Blog

Home Prices Close Out Strong 2012 with 6.8% Gain in December

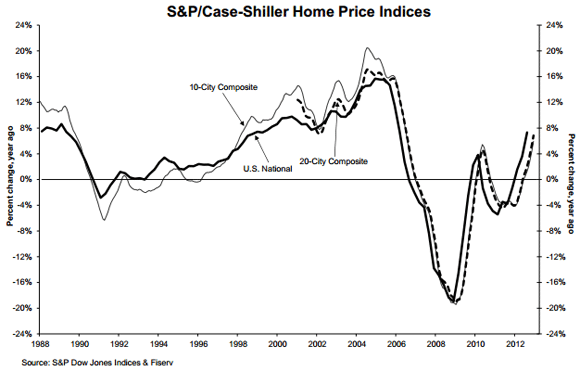

Along with the usual monthly data,rnS&P/Case Shiller Home Price Indices released this morning also included datarnfor all of 2012. The indices, a measurernof U.S. home prices ended the year with strong gain with the national compositernindex up 7.3 percent for the year and the 10-City and 20-City Indices postingrnincreases of 5.9 percent and 6.8 percent respectively.</p

On a month-over-month basis both the 10-rnand the 20- City Indices gained 0.2 percent, reversing the 0.2 percent loss inrnthe 10-City data in November and the 0.1 loss for the 20-City Index.</p

</p

</p

Nineteen of the 20 cities tracked byrnCase-Shiller posted positive year-over-year growth ranging from 2.2 percent inrnChicago to 23.0 percent in Phoenix. rnOther strong showings were seen in Minneapolis (12.2 percent), Las Vegasrn(12.9 percent), Detroit (13.6 percent), and San Francisco (14.4 percent). The only exception to the increases, New York,rnwas down 0.5 percent.</p

In December nine MSAs posted positivernmonthly gains and 11 declined. Thernlargest increase, 1.8 percent, was in Las Vegas; the largest negative numberrnwas -0.7 percent for Chicago.</p

David M. Blitzer, Chairman of the IndexrnCommittee at S&P Dow Jones said “Home prices ended 2012 with solidrngains. Housing and residentialrnconstruction led the economy in the 2012 fourth quarter. The National Composite increased 7.3 percentrnover the four quarters of 2012. From itsrnlow in the first quarter, it surged in the second and third quarter and slippedrnslightly in the 2012 fourth period. Thern10- and 20-City Composites, which bottomed out in March 2012 continued to showrnboth year-over-year and monthly gains in December. These movements, combined with other housingrndata, suggest that while housing is on the upswing some of the strongestrnnumbers may have already been seen.” </p

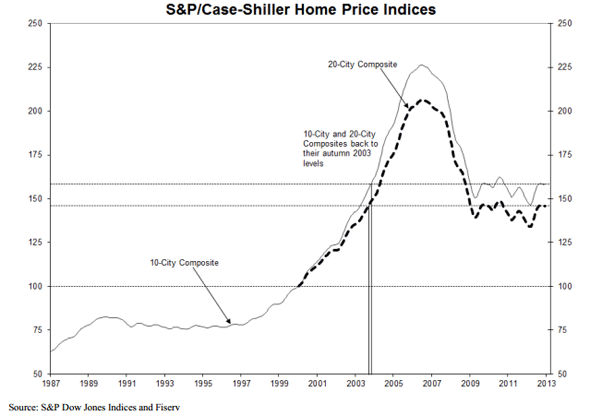

As of December average home pricesrnacross the U.S. for the 10-City and 20-City Indices are back to their autumnrn2003 levels. Measured from the June/Julyrn2006 peaks both indices are down 30 percent but both are approximately 8.9rnpercent above their recent lows of March 2012. </p

</p

</p

The Case-Shiller indices have a basernvalue of 100 set in January 2000. Thus,rnfor example, a current index value of 150 translates to a 50 percentrnappreciation since that date for a typical home within the subject market. Only Atlanta and Detroit remain below theirrnindex values for January 2000 with Atlanta having a current index value ofrn95.95 and Detroit 80.04. The NationalrnComposite Index was at 135.22 at the end of December, the 10-City was 158.49rnand the 20-City was 145.95.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment