Blog

Home Builder Confidence Falls. Foul Weather and Distressed Sales Cited as Reason

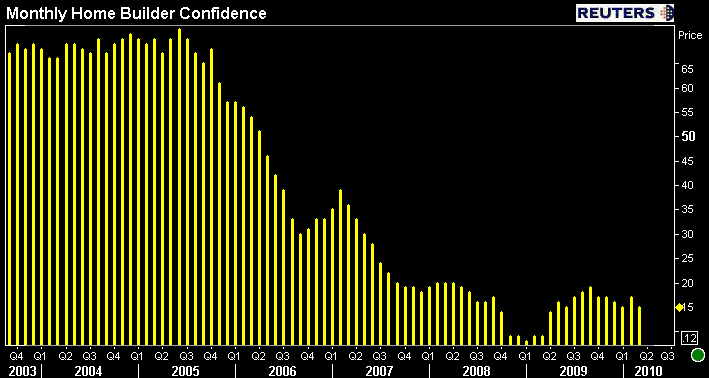

The National Association of Home Builders released their monthly Housing Market Index today.

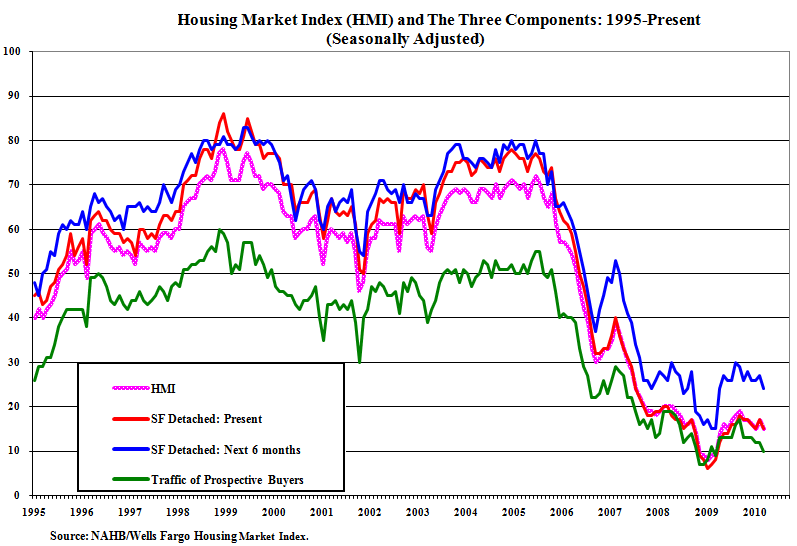

Derived from a monthly survey that NAHB has been conducting for morethan 20 years, the NAHB/Wells Fargo Housing Market Index gauges builderperceptions of current single-family home sales and sales expectationsfor the next six months as “good,” “fair” or “poor.” The survey alsoasks builders to rate traffic of prospective buyers as “high to veryhigh,” “average” or “low to very low.” Scores for each component arethen used to calculate a seasonally adjusted index where any number overrn 50 indicates that more builders view conditions as good than poor.

In March, Builder confidence lost the small amount of progress seen in February, falling two points to 15 where the index sat in January.

Here is a breakdown of the components:

- Current sales conditions declined two points to 15

- Sales expectations in the next six months declinedthree points to 24

- Traffic of prospectivebuyers declined two points to 10.

Regionally, the HMI results were mixed in March. While the Northeastposted a five-point gain to 23 and the West posted a one-point gain to15, the Midwest HMI slid three points to 10 and the South HMI edged downrn one point to 18.

The NAHB cites poor weather conditions and distressed property sales asreasons for the lack of buyer and builder confidence.

NAHB Chairman Bob Jones says:

“Unusually poor weather conditions certainly had a negative effect onrn builders’ business in February…..At the same time, the continual flow of distressed properties pricedrn below the cost of production is having an adverse effect on new-homeappraisals and also making it tough for builders’ customers to selltheir existing homes.”

NAHB Chief Economist David Crowe says:

“The lack of available credit for new projects, the large number ofdistressed properties for sale and the continuing hesitancy of potentialrn buyers due to the weak job market are definitely weighing on builderconfidence at this time….That said, the inventory of new homes on the market is at anextremely low level, and we do expect a 25 percent improvement innew-home construction in 2010 over 2009 to rebuild inventory and meetexpected pent-up demand.”

<br /

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment