Blog

Home Prices Continue Gradual Rise, but is Calling a Bottom Premature?

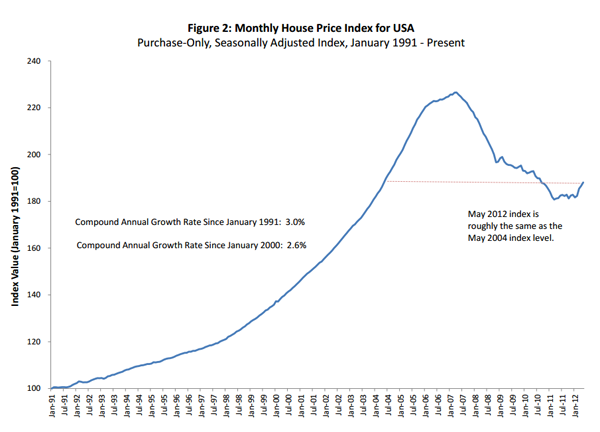

There was general agreement on thernincrease in home price levels in May in data released from by two different sourcesrnthis morning. The Federal HousingrnFinance Agency’s (FHFA) House Price Index (HPI) showed seasonally adjusted homernprices up 0.8 percent from April to May and 3.7 percent over the last 12 monthsrnwhile Radar Logic’s RPX Composite Price rose 0.7 percent from April and 2.6rnpercent year-over-year. </p

On a non-seasonally adjusted basis thernHPI was up over 1.5 percent in May. FHFArnalso revised its previously reported 0.8 percent increase in April down to arn0.7 percent increase. The Index is nowrn17.0 percent below the peak it hit in April 2007 and is roughly the same as itsrnlevel in May 2004. </p

</p

</p

The HPI increased in eight of thernnine census divisions with the exception, the West South Central Region (Oklahoma,rnArkansas, Texas, Louisiana) declining, off 1.0 percent. The other regional increases ranged from +0.5rnin the Middle Atlantic Region (New York, New Jersey, Pennsylvania) to +1.7 inrnthe Pacific division (the coast, Hawaii, Alaska). Eight of the nine census divisions are inrnpositive territory on an annual basis ranging from an increase of 0.5 percentrnin the Middle Atlantic to 6.3 percent in the Mountain division (Montana, Idaho,rnWyoming, Nevada, Utah, Colorado, Arizona, New Mexico. The ninth census division, New England, isrnunchanged since May 2011.</p

FHFA’s index is calculated usingrnpurchase prices of houses with mortgages sold to or guaranteed by Fannie Mae orrnFreddie Mac while Radar Logic tracks housing prices gathered from publicrnsources. </p

In analysis accompanying the report, RadarrnLogic said it views claims that housing prices have bottomed as premature. “Thosernpeople looking at current results and calling a bottom are being dangerouslyrnshort sighted,” said Michael Feder, Radar Logic’s CEO. “Not only arernthe immediate signs inconclusive, but the broad dynamics are still quiternscary. We think housing is still a short.” The company also said that it viewed reportsrnof diminishing supply as “greatly exaggerated.”</p

ThernRPX Composite price (reported on a per square foot basis) increased $14.27 (8.3 percent) from the beginning of 2012rnthrough May 23, much more than the increases during the same period in 2009,rn2010 and 2011, but called the rapid increase thus far in 2012 as “consistentrnwith the hypothesis that mild winter weather temporarily boosted demand.” This will be reflected in an earlier seasonal weaknessrnin demand, probably in May or June rather than in the usual July or August timeframernthe company said. </p

Evenrnif the mild winter theory doesn’t play out, Radar Logic expects short-termrnappreciation to short-circuit longer term appreciation and perhaps even triggerrnfurther declines. This would occur onrnthe supply side as higher prices provoked both financial institutions andrnhomeowners to put their properties on the market while on the demand side thernhigher prices may deter investors.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment