Blog

Home Price Plateau Possible in Areas Where Wages Can't Keep Up

While a study released on Thursday byrnRealtyTrac shows a huge discrepancy between the growth in home prices andrnincreasing wages, it appears that housing in most of the country remainsrnaffordable. The California companyrnlooked at wage growth and home price appreciation over recent two year periods andrnfound that the former is far from keeping up with the latter.</p

In itsrnanalysis RealtyTrac used data on median home prices taken from deeds registeredrnin 184 metropolitan statistical areas in the two years that ended in Decemberrn2014 and Bureau of Labor Statistics wage data from the second quarter of 2012,rnwhen home prices hit bottom and began to recover, and the second quarter ofrn2014. It adopted the six month time lagrnbetween the beginning of the two two-year time periods based on the hypothesis that a changernin average wages would take at least six months to impact home prices. </p

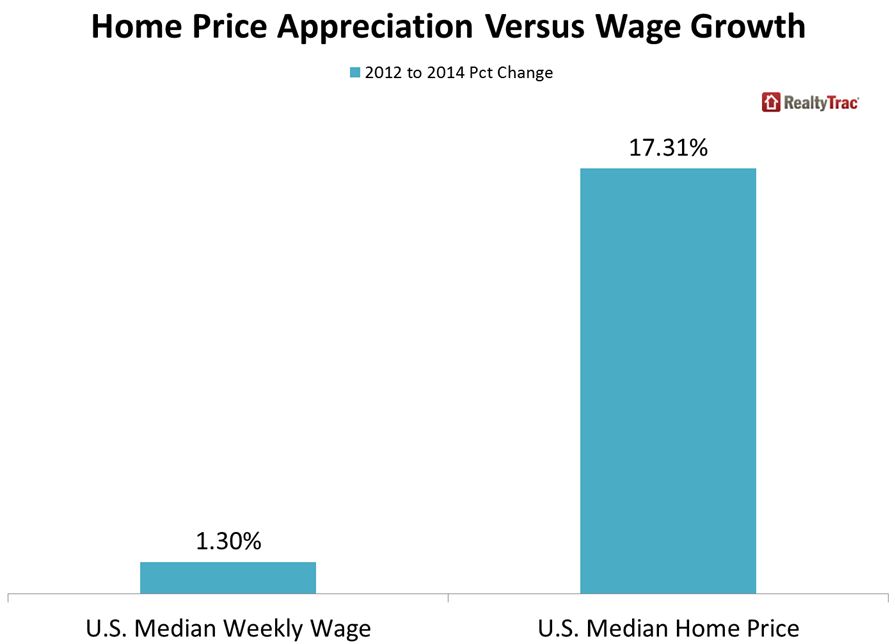

RealtyTracrnfound that home prices during the study period increased by 17 percent while medianrnwages nationwide were up only 1.3 percent. rnThus the appreciation in housing values outstripped the growth in wagesrnby a ratio of 13 to one. Further,rnRealtyTrac found that a greater increase in home values compared to wagesrnprevailed in over three-quarters (76 percent) of the housing markets.</p

</p

</p

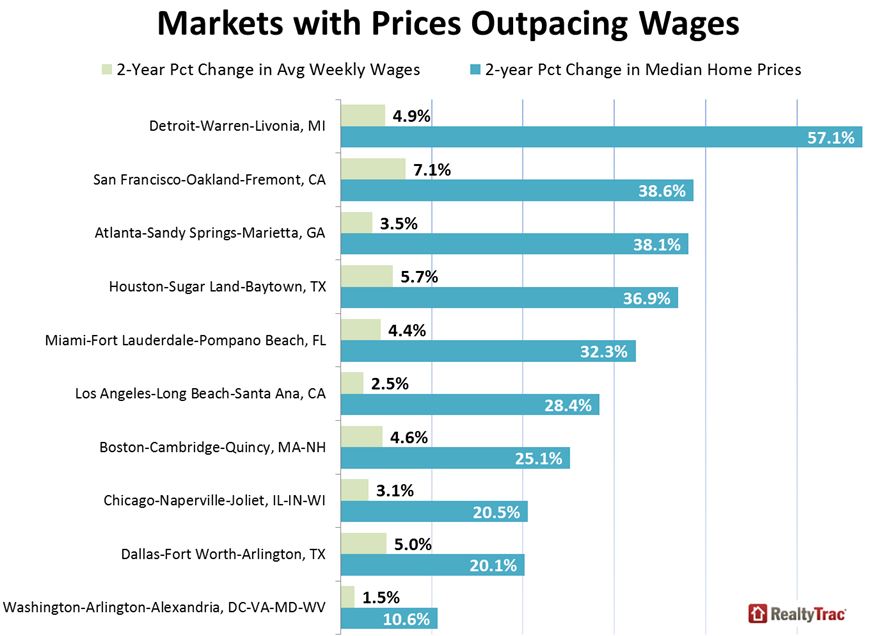

Looking atrnaverages, wages increased by 3.7 percent while housing values were up 13.4rnpercent. The 184 metropolitan areasrnincluded in the study have a combined population of nearly 228 million. Datarnon national wages is based on median wages while MSA level data is based uponrnaverage wages.</p

Those areas where price appreciationrnwas most out of sync with wages growth included Merced, California (141:1),rnMemphis, Tennessee (99:1), Santa Cruz, California (94:1), Augusta, Georgiarn(78:1), and Palm Bay-Melbourne-Titusville, Florida (62:1). </p

</p

</p

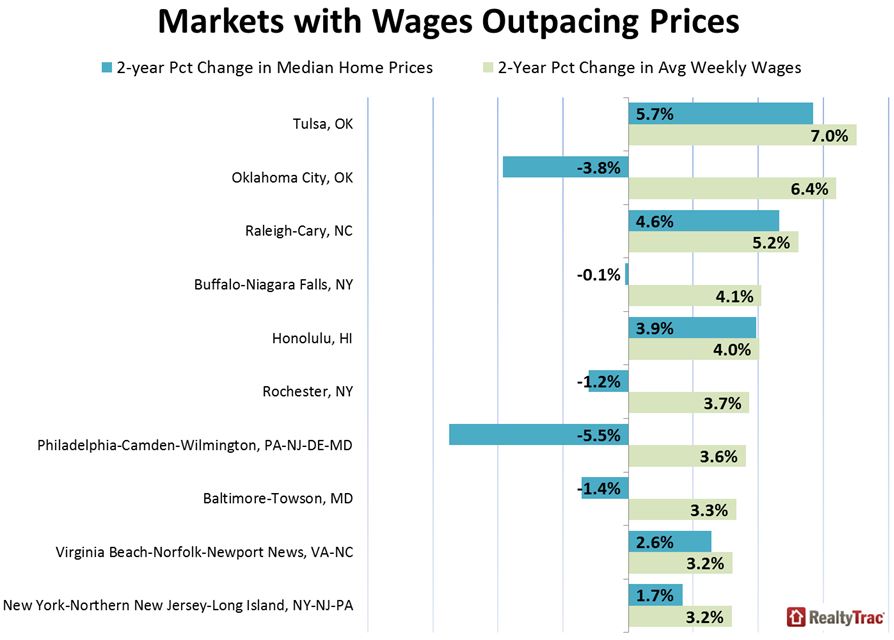

Wage growth outpaced home pricernappreciation in 44 of the 184 metro areas (24 percent) with a combinedrnpopulation of 51 million. Metropolitan statistical areas with the lowest ratiornof home price appreciation to wage growth were Hagerstown-Martinsburg,rnMaryland-West Virginia, Wichita, Kansas, Des Moines, Iowa, Gulfport-Biloxi,rnMississippi, and Harrisburg, Pennsylvania.</p

</p

</p

Daren Blomquist, vice president atrnRealtyTrac said, “Home prices in many housing markets across the country foundrna floor in 2012 and since then have rapidly appreciated, particularly inrnmarkets attracting institutional investors, international buyers or some otherrnflavor of cash buyer not constrained by income as much as traditional buyers. Eventually,rnhowever, those traditional buyers will need to play a bigger role in thernhousing market for the recovery to maintain its momentum. </p

“Those markets with the biggestrndisconnect between price growth and wage growth during the last two years are<bmost likely to see plateauing home prices in 2015 until wages catch up,”rnBlomquist continued. “Meanwhile, markets where wage growth has outpaced homernprice appreciation during the last two years are poised to see at least steadyrngrowth in home prices 2015 in most cases.”</p

RealtyTrac said that despite therndeviation between wages and home values most markets are still affordable byrntraditional standards. Of the 184rnmarkets 135 or 73 percent had a median home sales price in December thatrnrequired less than 28 percent of median income for monthly mortgage payments,rnincluding property taxes and insurance. rnThose markets have a combined population of 143 million. The remaining 45 areas (32 percent) wherernmore than 28 percent of the median income was required for housing have a combinedrnpopulation of 63 million and include traditionally unaffordable markets likernLos Angeles, San Francisco, Seattle, Boston, and Denver.</p

Metropolitan statistical areas with thernhighest rate of home price appreciation during the two years ending in Decemberrnwere Detroit (+57 percent), Salinas, California (+49 percent), Myrtle Beach,rnSouth Carolina (+47 percent), Houma-Bayou Cane-Thibodaux, Louisiana (+45 percent),rnand Modesto, California (+44 percent).</p

Metropolitan statistical areas with thernhighest rate of wage growth in the two years ending in the second quarter ofrn2014 were Gulfport-Biloxi, Mississippi (+13.2 percent), Naples-Marco Island,rnFlorida (+9.2 percent), Houma-Bayou Cane-Thibodaux, Louisiana (+8.9 percent),rnManchester, New Hampshire (+8.4 percent), and San Jose, California (+8.3rnpercent).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment