Blog

HARP Beats Expectations, Toping the 2 Million Mark

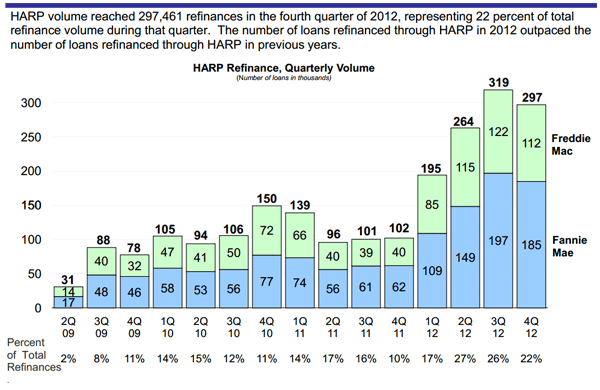

The Home Affordable Mortgage Refinancing Program (HARP)rnoutperformed expectations in 2012 after enhancements to the program in latern2011 increased its availability to underwater homeowners. The Federal Housing Finance Agency (FHFA)rnannounced today that 1,074,755 mortgages were originated through HARP in 2012,rndoubling the number over the life of the program which began in 2009 torn2,165,021. There were 438,228 HARPrnoriginations in 2011.</p

Volume in the fourth quarter of 2012 was 297,461 refinances, representing 22 percent of totalrnrefinance volume. December refinance volume fell to 76, 461 compared to 129,746 in November. The Novemberrnvolume had ballooned in advance of a 10 basis point guarantee fee increase that took effect starting December 1, 2012. Fannie Mae HARP originations in were 51,054 inrnDecember compared to 77,301 in November and Freddie Mac’s dropped from 52,445rnto 25,407.</p

HARP refinances since the inception of thernprogram have been overwhelmingly on primary residences with only 69,522 of thernover 2 million total covering second homes and 199,672 refinancing investmentrnproperties.</p

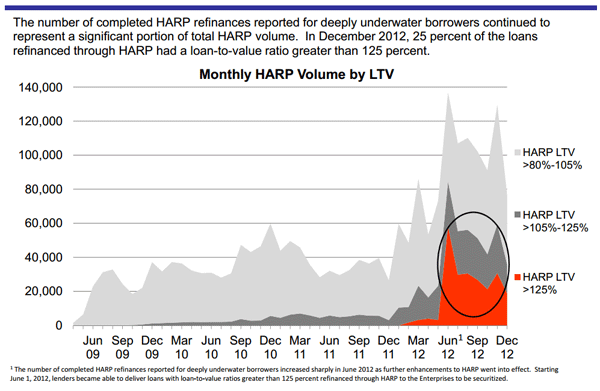

Since the enhancements to the HARP programrnwhich removed the previous 125 percent loan-to-value (LTV) cap were implementedrnat the beginning of 2012 there have been 228,144 mortgages originated withrnLTV’s exceeding 125 percent or about 20 percent of the HARP loans thatrnyear. A total of 605,946 loans werernoriginated with LTV’s in the lowest range for the HARP program, 80 to 105rnpercent LTV.</p

</p

</p

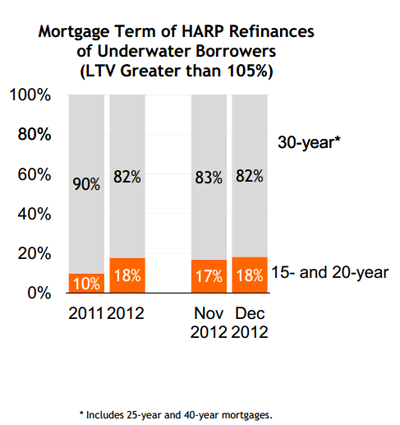

Eighteen percent of HARP borrowers in December took advantagernof the incentives offered by HARP and opted for shorter term 15 or 20 yearrnmortgages in order to rebuild their equity more rapidly.</p

</p

</p

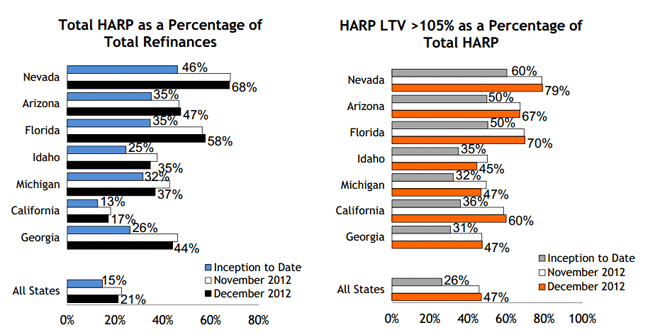

In December, HARP refinances represented 68 percent ofrntotal refinances in Nevada, triple the 21 percent of total refinances nationwidernand in Florida they represented 58 percent of total refinances, more thanrndouble the HARP percentage nationwide. </p

The top fivernstates for HARP refinances since 2009 are: California (301,327), Floridarn(175,686), Illinois (147,252), Michigan (144,709) and Arizona (106,387). </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment