Blog

Home Prices Overtaking Pre-Crash Peak

Home prices nationally are now within 3 percent of the peakrnthey reached in March 2007. The FederalrnHousing Finance Agency (FHFA) released its purchase only Home Price Index (HPI)rnfor February showing that home prices increased 0.7 percent on a seasonallyrnadjusted basis compared to January and were 5.4 percent higher than in Februaryrn2014. The increase brought home pricesrnback to January 2006 levels and within 2.7 percent of the pre-crash peak. </p

The numerical index number in February was 220.5 compared torn219.0 in January and 209.2 in February 2014. rnThe index is calculated using home sales price information fromrnmortgages sold to or guaranteed by the government sponsored enterprises (GSEs)rnFannie Mae and Freddie Mac. The basisrnfor the index is January 1991=100.</p

</p

</p

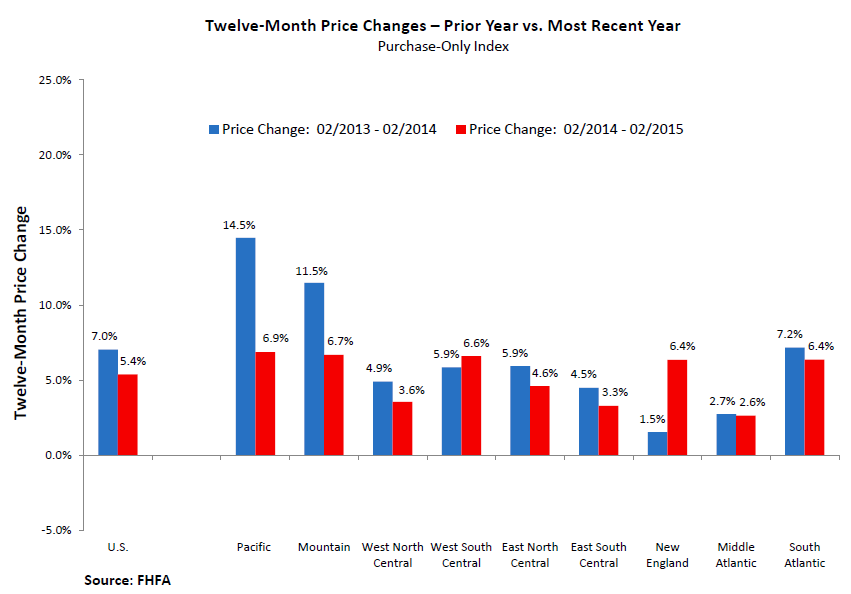

The seasonally adjusted monthly increase ranged across the nine censusrndivisions from -1.3 percent in the East South Central Division (Kentucky,rnTennessee, Mississippi, Alabama) to +1.8 percent inrnthe South Atlantic division (all East Coast states from Delaware tornFlorida). All regions posted positivernchanges for the 12-month period ending in February. The smallest increase was in the MiddlernAtlantic division (New York, New Jersey, Pennsylvania) at 2.6 percent,rnthe largest, at 6.9 percent was in the Pacific Division (West Coast states plusrnAlaska and Hawaii.) </p

The February index was at its lowest, 186.3, inrnthe East North Central division (Michigan, Wisconsin, Illinois, Indiana,rnOhio) and highest in the Mountain division (Montana, Idaho, Wyoming, Nevada,rnUtah, Colorado, Arizona, New Mexico) at 278.1.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment