Blog

GSE Foreclosure Prevention has Reached 2.4 Million Homeowners

Fannie Mae and Freddie Mac (the GSEs)rncompleted approximately 129,000 foreclosure prevention actions during thernsecond quarter of 2012, bringing the total to nearly 2.4 million since theyrnwere placed in conservatorship in September 2008. The two companies completed 50,373 loanrnmodifications, 36,343 repayment plans, 5,352 forbearance plans and 36,496 homernforfeiture actions, most of which were short sales. During the first quarter there were 146,099rnforeclosure prevention actions completed with a similar breakdown among thernvarious activities.</p

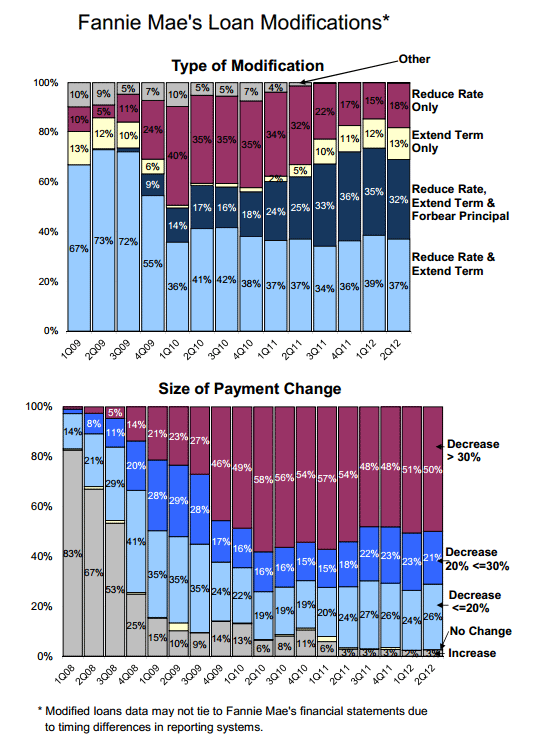

The Federal Housing Finance Agencyrn(FHFA) reported that nearly half of the borrowers who received loanrnmodifications during the quarter saw their monthly payments reduced by morernthan 30 percent and 29 percent of loan modifications included some principalrnforbearance.</p

Serious delinquency rates continued torndecline but early delinquencies – where borrowers missed one or two monthlyrnpayments – increased during the second quarter. rnLoans 30 to 59 days delinquent increased from 497,000 to 539,000 fromrnthe first to the second quarter while more serious delinquencies fell from 2.25rnmillion to 2.17 million. Foreclosurernstarts were also down, from 226,000 to 186,000 and the number of properties inrnthe GSE’s owned real estate portfolios (REO) was down about 10,000 units torn173,000.</p

The administration’s Home AffordablernModification Program (HAMP) has put 984,333 borrowers in modification trialsrnsince its inception in 2009 and 424,916 of those borrowers are now in permanentrnmodifications. Borrowers with permanentrnmodifications through non-HAMP programs total 522,652 since October 2009 and 53rnpercent of permanent modifications in the second quarter were non-HAMPrnmodifications. </p

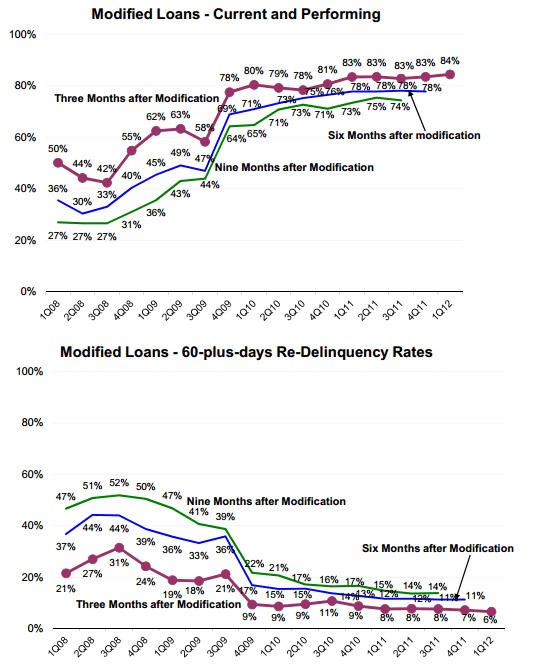

HAMP modifications have performedrnappreciably better than non-HAMP modifications throughout the life of thernprogram and performance has improved as the program gathered morernexperience. For example, of loansrnoriginated under HAMP in the 3rd quarter of 2011 80 percent wererncurrent and performing nine months later. rnThe corresponding non-HAMP modifications had a 71 percent performancernrate.</p

</p

</p

The Foreclosure Prevention Report issuedrnby FHFA on Wednesday also contains a state-by-state report on delinquencies andrnforeclosure prevention activities.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment