Blog

HAMP Conversion Rate Improves. Majority of Permanent Mods Are Unemployed Borrowers

The administration's Making Home Affordable Program (HAMP)rnis beginning to look a little more robust based on figures released Wednesdayrnthe U.S. Treasury Department and the Department of Housing and UrbanrnDevelopment (HUD), joint sponsors of the program.

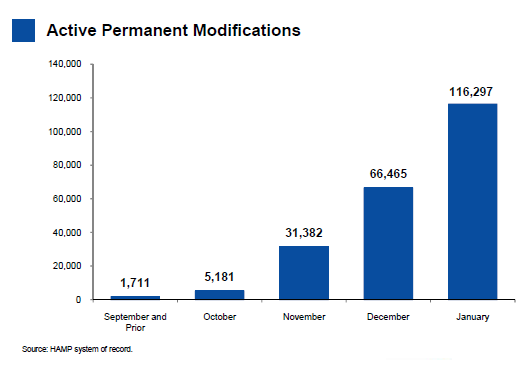

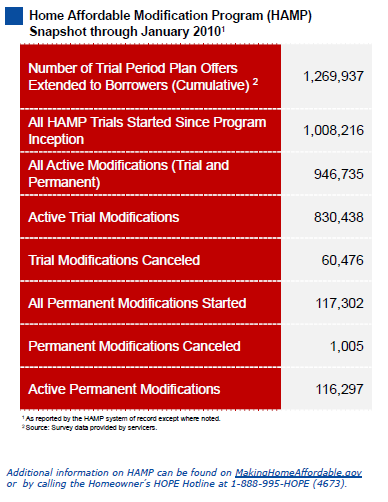

The newest figures indicate more borrowersrnare emerging from trial loan modifications and signing permanentrnloan modification offers. As of the end of January, a total of 116,297 permanent loanrnmodifications had been signed, nearly double the 66,465 reported at the end ofrnDecember. An additional 76,482 had been extended permanent modification offersrnbut had not yet returned the paperwork. 830,438rnborrowers are still in some stage of the required three month trial period requiredrnby the program guidelines.

Since the program began last spring, 1,269,937 householdsrnhave been extended loan modifications offers, 1,008,216 of which had enrolled inrntrials. 60,500 had been cancelled. However, the rate at which new candidates arernentering the program is dropping. Thernincrease in enrollment from December to January was 80,500 compared to 109,500rnfrom November to December and 110,081 the month before that. Enrollment in the trial peaked in October atrn157,000.

The Treasury Department estimates that there arernapproximately 5.6 million first mortgage loans that are 60 or more days delinquent,rnhowever, only 1.7 million of these are currently estimated to be eligible forrninclusion in the HAMP program.

Eligible loans are modified so that payments do not exceedrn31 percent of monthly income through interest rate reductions and, wherernnecessary, an extension of the term of the loan or forbearance ofrnprincipal. The Treasury Departmentrnestimates that the median decrease in monthly payment is $522.

Some fallrnout of eligibility because they are FHA or VA loans, jumbo loans, or those originatedrnafter the eligibility end date for origination. rnOthers are eliminated based on being non-owner occupied or vacant or forrnhaving negative income or a borrower debt ration already below the 31 percentrnlevel the program is designed to achieve. While the report states that these numbersrnrepresent a one-time snapshot and that more borrowers are expected to becomerneligible for HAMP, it still appears that there are a significant number of troubledrnloans out there that may not be reached by programs such as this and mayrnproceed to foreclosure.

HAMP utilizes loan servicers to contact borrowers who are 60rndays or more delinquent on their mortgage payments, evaluate their eligibilityrnfor the program and do the paperwork necessary to enroll them in trialrnmodifications. Over 100 servicers arernnow enrolled as participants in the program and firms servicing Freddie Mac andrnFannie Mae owned loans are automatically enrolled as HAMP participants. The HAMPrnprogram has been criticized for the low rate of conversion from trial tornpermanent modification status and, in January program administrated enacted arnprogram of increased supervision of servicers and additional assistance tornborrowers in an attempt to improve the conversion rate.

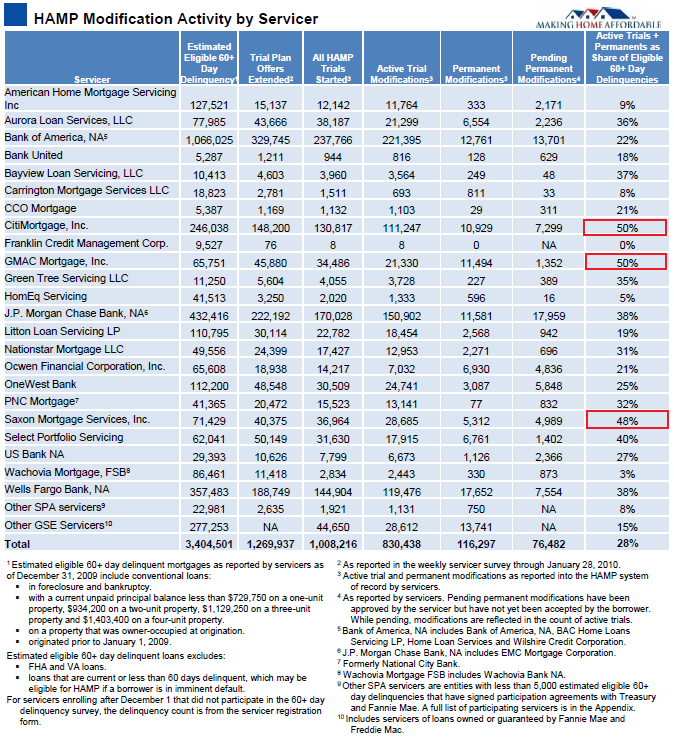

Three of the servicers, CitiMortgage, GMAC, and SaxonrnMortgage Services are at or near having enrolled 50 percent of their delinquentrnloans in the program and most of the large servicers have enrolled 30 to 40rnpercent of eligible loans in modifications.

While borrowers mustrnkeep their modified loans current for three months before converting tornpermanent status, only about 7,000 permanently modified loans have aged morernthan three months so the program is still too young to allow any estimates ofrnthe rate of default. As reported here yesterday, it is estimated thernredefault rate on Freddie Mac and Fannie Mae loan modifications are running atrnabout 60%.

MND's Adam Quinones adds one last observation from the report…

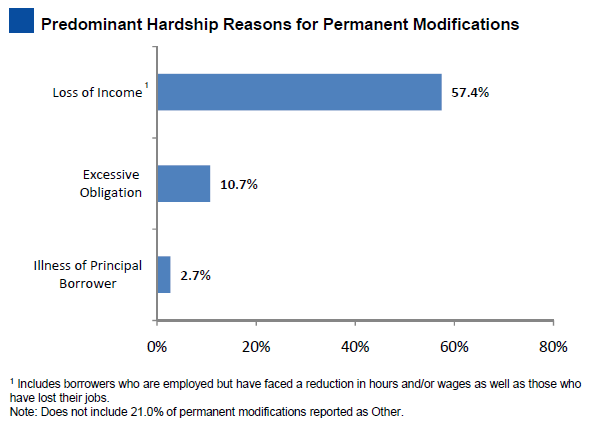

It is noted that the majority of successful loan modifications, 57.4% to be exact, have been borrowers who are out of work or are underemployed. If those borrowers are unable to get work, those loans might end up defaulting anyway. Again, this calls attention to the need for stimulus in the labor market.

JOBS JOBS JOBS!

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment