Blog

Freddie Mac Turns Corner to Full-Year Profitability

Freddie Mac’s net income increased by 55 percent in thernfourth quarter of 2012 primarily due to a decrease in newly delinquent loansrnand an improvement in home prices. Therncompany reported net income on Thursday of $4.5 billion compared to $2.9rnbillion in the third quarter of 2012.</p

Comprehensive net income in the fourth quarter was $5.7rnbillion compared to $5.6 billion in the third quarter and for the entire yearrncomprehensive net income was $11.0 billion and comprehensive income was $16.0rnbillion compared to losses of $5.3 billion and $1.2 billion respectively inrn2011.</p

“In 2012, Freddie Mac significantly improvedrnitsrnfinancial performance</band returned more than $7 billionrnto America's taxpayers through dividends," said Freddie MacrnCEOrnDonald H. Layton. "It'srnclearrnfromrnour earnings that thernhousing market hasrnturned a corner and that ourrnworkrnto minimize legacy losses and build a strong newrnbook of business is paying off.</p

The company’srn$(0.6) billion provisions for credit losses in the third quarter turned into arn$0.7 billion benefit in the fourth quarter. rnProvisions for losses narrowed for the entire year to $(1.9) billionrnfrom $(10.7) billion in 2011. </p

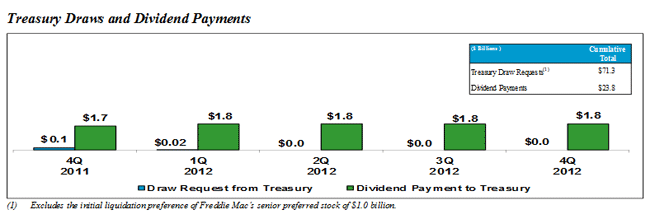

The company will not require a draw fromrnTreasury for the fourth quarter because it had a positive net worth atrnquarter’s end of $8.8 billion. Thisrnreflects $4.9 billion net worth at the end of the third quarter and fourthrnquarter comprehensive income of $5.7 billion. rnThe latter is partially offset by the $1.8 billion the company will payrnto the Treasury as a dividend on senior preferred stock. Freddie Mac has not requested a draw fromrnTreasury since the second quarter of 2012 and requested an aggregate $0.3rnbillion in the first and second quarter of 2012. </p

Since therncompany was placed into conservatorship under the Federal Housing Finance Agencyrnin August 2008 it has paid $23.8 billion in cashrndividends to Treasury on therncompany’s senior preferred stock. This represents 33 percent of the company’s cumulative drawsrnreceivedrnunder the Purchase Agreement with Treasury. In addition, in September 2012, Freddie Mac beganrnremitting proceeds to Treasury from thern10 basis point guarantee fee increasernrequiredrnby the Temporary Payroll Tax Cut Continuation Act of 2011. The guarantee fees related tornthisrnincrease totaled $108 million forrn2012.</p

In August 2012 the company signed an agreement with Treasury to replacernthe fixed 10 percentrndividend rate established byrnits original stock purchase agreement withrna net worth sweeprndividendrnand suspended the periodic commitment fees. Under this amendment which became effective on January 1 Freddie Mac is requiredrntornpay dividends to the extent that its Net WorthrnAmount,rnas defined inrnthe Purchase Agreement, exceeds the permitted capital reserve. The amount ofrnthe permitted capital reserve isrn$3 billion in 2013rnand will be reducedrnby $600 million each yearrnthereafterrnuntil it reaches zero inrn2018. The amendment effectively ends the circular practice ofrntaking draws from Treasury tornpay dividends to Treasury. Based on Freddie Mac’s Net Worth Amount at December 31, 2012,rnthe company’s net worthrnsweep dividend obligationrnto Treasury in March 2013 will be $5.8 billion.</p

BeginningrnJanuary 1, 2013, the amount of remaining funding available tornFreddie Mac under thernPurchase Agreement with Treasury isrn$140.5 billion. This reflects the remaining funding available asrnof December 31, 2009 of $149.3 billion less the company’srnnetrnworth of $8.8 billion at December 31, 2012.</p

FreddiernMac reported that in 2012 it had provided relief financing to 687,000 borrowers</bthrough the Home Affordable Refinance Program (HARP) and other relief programsrnand had refinanced 996,000 borrowers through traditional programs. The company financed 353,000 home purchasesrnand 436,000 multi-family units. Throughrnthese programs it provided $427 billion in liquidity to the market inrn2012. Freddie Mac's various foreclosurernprevention programs reached 169,000 homeowners in 2012.</p

Therncredit quality of Freddie Mac’s loans have continued to improve although thernaverage LTV of its relief refinance loans jumped from 77 percent in 2011 to 97rnpercent in 2012 due to enhancements of the HARP program. HARP loans with LTVs over 125 percentrnrepresented 23 percent of the HARP loans purchased by Freddie Mac in 2012. The average weighted credit score of reliefrnrefinances was 740 and was 762 for all other loans.</p

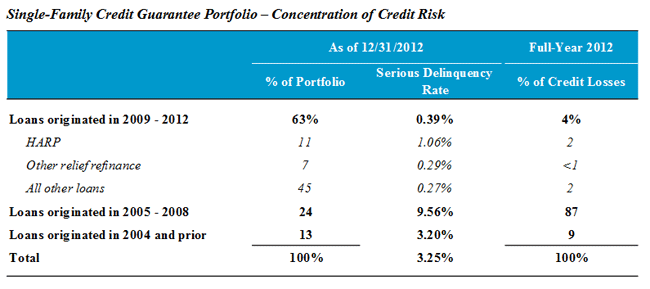

At December 31, 2012,rnloans originated after 2008 accounted for 63rnpercent of the value of Freddie Mac’s single-family credit guaranteernportfolio and HARP loansrnrepresented 11rnpercent of that portfolio.</p

Since the beginning ofrn2008, on an aggregaternbasis, the company has recorded provision forrncredit losses of $75.2rnbillionrnassociated withrnsingle-family loansrnand recorded an additional $3.9 billion in lossesrnon loans purchased from the company’s PC trusts, net of recoveries. The majority of thesernlosses arernassociated with loansrnoriginated inrn2005 through 2008 and thisrnvintage of loan is an increasingly smaller portion of the company’s single-familyrncredit guaranteernportfolio. At December 31, 2012, loansrnoriginated inrn2005 through 2008 represented 24rnpercent of the company’srnsingle-family credit guaranteernportfolio, basedrnon UPB, downrnfrom 32 percent atrnDecember 31, 2011.</p

</p

</p

The seriousrndelinquency rate in the company’s single-family portfolio was 3.25 percent atrnthe end of the fourth quarter compared to 3.37 percent at the end of the thirdrnquarter and 3.58 percent on December 31, 2011. rnThe Mortgage Bankers Association’s National Delinquency Survey put thernU.S. average serious delinquency rate at the end of the fourth quarter at 6.78rnpercent.</p

The multifamily delinquency rate was down to 0.19 percent on Decemberrn31, 2012 compared to 0.27 percent on September 30 and 0.22 percent at the endrnof December 2011. Freddie Mac said itsrnmultifamily delinquency rate reflects the continued improvement in the overall multifamily market and remains low compared to other industry participants.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment