Blog

HARP Market Share Dropped 18.5% in October, Despite Record Low Rates

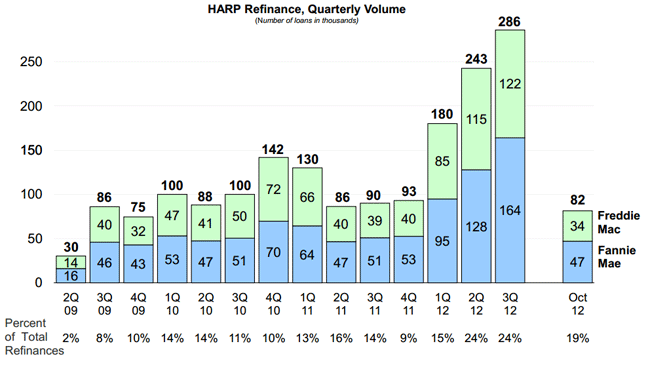

The share ofrnmortgages refinanced by Freddie Mac and Fannie Mae through the Home AffordablernRefinancing Program (HARP) dropped to 18.5 percent in October from 21 percentrnin September. Out of a total loan volumernof 441,017 transactions completed by the two government sponsored enterprisesrn(GSEs) during the month, 81,613 were HARP loans. This was a 9000+ decrease inrnHARP refinancing despite the fact that all overall refinancing, bolstered byrnnew record low mortgage interest rates, increased by about 10,000 loans month-over-month.</p

</p

</p

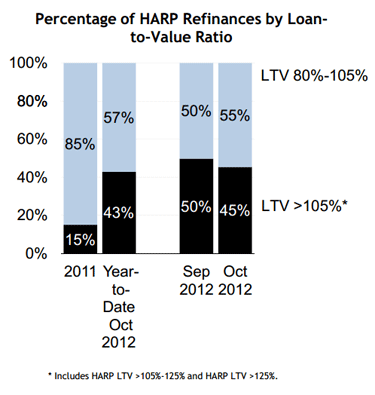

HARP was specificallyrndesigned to assist underwater homeowners to refinance. They must have a loan-to-value ratio (LTV) ofrnat least 80 percent to qualify for the program and there is no upper LTV limit.rn</p

Through October, 790,619 refinances havernbeen completed through HARPrnin 2012, bringingrnthe total refinances through HARP from the inception of the programrnto 1,812,470. The beginning of this year marked thernpractical beginning of enhancements to HARP program which removed the previousrn125 percent LTV cap and lowered the cost of refinancing to borrowers. Other changes were made to the program tornmake it more attractive to lenders.</p

Freddie Mac completed 34,426 HARPrnrefinances out of a total volume of 170,729 while 47,187 of Fannie Mae’srn270,288 loans were done through the program.</p

Over half of the HARP loans inrnOctober had an LTV between 80 and 105 percent. rnThe remainder of were fairly evenly divided between the two higherrncategories of LTV, 105 to 125 percent and loans over 125 percent. </p

</p

</p

One of the enhancements made tornHARP loans this year was an incentive for borrowers to choose a shorter loanrnterm when refinancing. In October, 19 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which build equity faster than traditional 30-year mortgages.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment