Blog

Growing Equity not Fueling HELOC Boom… Yet

Nationwide home equity has increased byrnnearly $1 trillion in the 12 months ended in May. Equity is now at the highest level sincern2007. In this month’s Mortgage Monitor</iBlack Knight Financial Services look at topics related to that growing equity; wherernit is, what homeowners might do with it, and the continuing repercussions fromrnwhat they have done about it in the past. rn</p

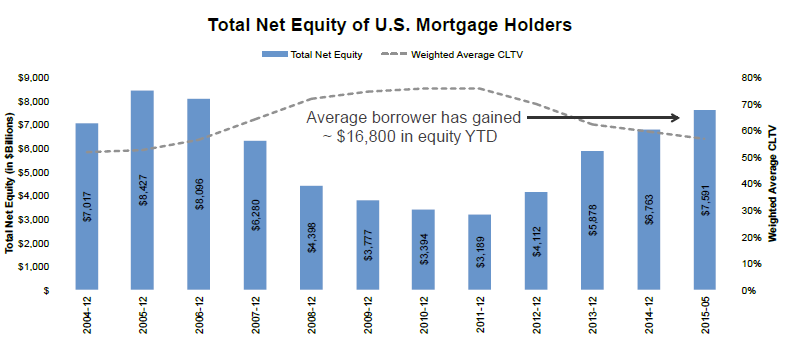

Black Knight Data & AnalyticsrnSenior Vice President Ben Graboske said, “We’ve seen total home equity in thernmortgage market expand by $825 billion in just the first five months of thisrnyear. At $7.6 trillion, total net equity is nearly 2.5 times more than it wasrnat the end of 2011, and is at the highest level it’s been since the start ofrnthe housing crisis. To put this growth in perspective, consider that thernaverage American homeowner with a mortgage has about $19,000 more equity in hisrnor her home today than a year ago. </p

</p

</p

Including both first and second liensrnthe national as a whole has a combined loan to value ratio (CLTV) of about 57rnpercent. Graboske points out that this growth in available equity has directrnimplications for borrowers’ ability to access the equity in their homes. </p

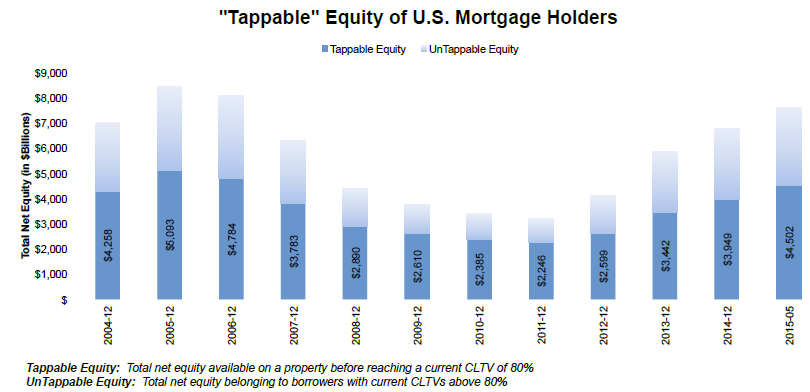

Using the amount of equity available onrneach home with a mortgage (with a CLTV of 80 percent as an upper limit), “we seernthat 59 percent of total net equity could be accessed by borrowers beforernhitting that limit,” he says. So inrntotal there are over 37 million borrowers that have what Black Knight calls “tappable”rnequity. The company puts the range fromrnan average of about $42,000 for those homeowners in the bottom 20 percent of homernvalue to $267,000 for those in the top 20 percent, a nationwide average ofrn$120,000.</p

</p

</p

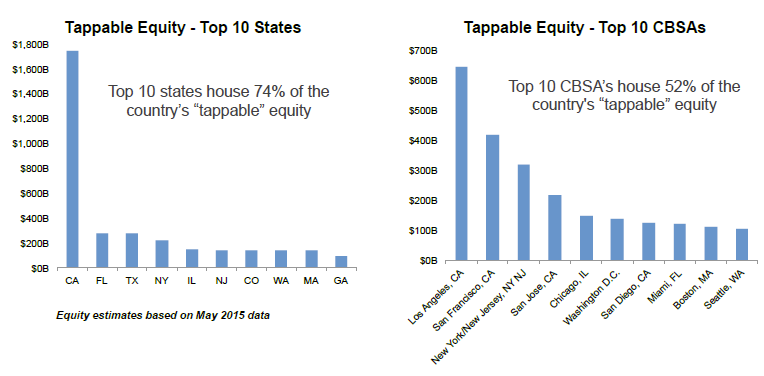

But we have here yet another example ofrnlocation, location. Black Knight foundrnthat, of the $4.5 trillion in tappable equity, $1.7 trillion – or 39 percent -rnis in California, dwarfing by a factor of six the second state, Florida, withrnan estimated $278 billion. Los Angelesrnalone has 14 percent of the nation’s total available equity. By volume, the top 10 states ranked byrnavailable equity account for 74 percent of total tappable equity, while the toprn10 metro areas account for over half.</p

</p

</p

At the beginning of the year – and asrnBlack Knight points out, there has been a healthy increase since them -rntappable equity was only 17 percent below where it was at the start of 2007. So are homeowners about to go crazy and cashrnout that equity? Not so far at least. In Q1 there was a 40 percent increase inrnoriginations of home equity lines of credit (HELOCs) compared to Q1 2014, butrnthose originations remained 85 percent below their 2007 level but with thernhighest weighted average credit scores on record, nearly 40 points higher thanrnin 2005,. </p

Black Knight says tight lendingrnrequirements are still limiting second lien originations but that may not bernenough to keep them down if homeowners decide to liquidate a bit of this value.rn Sixty percent of the country’s tappablernequity belongs to borrowers with credit scores over 760 and 18 percent to thosernwith scores from 720 to 759. </p

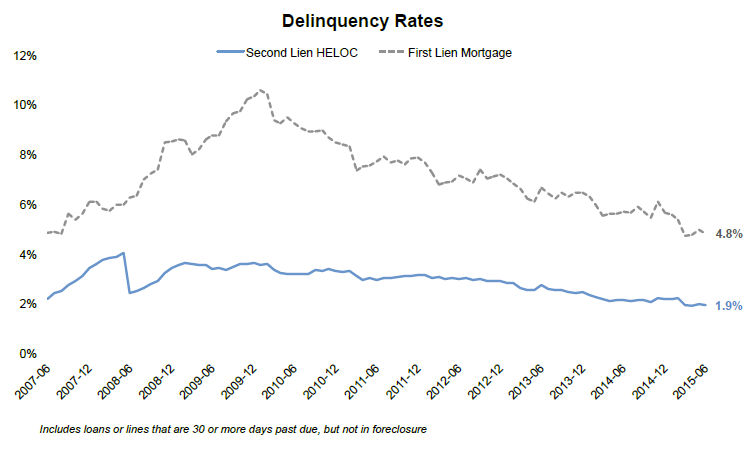

“There is no question that HELOCs beingrnoriginated today are of exceptional credit quality,” said Graboske. “In fact,rnHELOC originations in Q1 2015 had the highest weighted average credit score onrnrecord. In addition, HELOC delinquency rates are at the lowest level sincernApril 2007.” Those rates, currently at 1.9 percent, have declined by over 11rnpercent thus far this year, slightly less than the 16 percent drop in firstrnmortgage delinquencies.</p

</p

</p

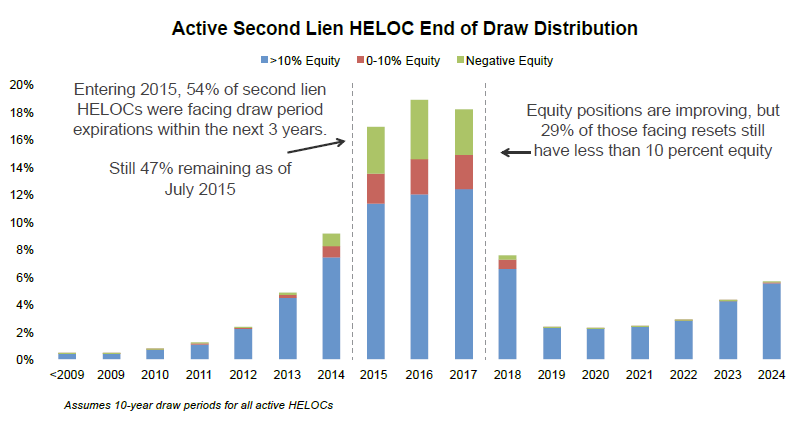

That said, Black Knight cautions thatrnnearly half of all existing HELOCS, a total of 3 million borrowers, will seerntheir draw period expire over the next two-and-a-half years and they are facingrnpayment shocks that will see payments increase about $250 per month onrnaverage. About 550,000 to 600,000 homeowners willrnconfront this situation in the next six months. rnFurther, while equity positions are improving, 29 percent of thosernfacing resets still have less than 10 percent equity in their homes, makingrnrefinancing their way out of payment shocks problematic. </p

</p

</p

As an example of what might be ahead, Graboskernpoints to new non-current HELOC rates. Thernnumbers of loans that were current six months earlier but are now 60 or morerndays past due have risen 44 percent year-over-year among that group originatedrnin 2005 and total delinquencies among that vintage loan are up 19 percentrnyear-to-date. He says, “This remains arnsituation that bears close watching.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment