Blog

GAO Study Finds Small Bank Failures have Minimal Impact on Community

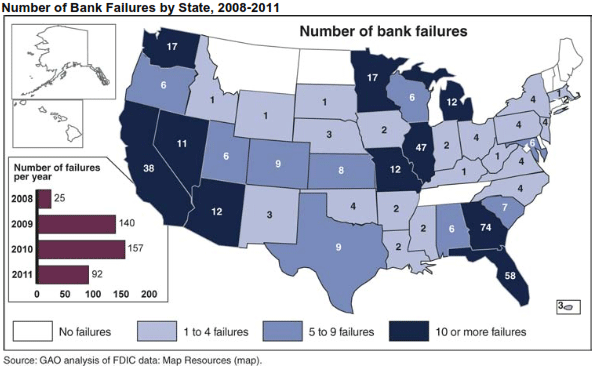

Over a four year period ended inrnDecember 2011 and representing the height of the banking crisis there were 414rnfailures of insured U.S. banks. Ofrnthese, 353 or 85 percent would be classified as smaller banks with less than $1rnbillion in assets and ten states had ten or more of these small bank failures. </p

Because of questions asked about factorsrncontributing to the failures, the effectiveness of FDIC’s resolution methods,rnand the effects on the banks’ local communities the GAO recently conducted arnstudy focusing on small bank failures in those state with the largest numbersrnto determine if there were local contributing factors. Its report was issued today. </p

The ten states were concentrated in thernwestern, midwestern, and southeastern regions of the country all of which hadrnexperienced strong growth in their housing market in the preceding tenrnyears. GAO found that the failures ofrnbanks in those states were largely driven by losses on commercial real estate (CRE)rnloans. These banks had also oftenrnpursued what GAO called aggressive growth strategies such asrnusing brokered deposits for funding and employing looser underwritingrnstandards. The rapid grown of thesernbanks’ CRE portfolios left them vulnerable to the sustained real estate andrneconomic downturn that began in 2007. While some local officials told GAO that somernlosses were caused by declines in the value of the CRE collateral, data was notrnavailable to assess the extent of this possible cause. </p

</p

</p

Fairrnvalue accounting also has been cited as a potential contributor to bankrnfailures, but between 2007 and 2011 fair value accounting losses in general didrnnot appear to be a major contributor, as over two-thirds of small failed banks’rnassets were not subject to fair value accounting. The Treasury Department and the FinancialrnAccounting Standards Board have observed that the current accounting model forrnestimating credit losses is based on historical loss rates, which were low inrnthe pre-financial crisis years and that earlier recognition of loan lossesrncould have potentially lessened the impact of the crisis. Instead banks had to recognize the lossesrnthrough a sudden series of provisions to the loan loss allowance, thus reducingrnearnings and regulatory capital. The Standards Board has proposed a loan lossrnprovisioning model that focuses on expected losses and would result in earlier recognitionrnof loan losses so banks could incentivize prudent risk management practices. The proposal should also help address therncycle of losses and failures that emerged in the recent crisis as banks werernforced to increase loan loss allowances and raise capital when they were leastrnable to do so.</p

ThernFDIC used shared loss agreements for about half the banks it closed during therncrisis. Under these agreements FDICrnabsorbs a portion of the ultimate losses on some assets of the failed bank thatrnare purchased by the acquiring bank. Itrnis the consensus of parties interviewed by GAO that use of these agreements,rnwhich are projected to cost FDIC about $42 billion over their contract life,rnpotentially saved the Deposit Insurance Fund another $40 billion. They are also credited for attracting biddersrnfor the assets. FDIC said it benefitedrnfrom reductions in its own immediate cash needs, moved assets quickly into thernprivate sector, and provided less disruption to the bank’s customers throughrnuse of the agreements.</p

GAOrnfound that the acquisitions of failed banks by healthy banks appear to havernmitigated potentially negative effects of the failures on local communities. Failures and acquisitions can have an impactrnon bank concentration and thus on competition but GAO found only a limitedrnnumber of areas where banking may have become significantly more concentrated,rnsometimes because the acquiring bank came from out of market. </p

Anotherrnconcern was that the failures might impact the availability of credit but GAOrnfound that, failing banks had generally reduced their extension of credit asrnthey failed and acquiring banks increased net credit after thernacquisition. Post acquisition creditrnstandards, however, were generally tighter so any increase in credit usuallyrnfavored those small business owners with good credit histories and strongrnfinancials. </p

Involvementrnin local philanthropy was not generally affected by the failures as againrninvolvement in local causes generally fell as small banks were failing and increasedrnunder new ownership although the acquiring bank might have a different focusrnfor its philanthropic activities.</p

Finally,rnGAO econometrically analyzed the relationships among bank failures, income,rnunemployment, and real estate prices for all states and the District ofrnColumbia for the 1994 through 2011 period and found that bank failures werernmore likely to affect a state’s real estate sector than its labor market orrnbroader economy.</p

ThernGAO did not make any recommendations based on its study but said it plans torncontinue to monitor the activities of the accounting standard setters tornaddress concerns with the loan loss provisioning model.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment