Blog

Home Builder Expectations Continue to Improve After Tax Credit Expiration

The National Association of Home Builders today released their monthly Housing Market Index.

Derived from a monthly survey that NAHB has been conducting for morethan 20 years, the NAHB/Wells Fargo Housing Market Index gauges builderperceptions of current single-family home sales and sales expectationsfor the next six months as “good,” “fair” or “poor.” The survey alsoasks builders to rate traffic of prospective buyers as “high to veryhigh,” “average” or “low to very low.” Scores for each component arethen used to calculate a seasonally adjusted index where any number overrn 50 indicates that more builders view conditions as good than poor.

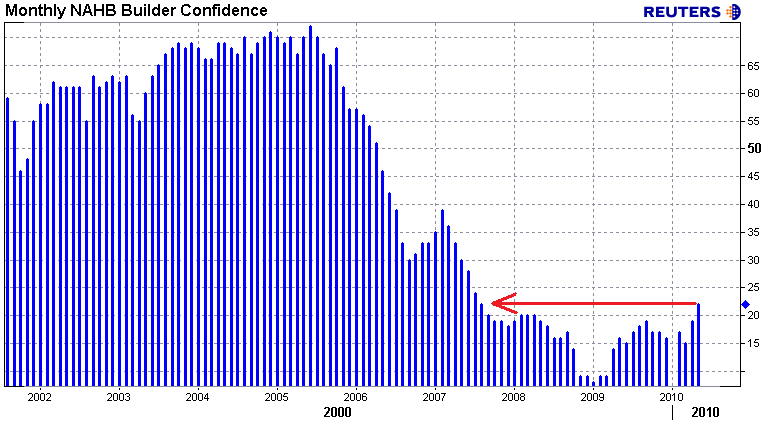

Builder confidence in the market for newly built, single-family homesrose for a second consecutive month in May to its highest point since August 2007. The Housing Market Index (HMI)rn gained three points to 22 in May….

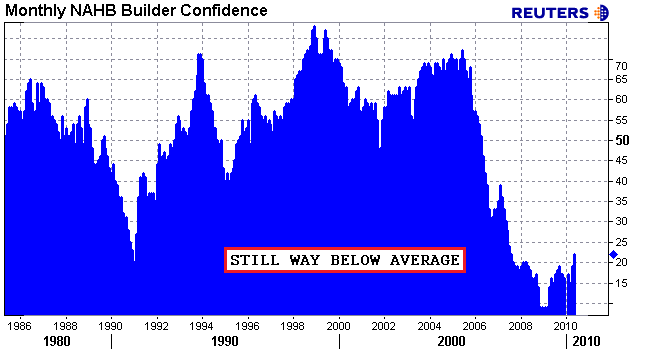

While this was the best read in more than two years, it's hard to overlook how weak builder confidence is relative to historical standards. To be clear, the HPI is not far from record low levels. (gotta start somewhere?)

NAHB Chief Economist David Crowe says:

“The really encouraging part of today’s HMI is that salesexpectations for the next six months continued to gain, despite theexpiration of the home buyer tax credits at the end of April….Thismeans builders are more comfortable that the market is truly beginningto recover, and that positive factors for buying a new home – lowinterest rates, great selection, stabilizing prices, and a recoveringjob market – are taking the place of tax incentives to generate buyerdemand.”

From the Release…

Each of the HMI’s three component indexes posted three-point gains in May. The component gauging current sales conditions climbed to 23, its highest level since July of 2007. The component gauging sales expectations in the next six months rose to 28, its highest point since November 2009, and the component gauging traffic of prospective buyers improved to 16, its best showing since September 2009.

The HMI also posted gains in every region in May. The Northeast, which has the smallest survey sample and is therefore subject to greater month-to-month volatility, rose 14 points to 35, its highest point since June of 2007. The Midwest posted a two-point gain to 17, while the South registered a one-point gain to 22, and the West posted a seven-point gain to 20.

Bob Jones, Chairman of the National Association of Home Builders adds:

“Builders surveyed for the HMI at the beginning of May were undoubtedly reacting to the heightened consumer interest they had just witnessed as the deadline for home buyer tax credits arrived at the end of April… “Builders are also hopeful that the solid momentum that the tax credits initiated will continue even now that those incentives are gone.”

<br /

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment