Blog

Home Prices Post Largest Increase in 6 Years, Up 6.3% Annually

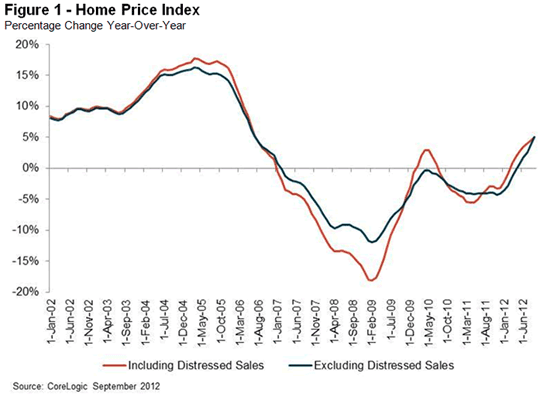

Home prices increased on an annual basis for the eighthrnconsecutive month on the CoreLogic Home Price Index (HPI) for October. The nationwide index which tracks home pricesrnof both market and distressed sales has increased 6.3 percent since Octoberrn2011. This is the largest increase sincernJune 2006. As CoreLogic notes should bernanticipated as the housing market enters its off-season, monthly sales wererndown 0.2 percent from September. </p

The HPI covering only market sales increased by 5.8 percentrnin October 2012 compared to October 2011 and was up 0.5 percent from September. October was the eighth month this indexrnincreased on an annual basis as well. </p

</p

</p

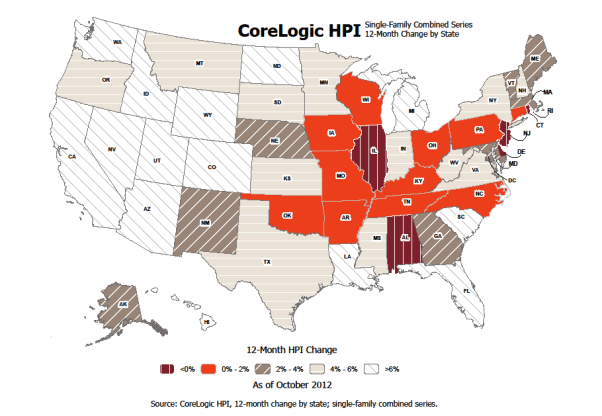

These solid increases werernfelt nationwide as all but five states are experiencing year-over-year pricerngains including distressed sales and all but three when foreclosure and shortrnsales are excluded. Negative changes forrnall sales were recorded in Illinois (-2.7 percent),rnDelaware (-2.7 percent), Rhode Island (-0.6 percent), New Jersey (-0.6 percent)rnand Alabama (-0.3 percent). The threernstates posting depreciation for market rate sales were Delaware (-2.1rnpercent), Alabama (-1.5 percent) and New Jersey (-0.2 percent). </p

“Thernhousing recovery that started earlier in 2012 continues to gain momentum,”rnsaid Mark Fleming, chief economist for CoreLogic. “The recovery isrngeographically broad-based with almost all markets experiencing somernappreciation. Sand and energy states continue to experience the most robustrnappreciation and some judicial foreclosure states are even recording increasingrnprices.”</p

The annualrnprice appreciation in some states was substantial. The five states with the highest home price appreciationrnincluding distressed sales were: Arizonarn(+21.3 percent), Hawaii (+13.2 percent), Idaho (+12.4 percent), Nevada (+12.4rnpercent) and North Dakota (+10.4 percent).</p

Excluding distressed sales,rnthe five states with the highest home price appreciation were: Arizona (+16.6 percent),rnHawaii (+12.2 percent), Nevada (+10.8 percent), Idaho (+9.7 percent) and Californiarn(+9.7 percent). </p

Includingrndistressed transactions, the peak-to-current change in the national HPI from itsrnpeak level in April 2006 to October 2012 was -26.9 percent. Excludingrndistressed transactions, the peak-to-current change in the HPI for the samernperiod was -20.6 percent. </p

CoreLogic is projecting that home prices inrnNovember, including distressed sales, will show an annual increase of 7.1rnpercent and a month-over-month decrease of 0.3 percent due to the expectedrnseasonal slowdown in sales activity. Excludingrndistressed sales, the CoreLogic Pending HPI is expected to rise 7.4 percent fromrnNovember 2011 and by 0.5 percent month-over-month from October 2012. </p

</p

</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment