Blog

HARP Refinancing Continues to Surge, High LTV Share Skyrockets

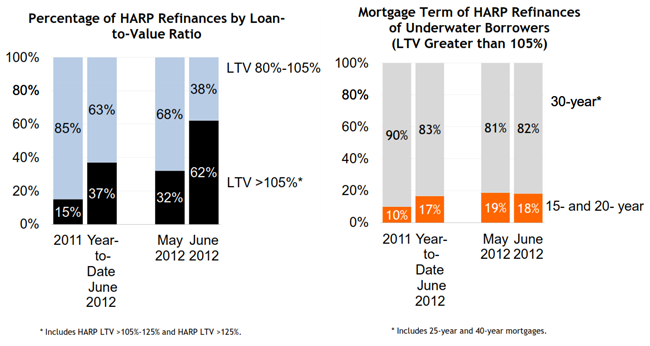

Refinancing through the revised Home Affordable RefinancingrnProgram (HARP 2.0) grew to a 33 percent share of all Fannie Mae and Freddie Macrnrefinancing in June, surging from the 20 percent share the program posted inrnApril. The proportion of thosernrefinancings with very high loan to value (LTV) ratios also increased significantly.rn </p

It appears that the changes made to the HARP program, removingrnthe 125 percent LTV ceiling, reducing and/or eliminating some fees, and easingrnlender risk, have worked. The program revisionsrnwere announced last fall but did not really begin to roll out until early this year.</p

During June Freddie and Fannie refinanced a total of 382,539rnloans. HARP refinancings for the monthrnnumbered 125,866. While the HARP loans werernfairly evenly divided between the two government sponsored enterprises (GSEs),rnFreddie Mac did less refinancing overall and slightly more HARP loans so had a muchrnhigher share of those loans, 43.7 percent compared to 26.1 percent at FanniernMae. </p

The total of HARP 2.0 loans written in the first six months ofrnthis year was 422,969, surpassing the 400,024 written during all of 2011. Since the program was originated in Aprilrn2009 1,444,820 borrowers have refinanced through the program.</p

The number of severely underwater homeowners using the program<bskyrocketed in June. The average numberrnof loans with LTVs over 125 percent averaged 2779 each month in thernFebruary-May period but totaled 53,758 in June, 40 percent of the HARPrnvolume. The Federal Housing FinancernAgency which issued the HARP report said that lenders began to sell Fannie Maernand Freddie Mac securities containing these high LTV loans on June 1.</p

</p

</p

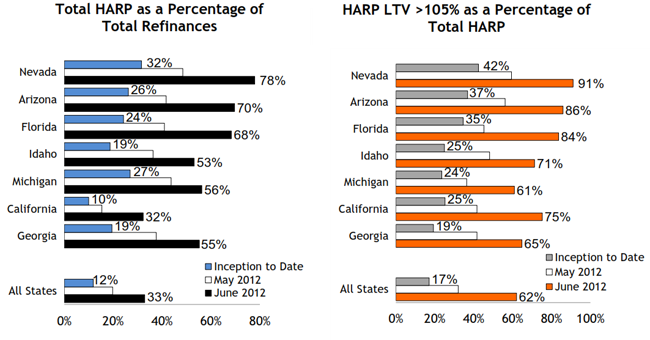

The proportion of loans refinanced through HARP was double thernnational average in the three states hardest hit by the housing downturn. HARP refinances represented two-thirds of GSErnrefinancing in Nevada, Arizona, and Florida. rnIn those three states borrowers with LTVs greater than 105 percentrnrepresented more than 80 percent of HARP volume compared to 62 percentrnnationally.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment