Blog

Freddie Mac's Updated Forecast And a Vote against FOMC Action

Freddie Mac’s long-time chief economist Frank Nothaftrndeparted some months ago to take the same role at CoreLogic and that vacancy atrnthe mortgage company has now been filled by Sean Becketti. The change of command is apparent in the newrnlook of the company’s monthly forecast.</p

Formerly called U.S.rnEconomic and Housing Market Outlook, it has re-emerged as Insight and Outlook and, in this issuernat least, it is less a straightforward summary and commentary on the month’srneconomic and housing news and more a multi-topic magazine.</p

While the forecast was still a prominent feature – cast inrnthe context of whether the country is ready for a Federal Reserve rate increasern- as is a recap of the month’s housing indicators, Insight and Outlook also takes on two separate issues; how torndetermine if house prices are becoming ‘too darn high’ and a look at Freddie’srnnew 97 percent mortgages and layered risk. </p

The broader ‘Outlook’ portion is titled: “Are We There Yet?” Indeed, that is the question Freddie Mac’s economists say thatrnthe market keeps asking the Federal Reserve. rnAfter six years of what they call “very tepid expansion,” is it time tornraise interest rates? They clearly do not think it is.</p

The Fed has consistently stated it is waiting for evidencernthat labor markets have recovered and inflation can at least be headed towardrnits 2 percent target before it raises short term rates. Freddie Mac looks at the current state ofrneach and finds them lacking. </p

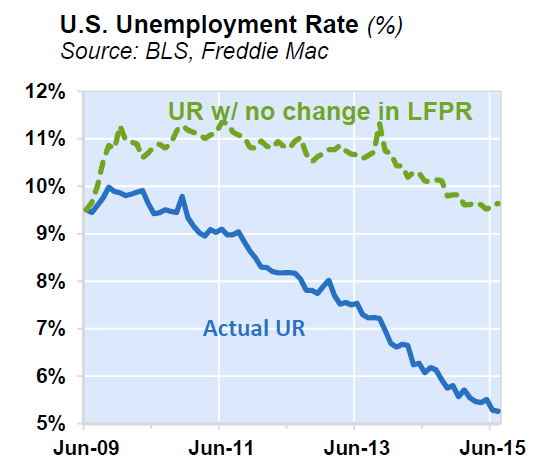

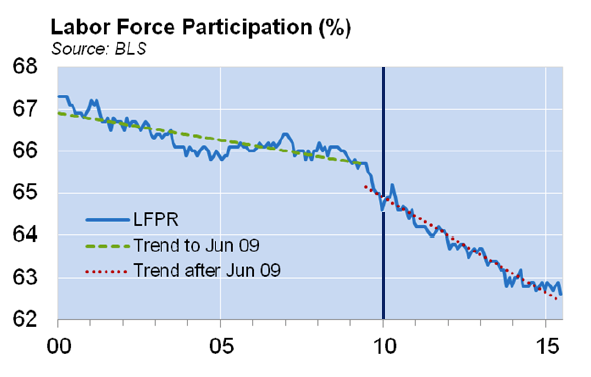

Unemployment is well below the 10 percentrnlevel it reached in October 2009 and at the current 5.3 percent is within arnrounding error of what the Fed considers full employment. However Freddie Mac maintains this is lessrnbecause of a growth in employment than an indication of a falling rate of laborrnparticipation. That rate has been shrinkingrnfor the last 15 years but tripled during the expansion. Freddie Mac concludes that “Weak employmentrncombined with stagnant wage growth suggests the Fed should be cautious inrntightening monetary policy.” </p

</p

</p

</p

</p

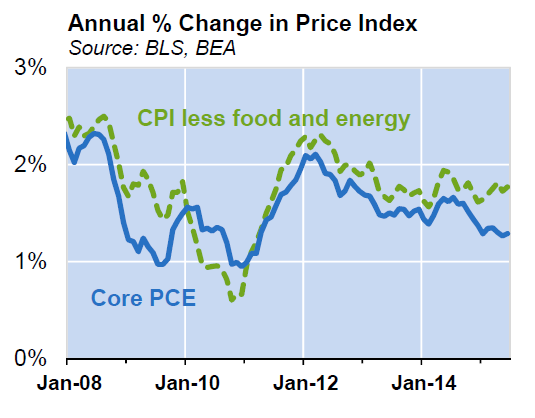

Inflation is also running below the target rate and may bernpoised to drop even lower. Corerninflation, a measure which excludes volatile food and energy prices, has notrnreached 2 percent on an annual basis since 2008. Core personal consumption expendituresrnmeasured by the PCE price index have recently fallen to around 1.2 percent andrnrecent global events may strengthen the dollar even further, putting morerndownward pressure on U.S. inflation.</p

</p

</p

These triggers, Freddie Mac says, don’t present a compellingrnreason to raise rates any time soon and that outlook doesn’t change when otherrnindicators are included in the analysis. rn”In our opinion, we’re not there yet,” the economists say. “The International Monetary Fund appears tornagree with us-in June it cautioned the Fed against raising rates too soon.rnNonetheless remarks by Janet Yellen and some (but not all) of the Fed governorsrnand presidents have persuaded the market that Fed may nonetheless act in September.rnIn any event, we expect the initial rate increases to be very cautious and morernsymbolic than impactful.”</p

They also regard housing as “a good news/bad newsrnstory.” Home sales are having the bestrnyear since 2007 and increasing home prices are chipping away at negative equity,rnhousing starts are up and builder confidence hit a 10 year high in August. But despite all of this, they say, “overallrnhousing activity remains week compared to historical norms.”</p

Under bad news they include uneven access tornmortgages across income groups, affordability barriers to homeownership,rnespecially in acquiring money for a down payment given rising prices, andrnincreasing rents which often consume a disproportionate share of income,rnfurther increasing the difficulty of amassing a downpayment.</p

Freddie Mac is still expecting growth to pick up inrnthe second half of the year and that long-term interest rates, including mortgagernrates, will increase only gradually whether or not the Fed acts this year. They made several changes to their forecastrnsince the previous month, most significant is an upward revision to predictionsrnfor mortgage originations this year and next, the second month in a row theyrnhave revised these projections. Becausernof strong refinance activity and home sales the estimate for mortgagernoriginations in 2015 has been raised to $1.45 trillion from $1.35 trillion and forrn2016 to 1.3 trillion from 1.275 trillion. rnThe expected refinance share was revised upward from 43 to 46 percent. They also increased their projection for homernsales in 2015 from 5.6 million to 5.73 million units.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment