Blog

GSE Reform Could Have Dire Unintended Consequences for Renters

Rental housing is a growing crisis according to thernCenter for American Progress, but policymakers have made it “an afterthought inrnthe debate over the future of mortgage giants Fannie Mae and Freddie Mac.” David M. Abromowitz, a Senior Fellow at thernCenter, said that the U.S. housing market appears on the road to recovery butrnany mention of a broad “housing recovery” ignores the far less rosy future ofrnroughly a third of the U.S. population, the 100 million people who rent.</p

Renters face a long-term and growing affordabilityrncrisis. The demand for rental housing hasrnskyrocketed and production has failed to keep up. As a result rents have climbed 4 percent thisrnyear while middle class wages have stalled and now one of every four rentersrnspends more than half their monthly income on housing. Rents are projected to increase by at leastrnanother 4.6 percent next year and 4 percent in both 2014 and 2015.</p

The percentage of Americans who rentrnis at the highest level since 1995; 1 million new renters were added in 2011rnalone. Two major causes for the increasernare that both Baby Boomers and Millennials are entering ages likely to rent andrnhousehold formation is growing again after the recession. Over one million new households formed in thern12 months ending in September 2012. </p

Foreclosures have changed millionsrnof families from homeowners to renters, especially among the working class andrnin communities of color. According to the San Francisco Federal Reserve, itrncould take more than a decade for many of these families to return tornhomeownership, so they have no option but to rent. Finally, tight lendingrnstandards make mortgage credit less accessible than at any time in the recentrnpast. This is paradoxical given howrnaffordable owning a home is today. </p

While the number of low-incomernrenters grew by 2.2 million over the past decade, Harvard’s Joint Center forrnHousing Studies says the number of adequate and affordable rental unitsrnactually decreased and analysts project that the current pace for rentalrnconstruction will fall well short of what is needed to meet demand between nowrnand 2015. Freddie Mac notes there willrnbe a net 1.7 million new renters between 2011 and 2015, but only about 200,000rnnew multifamily units per year. Thernnumbers could increase even faster over the following five years, with perhapsrnas many as 2.3 million new renters added between 2015 and 2021. Thernresult will be an increasingly tight rental market and higher rents for manyrnAmericans.</p

Abromowitz notes that even thoughrnthere is a glut of vacant single-family homes, most the result of foreclosure,rnconverting them to rentals will only help certain groups of renters. Many are located in outlying suburbs or inrnoverbuilt markets and others are in economically distressed areas with littlernhousing demand because there are no jobs. The populations driving the demandrnfor rentals, downsizing seniors, young adults, and immigrant families formingrnnew households, are more likely to want rentals in larger multifamily buildingsrnor in urban areas and areas where jobs are plentiful. </p

This mismatch of supply and demand have forcedrnrents up and vacancies to fall from 8 percent at the end 2009 to 4.7 percent inrnthe second quarter of 2012. Meanwhilernwages for the vast majority of workforce renters remain fairly stagnant. Fifty-three percent of renters now pay morernthan 30 percent of their income for housing, while 27 percent of renters payrnmore than half. </p

When households spend so much forrnrents it depresses demand for other goods and services. One analysis found thatrnhousing-cost burdened families spend 50 percent less on clothes and healthrncare, 40 percent less on food, and 30 percent less on insurance and pensionsrncompared to families in affordable units.</p

Abromowitz says we are reaching arncrossroads in multifamily housing policy. Many of the roughly 4 millionrnapartment units built during the 1970s and early 1980s under a variety of Nixon-erarnfederal programs are nearing or at the end of their subsidy periods, leavingrnmany lower-income tenants at risk for sharp rent hikes. Affordabilityrnrestrictions on another 1 million apartments produced under the low incomernhousing tax credit program will also soon expire. These nearly 5 millionrnapartments represent roughly 15 percent of the nation’s apartment stock. </p

In addition to direct subsidyrnprograms, the federal government has long supported a multifamily housingrnmarket through Fannie Mae, Freddie Mac, (the GSEs) and the Federal HousingrnAdministration. Specifically, the GSEs purchase and guarantee conformingrnmultifamily mortgage loans, package those loans into pools and sell thernresulting mortgage-backed securities (MBS), to outside investors. They also hold some multifamily loans inrntheir own portfolios. </p

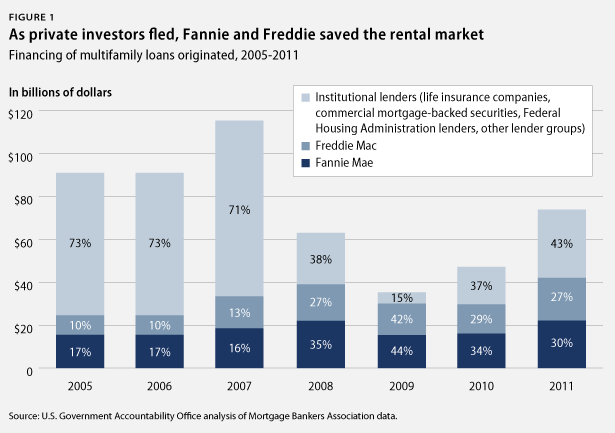

In good economic times, Fannie andrnFreddie tend to back a smaller portion of the multifamily market becausernprivate lenders and investors are eager to invest. In bad times however Fanniernand Freddie step in to keep the rental market afloat. Most recently, as privaterninvestors fled the housing market in 2007 and 2008, the GSEs share of thernmultifamily market shot up to fill the gap, and then eased back. </p

</p

</p

Without government-backed credit forrnmultifamily mortgages, the rental market would have completely collapsed. In 2009 Fannie and Freddie facilitated 85rnpercent of all multifamily loans, tripling their share of the multifamily loanrnmarket from two years earlier. They continue in this rule, supporting 57rnpercent of multifamily loans in 2011.</p

Even with this support multifamilyrnunit construction dropped from 284,000 starts in 2008 to 109,000 in 2009, arnnear 30-year low. Without government backing to attract private capital it isrnlikely that many of these units would not have been built and rents would havernincreased faster. Thousands ofrnmuch-needed construction jobs would also have been lost during the downturnrnand, as a result, the current affordability crisis would be an economicrncatastrophe.</p

GSE loans performed far better thanrnmost originated in the private market. They experienced delinquency rates ofrn0.45 percent at the end of 2009 compared to 6.5 percent for private-labelrnCommercial MBS multifamily loans and 5 percent for commercial banks’rnmultifamily loans. The GSEs also madernloans available for smaller buildings in markets not as popular withrninstitutional private lenders. </p

A healthy market for decent rentalrnhousing requires wide access to multifamily mortgages under a range of marketrnconditions. This financing spurs the construction, maintenance, and resale ofrnapartment buildings; expands supply where there is pent-up demand, and helpsrnkeep rents more stable for families at all income levels. Despite the role the government has played inrnkeeping this market alive, some policymakers are considering significant reductionsrnof government support for all housing finance including multifamily housing. Somernare even calling for the federal government to withdraw from Fannie andrnFreddie’s multifamily business entirely. </p

The Federal Housing Finance Agency,rnconservator of Fannie and Freddie, appears ready to privatize the multifamilyrnmortgage market, announcing it was reviewing the possible impact of eliminatingrnthe GSE-issued government guarantee on multifamily MBS. If this reduces construction of new rentalrnunits it could lead to increased rents for millions of low- and moderate-incomernfamilies. Abromowitz said that this and similar congressional proposals forrnwithdrawals of all government support for apartment finance would be a bigrnmistake.</p

He suggests instead that lawmakersrnshould focus on smart reforms. He referredrnto an earlier Center for American Progress plan to preserve a secondary marketrnfor multifamily mortgages. The plan includes an explicit, privately paid for,rnand limited guarantee on strictly underwritten MBS issued by private firms. Inrnaddition, to assuring that renters benefit from any government backstop to thernapartment finance market, the plan proposes that at least 51 percent of thernrental housing units financed in the overall portfolio of private firms in arngiven year have rents no more than 29 percent of the income of occupantsrnfalling below 80 percent of local median income.</p

While most analysts agree that arnhealthy multifamily market requires a strong government role, not everyonernthings this includes an explicit government guarantee. The Center recentlyrnreviewed 21 plans for mortgage market reform and only eight maintained an explicitrnguarantee on multifamily securities. rnMost of those plans simply mentioned the rental market in passing.</p

Abromowitz said too many Americans includingrnmany of the most vulnerable rely on the rentals for their housing and cannot remainrnan afterthought in deciding the future of the housing market. “We must pursuernapproaches that create a lasting 21st-century finance system and meet the needsrnof both renters and homeowners,” he said.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment