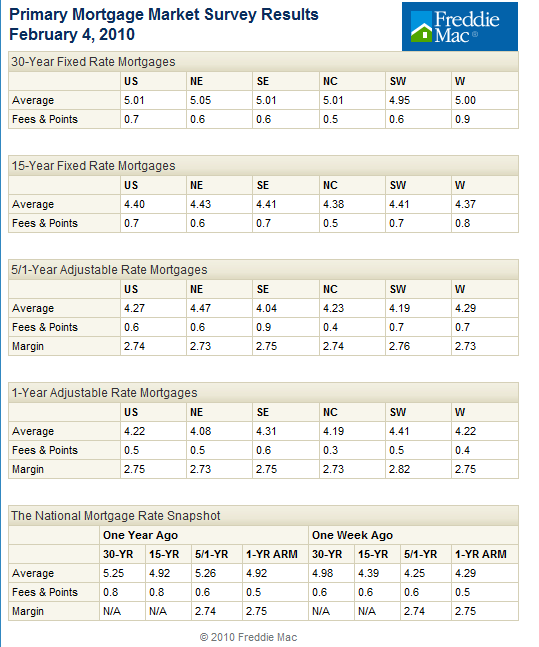

Ratesrnrose slightly during the week ended February 4 according to data released todayrnby Freddie Mac. The weekly Primary Mortgage Market Survey showed that thernaverage rate for 30-year fixed-rate mortgages (FRM) was 5.01 percent with 0.7rnpoint compared to a week earlier when the rate was 4.98 percent with 0.6 point.rnThe 15-year FRM averaged 4.40 percent, up one basis point from the previousrnweek. Fees and points were unchanged atrn0.6.

AdjustablernRate Mortgages (ARM) rates were mixed. The five-year Treasury-indexed hybridrnARM had an average rate of 4.27 percent with 0.6 point compared to 4.25 percentrnwith 0.6 point last week while the 1-year Treasury-indexed ARM was down to 4.22rnpercent with 0.5 point from 4.29 percent also with 0.5 points.

Here is a summary of the survey results:

Frank Nothaft, Freddie Mac vice president and chief economist saidrnabout the survey, “Mortgage rates remained relatively stable for a secondrnweek amid news of a strengthening housing market. Residential fixed investmentrnrose for two consecutive quarters over the last half of 2009 following a steadyrnquarterly decline since the beginning of 2006,” he added. “Pendingrnexisting home sales rebounded by 1% in December from a record drop in Novemberrnthat was due in part to the original expiration of the homebuyer tax credit,rnaccording the National Association of Realtors. More recently mortgagernapplications for home purchases jumped 10% at the end of January, according tornfigures from the Mortgage Bankers Association.”

“Evenrnmore encouraging news came from the Federal Reserve's Senior Loan OfficerrnOpinion Survey which reported that banks have generally stopped tighteningrnstandards on most types of loans in the fourth quarter of 2009, with commercialrnreal estate as the exception. However, banks have yet to unwind the tighteningrnthat occurred over the last two years. Moreover, substantially fewer banksrnexpected credit quality to deteriorate over the coming year.”

Most rates were also higher in a report issued by Fannie Mae earlier inrnthe week. Fannie's weekly yields for conventional fixed rate mortgages for the weekrnended January 29 were, 4.74 percent for the 30-year, up from 4.68 the weekrnbefore, and 4.07 percent for the 15-year compared to an earlier rate of 4.04.

Government guaranteed FHA and VA 30-year fixed-rate loans werernunchanged at 5.47 while the one-year ARM was up two basis points to 2.45 percent.rnAll Fannie Mae yields are quoted net of servicing fees.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment