Blog

Home Prices Increase in 19 of 20 Cities in Latest Case-Shiller Survey

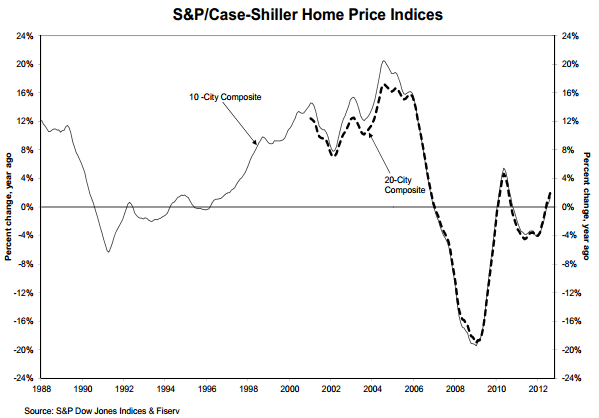

There isrncontinued good news about home prices from the S&P/Case-Shiller Home PricernIndices today. Both the 10-City and thern20-City Composites increased 0.9 percent in August compared to the previousrnmonth. Nineteen of the 20 cities alsornincreased month-over-month. The Augustrn10-City Index number was 158.62 and the 20-City was 145.87 compared to 157.25rnand 144.60 in July.</p

The annualrnincrease for the 10-City index was 1.3 percent and the 20-City was up 2.0rnpercent and these increases were larger than those posted in July which werern0.6 percent and 1.2 percent respectively. rnThe respective index numbers in August 2011 were 156.51 and 142.97. Seventeen of the 20 cities posted positivernannual returns.</p

</p

</p

Seattle, thernsole metropolitan area posting a negative monthly number was down 0.1 percentrnfrom August while the three cities with negative annual returns were Atlantarnwhich fell 6.1 percent from a year earlier; New York was down 2.3 percent andrnChicago 1.6 percent. Phoenix was thernmost improved among the 20 cities with an annual increase of 18.8 percent.</p

David M.rnBlitzer, Chairman of the Index Committee at S&P Dow Jones Indices said thatrnthe positive return for Phoenix was its fourth consecutive month with annualrnincreases in the double-digits and that even Atlanta’s loss was a significantrnimprovement compared to the nine consecutive months of double-digit declines itrnposted from October 2011 through this past June. Blitzer noted that the annual rate in LasrnVegas also finally moved to positive territory with an increase of 0.9 percentrnin August, the first increase since January 2007.</p

“The sustained good news inrnhomernprices over the pastrnfive months makes us optimistic for continuedrnrecovery in the housing market,”rnBlitzer said.</p

He continued, “News on home pricesrnconfirms other good news about housing. Singlernfamily housing starts are 43% ahead ofrnlast year’s pace, existingrnand new homernsales are also up, the inventory of homesrnfor sale continues to drop andrnconsumer mortgage default rates are reaching new lows. Further consumerrnconfidence continuesrnto rise. Evenrnas we end the seasonally strong home buying period, the statistics are positive.rnFor the fifth time in a row, both Composites had monthly gains. Home prices inrnSeattle fell modestly in August, but otherrnthanrnthat the 20 citiesrnhave also seen home prices generallyrnimprove since April.”</p

</p

</p

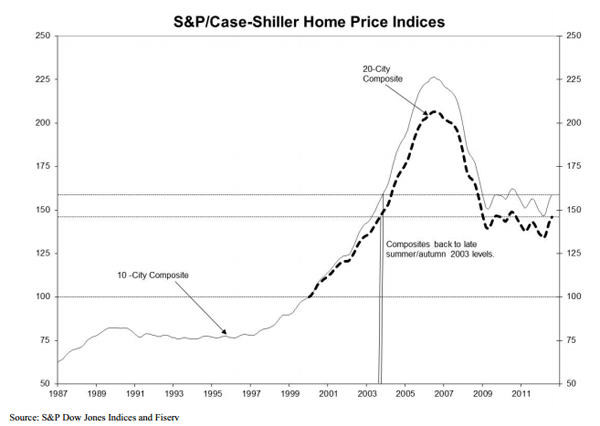

The above chart shows the index levels for the 10-City and 20-City Composite Indices. As ofrnAugust 2012, average home prices across the United States are back to their summer/autumn 2003 levels for bothrncomposites. Measured from their June/July 2006 peaks, the decline for bothrnisrnapproximately 30% through August 2012 and approximately 35% from the June/July 2006rnpeak values. The August 2012 levels for both Composites are about 8.5% above their recent early 2012 lows.</p

The S&P/Case-Shiller Composite of 10 Home Price Index is a value-weightedrnaverage of the 10 original metro area indices.rnThe S&P/Case-Shiller Composite of 20 Home Price Index is a value-weightedrnaverage of the 20 metro area indices. The indices have a base value of 100 in Januaryrn2000; thus, for example, a current index value of 150 translates to a 50% appreciation rate sincernJanuary 2000 for a typical home located withinrnthe subject market.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment